In this guide, we cover the key information you need to prepare for a tax audit in Ireland. Self-employed individuals and others required to file under self-assessment must submit an annual tax return, usually by 31 October, with an extended mid-November deadline available for those who file and pay online through ROS.

Anyone who files a tax return can be selected for a Revenue audit or compliance intervention. In 2025, Revenue completed over 291,600 audits and compliance interventions, collecting €734 million in additional tax. With figures like these, it’s understandable that many taxpayers find the idea of an audit stressful.

Being selected for an audit can happen to anyone and does not automatically mean you are suspected of tax evasion. Revenue routinely reviews tax returns, and if something appears unusual or requires clarification, they may request additional information.

If your records are in order, there is usually little to worry about. However, if you receive an audit notification from Revenue, taking the right steps early can make the process far smoother.

This guide explains how to prepare for an audit and how professional support can help you manage it confidently.

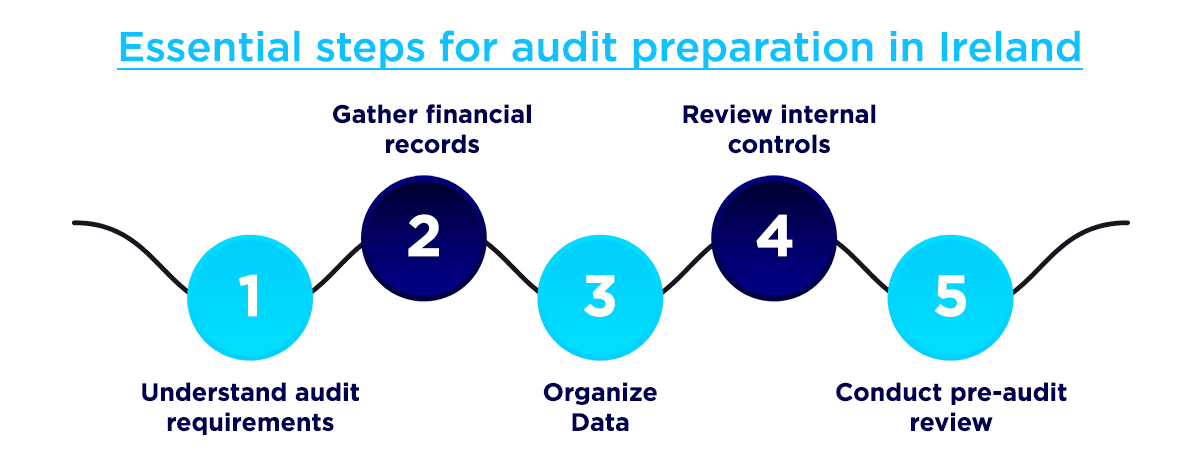

Steps for Preparing for an Audit in Ireland

Step 1 – Review Your Audit Notification Letter

If you are chosen for an audit, you will get a letter 21 days before. It is important to read this letter carefully. The letter will tell you:

- The date and time of the audit

- The accounting period being audited

- Whether the audit will look at one issue or several

If you have questions about the letter, contact Revenue right away or consult your Ireland tax advisor.

Step 2 – Meet with Your Accountant or Tax Advisor

Meeting with your tax advisor can help you understand the audit process and reduce your worries. Your accountant can also tell you what information to prepare. Discuss any tax issues or concerns with your accountant. For example:

- Do you have expenses without receipts?

- Is there any income not reported on your tax return?

Your accountant can guide you on how to prepare for these issues. They can also help you do a practice run for the audit to make sure all needed information is ready and no problems are overlooked.

Step 3 – Gather All Relevant Documents

To support your tax returns, have all related documents ready for the audit. You will need:

- Sales and purchase invoices

- Any other financial records

Mistakes can happen, so check all documents from the tax period in the audit letter. This helps find any errors or discrepancies.

Step 4 – Make Voluntary Disclosures

Being honest is very important, especially with taxes. If you find a mistake on your tax return after getting the audit notice, you can submit a qualifying disclosure to Revenue.

You have two weeks after getting the notice to inform Revenue about your intent to make a disclosure. Then, you have 60 days to gather everything needed and arrange payment for back taxes and interest (up to 10% per year).Make sure your disclosure covers all issues in the audit notice and any other problems you find.

Making a qualifying disclosure usually reduces penalties at the end of the audit. Penalties start at 100% of the owed tax but can drop to as low as 3% with full disclosures. Another benefit of making a disclosure is that it may keep your name out of the news as a tax defaulter.

What Happens During an Audit?

An audit generally follows these steps:

1. The auditor explains the audit’s purpose and how long it will take. You can disclose any suspected tax liabilities at this stage.

2. Your financial records for the relevant tax year are reviewed.

3. The auditor will let you know if your return is correct. If changes are needed, they will discuss them with you and provide written details of what needs to be amended.

4. You will have a final meeting with the auditor to agree on any settlement, if required.

5. After agreeing on the settlement, you can pay the auditor, who will then give you a receipt.

Outbooks simplifies filing your Irish tax return.

Why Me?

Fewer than one in 20 audits are random. If you receive an audit letter, it usually means that Revenue has concerns about something in your tax returns or believes you have not declared all your income.

Can I Avoid an Audit?

No! However, there are ways to lower your chances of being selected.

Your Records

Not keeping proper tax records is a common error. Poor accounting and bookkeeping can lead to mistakes, increasing the chance of an audit. For instance, self-employed individuals and PAYE taxpayers must keep expense receipts for at least six years. It is essential to store these documents safely and in an organised manner.

It is the taxpayer’s responsibility to maintain an effective accounting system. A reliable cloud-based accounting system can cost as little as £20-£30 per month. Without proper organization of your tax documents, audits can become challenging.

What’s Allowable?

Understanding what expenses are allowable for tax is crucial. Any expense claimed must be entirely for the purpose of your trade. If your business charges VAT, Revenue will check if it was charged correctly. For example, you cannot charge 0% or 13.5% VAT when you should have charged 23%.

Missing a Tax Return

Failing to file a required tax return can draw attention from Revenue. Make sure to meet all filing deadlines and verify that all returns are complete.

Stay Audit-Ready in 2026 with Outbooks Ireland

With Revenue’s 2025 audits yielding €734m across 291,600 interventions, preparation is more critical than ever. Follow these steps and partner with Outbooks Ireland for professional outsourced bookkeeping, tax return filing, and audit support.

Contact us today at +353 21 2069255 or info@outbooks.com to safeguard your business.

Parul is a content specialist with expertise in accounting and bookkeeping. Her writing covers a wide range of accounting topics such as payroll, financial reporting and more. Her content is well-researched and she has a strong understanding of accounting terms and industry-specific terminologies. As a subject matter expert, she simplifies complex concepts into clear, practical insights, helping businesses with accurate tips and solutions to make informed decisions.