Are you tired of spending hours on spreadsheets and tax forms instead of growing your Limerick business? Outsourced bookkeeping services and accounting services Limerick offer a lifeline, freeing you from time-consuming financial admin so you can focus on what matters, customers, operations and expansion.

Managing a business in Limerick demands your attention across multiple areas: operations, customer service and strategic growth. Financial record-keeping, while essential, often becomes a time-consuming distraction. This is where outsourced bookkeeping and accounting services in Limerick provide genuine value, delivering Limerick outsourced accountants expertise without the cost of full-time hires.

Professional accounting services in Limerick have evolved with cloud technologies like Xero, enabling bookkeeping Limerick pros to handle everything remotely. Whether you’re a small business bookkeeper needing payroll for small business Limerick, a startup seeking a Xero certified bookkeeper, or facing help with backlog bookkeeping, these accountancy firms Limerick scale to your needs. Discover monthly bookkeeping packages prices, RTI and VAT compliance support for small business and more in this complete guide for Limerick businesses.

Key Takeaways:

- Professional services cost significantly less than full-time employment

- Access specialised expertise without paying benefits or training cost

- Cloud platforms enable seamless remote financial management

- Improved accuracy and regulatory compliance with professional services

- Flexible models scale according to your actual business requirements

Understanding Ireland’s Business Landscape in 2025

The context for Limerick businesses operates within Ireland’s broader economic framework. According to the Central Statistics Office (CSO) Business in Ireland 2023 report released in December 2025, SMEs account for 99.8% of active enterprises and employ 66.9% of persons in Ireland’s business economy.

The latest CSO data shows Ireland had 401,359 active enterprises in the business economy, employing 2,345,457 persons. Small and medium enterprises continue to form the backbone of the Irish economy, with 92.6% of businesses employing fewer than 10 people.

However, challenges remain for Irish businesses:

- Cost pressures continue to impact operational margins

- Access to finance remains a concern for many SMEs

- Regulatory compliance requirements demand constant attention

- Economic uncertainty affects long-term planning

These realities make accurate, timely financial information essential for informed decision-making, especially for bookkeeping Ireland and Limerick accountancy needs.

What are Outsourced Bookkeeping Services?

Outsourced bookkeeping means engaging external professionals to manage your financial records instead of hiring full-time staff. Understanding the distinction between bookkeeping and accounting helps you choose the right service level for your business needs.

A professional bookkeeper in Limerick handles daily transactions, maintains records and prepares reports without requiring office space or employee benefits.

Accounting and bookkeeping services in Limerick cover broader functions. While bookkeepers record transactions, accountants Limerick provide:

- Tax strategy and planning

- Financial analysis

- Statutory compliance

- Strategic advisory services

Many accountancy firms Limerick offer both, providing integrated accounting and bookkeeping services. Small businesses with straightforward needs may require only basic bookkeeping service support, while growing companies benefit from comprehensive bookkeeping and accounting services for small businesses.

Why Businesses in Limerick Choose Outsourcing?

Cloud accounting platforms like Xero, QuickBooks and Sage enable remote professionals to manage your finances securely without physical presence. The shift towards outsourcing bookkeeping services is driven by practical benefits that directly impact your bottom line and operational efficiency.

Several factors drive businesses towards outsourced bookkeeping services:

- Cost efficiency: Full-time employment includes salary plus PRSI, pension, holidays, sick leave, training and workspace. Outsourcing converts fixed cost to variable expenses.

- Specialised expertise: Limerick accountants working with multiple clients bring diverse experience to your business without funding their learning curve.

- Scalability: Services adjust to busy or slow periods, ensuring you pay only for necessary support.

- Technology investment: Professional bookkeeping service providers invest in current software and security infrastructure.

- Core business focus: Time spent on bookkeeping diverts from revenue-generating activities and strategic planning.

What Services Are Available?

When evaluating accounting options in Limerick, most providers offer similar fundamentals. The key is understanding what basic bookkeeping covers versus advanced accounting services, so you can match your business needs with the right service tier.

Quality and communication create meaningful differences between chartered accountants Limerick providers.

Essential Functions

Any competent bookkeeping service delivers:

- Accurate transaction recording

- Bank reconciliation

- Accounts receivable and payable management

- Monthly or quarterly financial statements

- Organised digital records with convenient access

- Invoice and receipt processing

Advanced Services

Leading accountancy firms in Limerick extend beyond basics:

- VAT compliance: RTI and VAT compliance support for Limerick small business operations proves critical. Late submissions or errors result in penalties exceeding professional service cost.

- Payroll administration: Payroll and bookkeeping services complement each other. Managing payroll for small business Limerick involves navigating evolving regulations regarding tax, PRSI, pensions and benefits.

- Management accounting: Quick turnaround monthly management accounts Limerick enable real-time decision-making based on current performance rather than historical data.

- Tax advisory: Tax advisors Limerick ensure you meet obligations while minimising liabilities through legitimate planning. Professional advice frequently generates returns exceeding its cost.

- Financial planning: Forward-looking projections, cash flow forecasting,and scenario analysis help anticipate challenges and opportunities.

For niche needs like online payroll and bookkeeping service for Limerick pubs, specialist providers offer solutions.

Service Costs and Pricing

Regarding how much an outsourced bookkeeper cost for businesses in Limerick, the answer depends on transaction volume, complexity and service requirements. Understanding the pricing structure helps you budget appropriately and compare providers effectively.

Monthly bookkeeping packages Limerick prices typically range:

| Service Tier | Monthly Cost | Included Services |

|---|---|---|

| Basic | €150 – €300 | Transaction recording, bank reconciliation, basic reports |

| Standard | €300 – €600 | Basic services plus VAT returns, payroll, detailed statements |

| Comprehensive | €600 – €1,200+ | Full service including management accounts, analysis, advisory |

Cost factors include:

- Transaction volume (50 vs. 500 monthly transactions)

- Industry complexity (construction vs. retail)

- Reporting requirements (basic vs. detailed departmental)

- Platform expertise (Xero certified bookkeeper in Limerick for startups)

- Specialised knowledge (online payroll and bookkeeping service for Limerick pubs)

- Cleanup needs (help with backlog bookkeeping Limerick)

How to Choose the Right Provider?

Quality varies significantly among Limerick accountants options. Knowing what to look for helps you identify providers who will truly support your business rather than just process transactions.

Key differentiators include:

- Industry experience: Providers familiar with your sector understands unique challenges, regulations and patterns without extensive explanation.

- Professional qualifications: Seek chartered accountants Limerick or bookkeepers with recognised certifications (ACCA, ACA, ICB).

- Technology proficiency: Providers should demonstrate software fluency and offer best accounting software for small business Limerick recommendations to your operations.

- Communication clarity: Financial information should be accessible. Providers who explain concepts clearly enable informed decisions.

- Transparent pricing: Reputable providers clearly explain fee structures and what’s included at each level.

- Client references: Established providers connect prospective clients with current customers who share service experiences.

Look for bookkeeping consultant / freelance bookkeeping services for flexible, project-based support.

Common Challenges and Solutions

Professional outsourced bookkeeping services solve specific problems that Limerick businesses commonly face. From catching up on overdue records to setting up new systems, these challenges have practical solutions.

Clearing Backlog Records

Many businesses need help with backlog bookkeeping Limerick. Professional services systematically reconstruct records, identify missing documentation and bring businesses current with regulatory requirements.

Setting Up a New Business

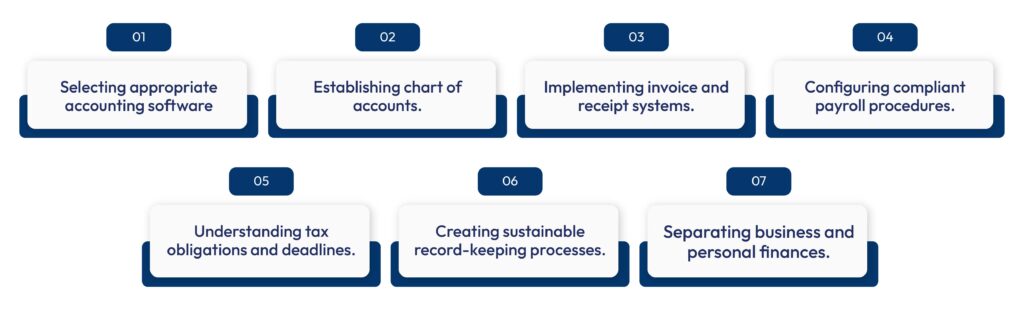

A comprehensive bookkeeping checklist for new business Limerick should address:

A knowledgeable small business bookkeeper or freelance bookkeeping services provider guides you through these steps.

Choosing the Right Software

Experienced virtual bookkeeping services Limerick Ireland providers work with multiple platforms, recommending solutions suited to your needs by evaluating:

- Transaction volume and types

- Invoicing requirements

- Inventory management needs

- Integration with existing systems

- Budget constraints

- User-friendliness

- Reporting capabilities

Handling Seasonal Changes

Many Limerick businesses experience seasonal variations. Outsourced services accommodate fluctuations naturally increasing support during peaks and adjusting downward during slower periods.

Benefits of Virtual Services

Virtual bookkeeping services Limerick Ireland has altered how businesses access expertise. Geographic proximity no longer limits options, opening up possibilities for specialised support that might not be available locally.

Cloud software, video conferencing and secure document sharing enable collaboration regardless of physical location.

Benefits include:

- Reduced overhead (no commute or local office cost)

- Broader talent pool (access specialists scarce locally)

- Business continuity (backup systems and staff coverage)

- Scheduling flexibility (meetings outside traditional hours)

- Technology leverage (advanced collaboration tools and automation)

This proves valuable for specialised requirements like finding a Xero certified bookkeeper in Limerick for startups locally.

Conclusion

Outsourced accounting Limerick services provide more than organised financial records they deliver time savings and operational clarity. Consider what causes the most stress in your financial management: delays in invoicing, uncertainty about cash flow, or compliance deadlines. Professional bookkeeping Limerick support addresses these specific challenges, allowing you to focus on business growth rather than administrative tasks.

The investment in quality accounting services in Limerick typically delivers returns through improved decision-making, reduced errors and better compliance. For Limerick businesses at any development stage, finding the right accountancy firms in Limerick partner enables you to concentrate on core operations while maintaining financial control and visibility.

Ready to streamline your finances? Contact Outbooks Ireland for outsourced bookkeeping & accounting services: info@outbooks.com or +35 3212069255.

Frequently Asked Questions

How quickly can providers start working with my business?

Does outsourcing mean losing control over finances?

What if I have internal staff for basic entry but need advanced help?

How do I determine if outsourcing suits my business?

What security measures protect my data?

What’s included in basic packages versus additional fees?

Parul is a content specialist with expertise in accounting and bookkeeping. Her writing covers a wide range of accounting topics such as payroll, financial reporting and more. Her content is well-researched and she has a strong understanding of accounting terms and industry-specific terminologies. As a subject matter expert, she simplifies complex concepts into clear, practical insights, helping businesses with accurate tips and solutions to make informed decisions.