Outsourced accounting involves contracting with an external service provider to manage a company’s financial records and transactions. But what is accounting outsourcing exactly and why are more Irish businesses choosing this solution with reliable outsourced bookkeeping?

Accounting outsource services provide businesses with access to professional financial management without the overhead costs of maintaining an in-house team. An outsourced accountant handles everything from day-to-day bookkeeping to complex financial analysis, ensuring your business remains compliant with Irish tax laws and regulations through expert outsourced bookkeeping.

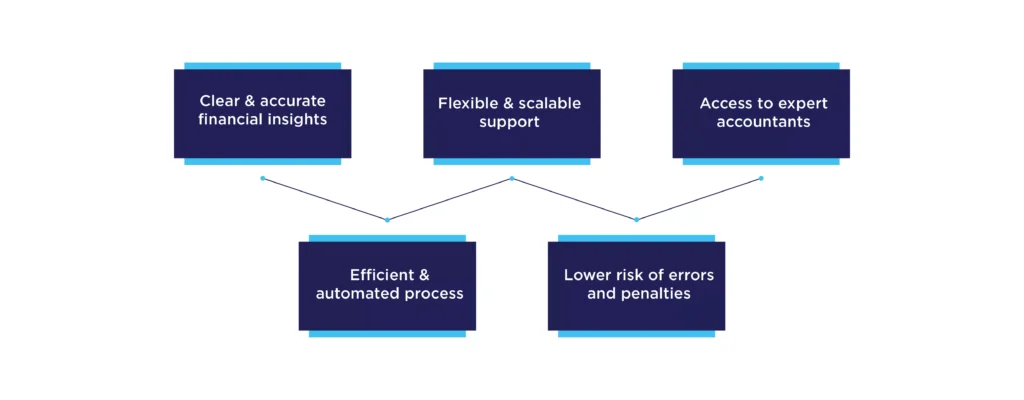

The difference between hiring an outsource accounting firm and building an internal team is significant. With outsourcing of accounting services, you gain immediate access to a team of specialists, advanced accounting technology, and scalable solutions that grow with your business.

Key takeaways

- Outsourcing accounting reduces costs by eliminating expenses related to hiring, training, and maintaining an in-house team.

- You gain access to a team of experts with up-to-date knowledge of Irish tax laws, compliance, and financial management.

- Outsourced accounting improves cash flow visibility and provides timely, accurate financial reports for better decision-making.

- Flexible services scale with your business needs, providing support during busy periods without permanent staffing costs.

- Advanced cloud-based technology and robust data security keep your financial data safe and accessible anytime, anywhere.

This article was updated and republished on 26 January 2026 to include the latest insights on outsourced accounting, technological advancements and compliance updates for Irish businesses.

Why Accounting matters for Irish Businesses?

The accounting department handles the day-to-day tasks of keeping your business in line with the law. The services provided include payroll processing, financial reporting, accounts payable and accounts receivable management.

Accounting is a process that helps organisations keep track of their revenue and costs, enabling them to manage their cash flow better and meet all their tax obligations on time, utilising abilities such as auditing, securing investments and purchasing assets.

By understanding the value of accounting, organisations can evaluate whether or not they need to hire additional accountants to improve their financial management. To save the cost of an in-house accounting team and grow your business to the next level, meeting all tax laws in Ireland is where outsourcing accounting comes into play!

Accounting services that businesses need

- Tax services and compliance

- Bookkeeping services and VAT returns

- Audit and assurance services

- Financial analysis and consulting services

- Management accounting and reporting

- Payroll administration

When should you hire Outsourced Accounting Services in Ireland?

How do you know when you need the services of a bookkeeper or accountant? In the following cases, it is highly recommended that you begin searching for an outsource accounting firm in Ireland.

Establishing your business

A serious commitment is necessary when starting a firm. If you want things to go well during onboarding, you need to know the ins and outs of company registration. In the early stages of starting a business, it is wise to get professional guidance on various significant challenges, including business structure, tax planning, and financial management.

For startups, outsourced accounting for startups provides a cost-effective way to establish robust financial processes from day one, allowing founders to focus on product development and market growth rather than getting bogged down in financial administration.

To manage obligations regarding local regulatory laws

Annual returns, tax returns, financial statements, and other document filings are some reasons you may require an accountant. For someone without formal accounting training, this task can be challenging.

For instance, in Ireland, everyone is responsible for their taxation. A company’s tax liability is determined, and a declaration is submitted to revenue. If you make a mistake on your tax return, you might overpay or underreport your taxes. In the second case, you will be on the revenues “Defaulters List” and must pay interest. Failure to submit annual returns by the required date is a significant breach of the Companies Act.

See related post: Accounting and Accounting rules in Ireland

Your business is growing

Accounting tasks can need to be outsourced when a company’s financials get too complicated. Professional accounting guidance is crucial for expanding firms because of the complex financial decisions that come with dividend payments, employee benefits, and ownership changes. Additionally, by having accounting handled by an outsourcing provider, top-level management can concentrate on expanding the company rather than fixing immediate cash flow and tax problems.

Signs your Business needs an Outsource Accounting Firm

- You’re spending excessive time on bookkeeping: As a business owner, your time is better spent on strategy, sales and growth rather than data entry and reconciliation.

- You lack timely financial information: If you can’t access accurate financial reports within days of month-end, you’re making business decisions without clear visibility. Outsourced accounting solutions provide real-time dashboards and monthly management accounts.

- You’re preparing for investment or funding rounds: Investors require clean, auditable financials. Small business outsourced accounting ensures your books are investor ready.

- Compliance requirements are overwhelming: Between VAT returns, payroll submissions, corporation tax and Companies Registration Office filings, Irish businesses face significant regulatory burden.

Top benefits of Outsourcing Accounting to reliable providers

A professional accountant is the best and most effective way to run your business in Ireland. Companies can take advantage of the benefits of outsourcing accounting services for small businesses they might not have considered before.

Cost-effectiveness

Hiring a dedicated accounting team can be expensive, especially for a startup or a small business. In addition to salaries, company owners will also be paying for various “overhead” expenditures including health insurance, bonuses, office space, and software licenses. The outsourcing company is responsible for its infrastructure and taxes, resulting in significant cost savings.

The benefits of outsourcing accounting include eliminating recruitment fees, training expenses, and the costs associated with employee turnover. Businesses report substantial savings and increased profitability after optimising their financial processes through outsourcing.

See related post: Online Accounting Services for Small Businesses

Having reliable Accountants at your reach

Many qualified accountants are available in Ireland, but choosing the right accounting firm for your business is crucial. The most reliable outsourcing accounting firm will be on your side as your partner at every step of your journey. Outsourcing firms collaborate with businesses across industries and are accustomed to changing tax laws and using new technologies to solve complicated issues.

With an outsourced accountant, you gain access to a team of specialists rather than relying on a single individual’s expertise. This means you benefit from tax specialists, financial analysts, bookkeepers, and strategic advisors all working together on your accounts.

Avoid problems with employee turnover and vacation time

Recruiting and employing an accounting team is expensive and time-consuming. What would happen to your business if you had only one accountant and that person needed time off for vacation or illness? Instead, regardless of when you need them, an outsourced accounting professional will be there to take care of your finances.

With outsourcing of accounting services, continuity is guaranteed regardless of individual absences, holidays, or resignation.

Adaptability to changing business requirements

Your firm has expanded, so a single person can no longer manage all the accounting requirements. When you outsource, you don’t have to always be on the lookout for new employees to hire. In addition, you can quickly scale up with the help of an outsourced accounting firm since their services are flexible based on your usage.

Whether you’re processing a handful of invoices per month or hundreds, outsourced accounting solutions flex to meet your needs. During peak periods like year-end or VAT return deadlines, you have immediate access to additional resources.

See related post: How Virtual Accounting Services Are Transforming Businesses in Ireland

Access to advanced technology and cloud-based solutions

One of the most significant benefits of outsourcing accounting is immediate access to cutting-edge financial technology without capital investment. Professional outsource accounting firms utilise:

Cloud-based Accounting Platforms: Industry-leading software like, QuickBooks Online, Xero and Sage provides real-time access to your financial data from anywhere.

Automated Data Entry and Invoice Processing: AI-powered tools automatically capture invoice data, match receipts, and categorise transactions, reducing manual data entry and virtually eliminating human error.

Real-Time Financial Dashboards: Access key metrics, cash flow position, profit margins, and performance indicators through intuitive dashboards updated regularly.

Integration Capabilities: Seamless connections between your bank accounts, payment processors, invoicing systems, and payroll platforms create a unified financial ecosystem.

Enhanced data security and GDPR compliance

Data security is important when handling sensitive financial information. Professional outsourcing accounting firms implement enterprise-grade security measures including bank-level encryption, multi-factor authentication, regular security audits, GDPR compliance protocols, secure backup systems, and Anti-Money Laundering (AML) training for staff.

You can learn more about security measures on our data security page.

Real-time financial insights and strategic planning

Beyond basic bookkeeping, small business outsourced accounting provides strategic financial intelligence including monthly management accounts, cash flow projections, budget vs actual analysis, Key Performance Indicator (KPI) tracking, scenario planning, and profitability analysis. This helps you understand which products, services, or customers generate the most profit, enabling smarter business decisions.

Access to Outsourced CFO Services

Many businesses need strategic financial leadership but can’t justify a full-time CFO. Outsourced accounting firms Ireland increasingly offer part-time CFO services, providing strategic financial planning, fundraising support, exit planning strategies, financial forecasting, board-level financial reporting, and cash flow optimisation. This gives growing businesses access to C-suite expertise at a fraction of the cost.

Outsourced Accounting Solutions for different business types

Outsourced Accounting for Startups

Startups face unique financial challenges that make outsourcing particularly valuable. From establishing financial foundations to funding readiness, cash runway management, and equity structure management, outsourced accounting for startups ensures you’re building on solid ground while preserving capital for growth activities. Irish tech startups may also qualify for R&D tax credits, which outsourced accountants can help you capture.

Small Business Outsourced Accounting

For established small businesses, outsourcing accounting for small business offers flexible engagement models, eliminates recruitment headaches, provides a professional growth partner, and supports succession and exit planning. As your business grows, your accounting needs evolve dramatically, and an outsource accounting firm grows with you.

Technology and SaaS Companies

Tech companies have specialised needs including recurring revenue recognition, venture funding and equity structures, multi-currency operations, R&D tax credit optimisation, and metric reporting that investors expect like Monthly Recurring Revenue (MRR), Customer Acquisition Cost (CAC), and Lifetime Value (LTV).

What Should You Consider Before Choosing Outsourced Accounting?

When evaluating outsourced accounting solutions, ensure your chosen partner meets these criteria:

- Proven track record serving Irish businesses

- Seasoned professionals with efficiency in handling complex accounting tasks

- Capabilities to deliver industry-best solutions using advanced technologies

- Comprehensive data security measures to protect your sensitive financial information

- Flexible engagement models to suit your unique business needs

- Timely service delivery and responsiveness

- Positive testimonials from satisfied clients

- Full range of services from bookkeeping to strategic advisory

See related post: Online Accountants: Simplified Bookkeeping and Accounting in Ireland

Credible Outsourced Accounting Services with Outbooks

Accurate bookkeeping and accounting are crucial to the success of any firm in Ireland. Outsourcing accounting services is a quick and easy approach to rest easy knowing your books are balanced and accurate. With the help of an outsourcing accounting firm, you can save expenses, free up in-house time, and focus on developing new business opportunities.

Are you looking for a dedicated partner to handle your accounting and bookkeeping needs that would treat your money as its own? Get in touch with experts at Outbooks in Ireland for all your accounting needs right now.

Our seasoned professionals at Outbooks offer tailored accounting and tax services by knowing your business needs. We assure you of financial excellence in the long run. Feel free to contact Outbooks at info@outbooks.com or +353 212069255 to learn more about our reliable outsourcing accounting solutions in Ireland today!

Frequently Asked Questions about Outsourced Accounting

What is outsourced accounting?

What accounting services can I outsource in Ireland?

How can outsourcing accounting benefit small businesses and startups?

How much does outsourced accounting cost in Ireland?

How does outsourcing help ensure compliance with Irish tax laws?

Can outsourced accounting improve my business’s cash flow management?

What should I consider when choosing an outsourced accounting firm in Ireland?

Will outsourcing accounting compromise the confidentiality of my financial data?

Popular Accounting Posts

- Simplify your Accounting and Bookkeeping needs with our Outsourcing Services

- Online Accounting Services for Small Businesses

- A Guide to Select the Ideal Dublin Accountants for Accounting Firms

- How can Accounting services benefit business start up Ireland?

- The Benefits of Outsourcing Accounting Services for Small Businesses

- Demystifying Irish Accounting Standards: A Comprehensive Guide for Businesses

Parul is a content specialist with expertise in accounting and bookkeeping. Her writing covers a wide range of accounting topics such as payroll, financial reporting and more. Her content is well-researched and she has a strong understanding of accounting terms and industry-specific terminologies. As a subject matter expert, she simplifies complex concepts into clear, practical insights, helping businesses with accurate tips and solutions to make informed decisions.