Cashflow problems are a leading cause of business failure in Ireland. Even profitable companies can collapse when they lack the cash to cover expenses, pay suppliers, or meet payroll. The Strategic Banking Corporation of Ireland’s 2025 SME Outlook Report shows that 71% of Irish SMEs cite access to finance as a significant risk, while 73% struggle with high material costs.

Many business owners focus on profit while ignoring a simple truth: you can’t pay bills with unpaid invoices. Irish accountants use cashflow forecasting and reporting to identify this gap early, helping SMEs avoid the dangerous disconnect between profit on paper and cash in the bank.

Key takeaways:

- How cashflow reports reveal your business’s true financial health?

- Practical methods to accelerate customer payments and manage supplier terms

- The role of forecasting in preventing cash shortages

- Strategies accountants use to strengthen working capital

- 2026-specific considerations for Irish SMEs

Why Irish SMEs Struggle with Cash Flow?

Several factors contribute to cash flow problems and growth challenges in Irish SMEs.

Common cashflow challenges include:

- Late payments from customers: Extended payment terms (30-60 days) tie up working capital

- Seasonal variations: Revenue fluctuations throughout the year create predictability issues

- Rapid growth: Expansion requires upfront investment before new revenue materialises

- Poor planning: Lack of forecasting leaves businesses unprepared for shortfalls

Without proper cash flow support, these issues compound quickly. They force businesses into expensive short-term borrowing or, worse, insolvency.

Accountant’s Role in Managing Cash Flow

Professional accountants serve as strategic partners in business cash flow analysis, far beyond traditional number-crunching roles. They transform complex raw financial data into clear, actionable insights that drive smarter business decisions and stronger liquidity.

Practical Strategies to Improve Cash Flow in Small Business Operations

Irish accountants prioritise these proven cash flow improvement strategies by impact, start with collections for fastest results. Irish SMEs typically achieve 20-30% working capital gains within 90 days using these systematic inflow and outflow optimisation tactics.

How to Increase Cash Flow Through Better Collections?

- Speed up invoicing processes

Send invoices immediately upon delivery of goods or services. Delays in invoicing directly extend the time until payment arrives – every day counts when managing cash flow.

- Tighten payment terms

Consider reducing standard payment terms from 30 to 14 days for new customers. Alternatively, offer early payment discounts (e.g., 2% discount for payment within 7 days) to accelerate cash inflows.

- Implement deposit requirements

For large orders or projects, request deposits or staged payments. This approach improves cash flow forecasting accuracy and reduces exposure to non-payment risk.

- Automate payment reminders

Use accounting software to send automatic reminders before and after due dates. This maintains professional pressure on collections without consuming management time.

- Review credit policies regularly

Not every customer deserves the same payment terms. Assess creditworthiness and adjust terms accordingly to protect your working capital from slow payers.

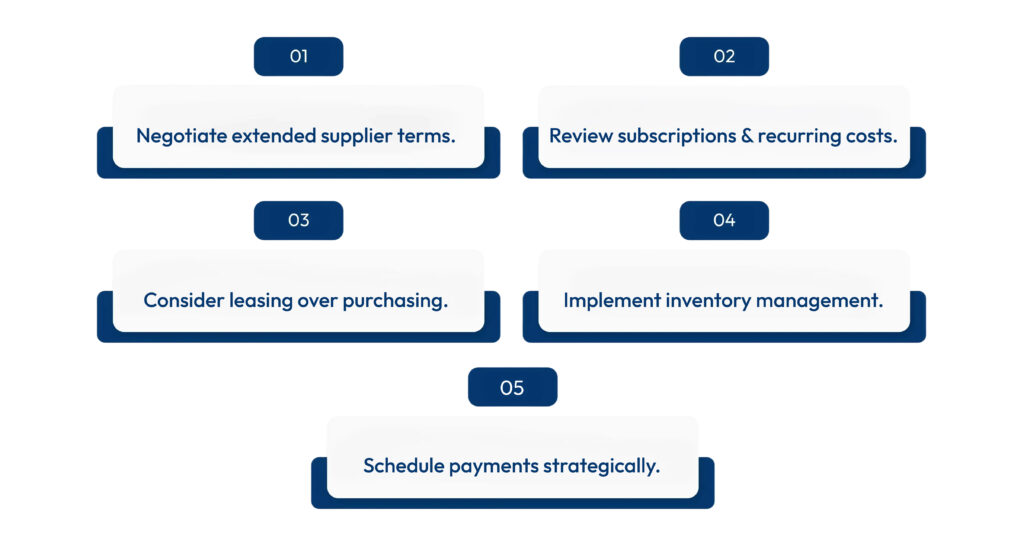

Below are some pointers to reduce cash outflows strategically

Using Cashflow Reports & Key Metrics for Better Business Decisions

A comprehensive cashflow report typically includes three sections: operating activities, investing activities andfinancing activities. For most SMEs, the operating section deserves closest attention as it shows cash generated from core business operations.

Key Metrics to Monitor

Regular business cash flow analysis helps identify trends before they become problems. An accountant or outsourced accountant can benchmark your performance against industry standards, highlighting areas requiring attention.

| Metric | What It Shows | Target | Irish SME Benchmark |

|---|---|---|---|

| Operating Cash Flow | Cash from business activities | Consistently positive | 15-20% of revenue |

| Cash Conversion Cycle | Days between paying suppliers and receiving customer payments | Minimise | 30-45 days |

| Current Ratio | Ability to cover short-term obligations | Above 1.5 | 1.5-2.0 |

| Quick Ratio | Liquidity excluding inventory | Above 1.0 | 1.0-1.3 |

Building Cash Reserves for Stability

One often-overlooked aspect of effective cash management involves maintaining appropriate reserves. Accountants typically recommend Irish SMEs maintain enough cash to cover 3-6 months of operating expenses.

This provides several benefits:

- Security during slow periods: Seasonal businesses can survive low-revenue months.

- Negotiating power: Cash reserves reduce dependency on emergency borrowing

- Opportunity readiness: Available cash enables you to seize time-sensitive opportunities

- Investor confidence: Strong liquidity attracts investment and credit

Cash kills more businesses than lack of profit. Building reserves protects against this reality.

Implementing a Cashflow Improvement Plan

Understanding theory is one thing; implementation is another. Here’s a systematic approach to strengthen your cash position over six months.

Month 1: Assessment and Analysis

Work with your accountant to conduct a thorough cashflow audit. Identify your current cash position, average collection periods, payment cycles andseasonal patterns.

This baseline assessment reveals specific cash management problems and solutions relevant to your situation. You can’t improve what you don’t measure.

Month 2-3: Quick Wins

Implement immediate improvements such as tightening invoicing procedures, contacting overdue accounts and reviewing the largest expense categories. These actions typically generate noticeable results within 30-60 days.

Focus on the 80/20 rule: which 20% of actions will produce 80% of the improvement?

Month 4-6: Structural Changes

Make deeper changes like renegotiating supplier contracts, adjusting pricing structures, or implementing new accounting for small and medium enterprises software. These improvements require more effort but deliver lasting benefits.

Consider changes to business models, customer selection criteria andstrategic partnerships that enhance liquidity long-term.

Ongoing: Monitoring and Adjustment

Establish monthly cashflow review meetings with your accountant. Regular monitoring ensures you stay on track and can adjust strategies as circumstances change.

What gets measured gets managed. What gets reviewed gets improved.

2026 Considerations for Irish SMEs

The financial landscape for Irish businesses continues to evolve in 2026. Several factors require particular attention when planning your liquidity strategy.

Economic Environment

While specific government statistics for 2026 are still being compiled, industry indicators suggest Irish SMEs face continued pressure from payment delays and rising operational costs. Proactive cash flow support has become essential rather than optional.

Tax Planning and Cashflow

Work with your accountant to schedule tax payments strategically. Understanding your Corporation Tax, VAT andPAYE obligations helps prevent cash surprises. Setting aside funds monthly for tax bills prevents year-end scrambles.

Digital Transformation Benefits

Modern SME accounting software provides real-time cash visibility and automated processes that reduce administrative burden. Investment in these tools pays dividends through improved liquidity control and reduced errors.

The Value of Professional Cash Flow Support

Many business owners attempt to manage liquidity independently, viewing professional accounting as an unnecessary expense. This perspective overlooks the substantial return on investment that expert cash flow help provides.

Consider the typical costs of poor liquidity management:

- Late payment penalties and interest charges

- Lost supplier discounts due to delayed payments

- Emergency loan interest rates (often 8-15% annually)

- Opportunity costs from missed growth investments

- Time spent firefighting rather than building the business

Against these costs, the investment in professional services represents significant value. Accountants prevent expensive mistakes, identify improvement opportunities andfree your time for revenue-generating activities.

Conclusion

Effective business cash flow management separates thriving Irish businesses from struggling ones. While profit matters, liquidity determines whether your business survives and grows. The combination of professional accountant expertise and robust cashflow reports provides the foundation for sustainable success.

Ready to improve your Irish SME cash flow? Contact Outbooks Ireland at info@outbooks.com or +353 21 2069255 for your expert cashflow assessment today!

Frequently Asked Questions

What is a cashflow report and why do I need one?

How can I generate cash flow in a business quickly?

What’s the difference between profit and cashflow?

How often should I review my business cashflow?

Can an accountant really help improve my cashflow?

What are the warning signs of cashflow problems?

Parul is a content specialist with expertise in accounting and bookkeeping. Her writing covers a wide range of accounting topics such as payroll, financial reporting and more. Her content is well-researched and she has a strong understanding of accounting terms and industry-specific terminologies. As a subject matter expert, she simplifies complex concepts into clear, practical insights, helping businesses with accurate tips and solutions to make informed decisions.