Many UK accountants, business owners and finance teams supporting Irish trading operations face uncertainty around import VAT, especially for goods arriving from outside the EU. One frequent concern is whether VAT has to be paid at the point of importation and then reclaimed on a later VAT return and how that impacts cash flow and reporting.

For businesses that import goods into Ireland, paying VAT immediately on arrival can strain working capital, particularly when stock moves frequently or payment terms are delayed. Irish postponed VAT accounting offers a way to manage this more effectively.

In this guide we cover:

- What postponed VAT accounting means

- Who can use postponed accounting in Ireland

- Key benefits for businesses

- How to complete postponed VAT on VAT returns

- Practical example and statement usage

What is Postponed VAT Accounting?

Postponed VAT Accounting (PVA) is a system that allows Irish VAT-registered businesses to account for import VAT on their periodic VAT return (VAT3) rather than paying it immediately when goods enter the country.

Under this scheme, the import VAT that would normally be paid at the border is both declared and reclaimed in the same VAT return, provided the usual VAT deduction rules are satisfied. This means businesses can avoid any upfront cash outflow for import VAT, improving cash flow management.

The value of imported goods is reported in specific fields on the VAT3 return. The mechanism operates similarly to the reverse charge system, VAT is self-accounted by the importer, appearing as both input VAT and output VAT on the same return.

Who Can Use Postponed VAT Accounting?

Eligibility Conditions

To qualify for postponed VAT accounting in Ireland (with no postponed VAT accounting end date announced):

- The business must hold a valid Irish VAT registration.

- It must be registered for Customs & Excise (C&E) businesses may need to register for postponed VAT accounting if not already set up.

- An active Economic Operators Registration and Identification (EORI) number is required to meet customs clearance conditions.

Automatic Entitlement

Businesses that were both VAT-registered and C&E-registered on 31 December 2020 automatically qualified for postponed VAT accounting from that date. Newer businesses should register for postponed VAT accounting after completing both VAT and C&E registration to access the full PVA system.

Goods Covered

Postponed VAT accounting applies to goods imported from countries outside the European Union (EU). It can be used for most types of imported goods, provided that the imports meet VAT deductibility rules and the business is entitled to reclaim input VAT in the normal way.

Benefits of Postponed VAT Accounting

1. Cash Flow Efficiency

Postponed VAT accounting eliminates the requirement to pay import VAT upfront at customs, removing the delay in reclaiming it on a future VAT return. This provides a notable cash flow advantage, particularly for businesses that frequently import goods or operate with tight working capital.

2. Simultaneous Declaration and Claim

Under postponed VAT accounting, the VAT due on imports and the VAT reclaimable as input tax are reported on the same VAT return. In most cases, these amounts are equal, effectively offsetting each other and reducing the need for separate payment and refund processes. This minimises administrative effort and improves reporting efficiency.

3. Simplified Reporting

The inclusion of dedicated Postponed Accounting (PA) fields on the VAT3 return ensures import VAT is recorded consistently and transparently. This approach reduces reporting errors, streamlines compliance with Revenue guidelines and aligns VAT and customs data for improved accuracy.

How to File Postponed VAT Accounting on Your Irish VAT Returns?

When using postponed VAT accounting, the VAT3 return and VAT Return of Trading Details (RTD) must be completed correctly to remain compliant with Irish Revenue requirements. Here’s a step-by-step guide, including how to handle the postponed VAT accounting statement.

Step 1: Ensure Eligibility and Documentation

- Confirm that your business is registered for VAT in Ireland and for Customs & Excise (C&E) with a valid EORI number. Businesses must register for postponed VAT accounting through Revenue before applying it to imports.

- Retain supporting evidence of all imported goods, including customs declarations, invoices and import documentation, plus the postponed VAT accounting statement from ROS.

Step 2: Identify Relevant VAT Return Fields

On the VAT3 return, specific “Postponed Accounting” (PA) fields capture import values subject to postponed VAT accounting:

- PA1 – Declared customs value of goods imported under postponed VAT accounting.

- PA2, PA3 and PA4 – Supplementary fields used to record VAT due and input VAT reclaimed under postponed accounting.

Step 3: Enter Import Values

- Include the net customs value of imported goods in field PA1.

- In the RTD return, record the corresponding values in PA2, PA3 and PA4 as required by Revenue guidance.

- Imported goods that are zero-rated for VAT also need to be included if postponed accounting was applied.

Step 4: Declare VAT Payable and Reclaim

- Under postponed VAT accounting, declare the import VAT that would be payable in the relevant field.

- Simultaneously, you can reclaim the same VAT amount if the acquisition meets normal deductibility rules.

Step 5: File the VAT3 Return On Time

- Complete and submit the VAT3 return by the due date, ensuring all postponed VAT accounting entries are accurate and consistent with customs data.

- Keep detailed customs evidence (such as the SAD form or electronic import documentation) and the postponed VAT accounting statement to provide to Revenue if verification or audit queries arise.

Postponed VAT Accounting Example

Imagine an Irish company (VAT registered in Ireland) imports goods with a customs value of €100,000 from outside the EU at the standard 23% VAT rate.

Using postponed VAT accounting, they declare €100,000 in PA1 on the VAT3 return, record €23,000 as VAT payable and reclaim the full €23,000 as input VAT on the same return (Line 135).

No payment is made at the border, keeping cash flow neutral.

In this scenario:

- The VAT payable is recorded on the importer’s VAT return through postponed accounting and not paid at the border.

- The same VAT is claimed on the return, as input VAT on Line 135 of the VAT 3 form, subject to normal deductibility rules.

- The net effect on cash flow remains neutral, since the VAT due and the VAT reclaim occur in the same return period, avoiding any upfront VAT payment at import.

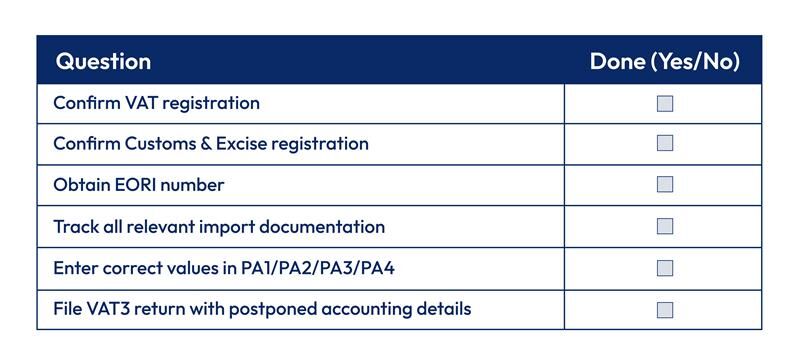

Practical Checklist for Postponed VAT Accounting

This checklist helps you prepare returns accurately and avoid errors.

Common Errors and How to Avoid Them

Incorrect Customs Declaration Codes

Import declarations must include the correct indicator that postponed VAT accounting is being applied. If incorrect, Revenue may reject declarations or exclude postponed accounting.

Failure to Include Zero-Rated Goods Correctly

Goods that are zero-rated for VAT must still be entered correctly under postponed accounting where applicable, even if no VAT is payable. Incorrect treatment can distort reporting on the VAT 3 return and lead to reconciliation issues.

Missing Supporting Documentation

Retain all customs and import records, including C&E documentation, invoices and the monthly postponed VAT accounting statement (available in ROS), as Revenue may request confirmation of eligibility and declared values.

Conclusion

Postponed VAT accounting in Ireland allows VAT-registered businesses to declare import VAT on their VAT return instead of paying it at the point of import. By declaring and reclaiming VAT in the same period, businesses can improve cash flow and keep customs and VAT reporting aligned.

Understanding how to register for postponed VAT accounting, use the postponed VAT accounting statement and complete VAT returns correctly is essential for compliance. Many businesses choose specialist support, such as Outbooks, to manage VAT returns, reconciliations and postponed VAT accounting requirements accurately.

Ready to master postponed VAT accounting in 2026? Contact Outbooks Ireland at +353 212069255 or info@outbooks.com for seamless compliance!

FAQs

What is postponed VAT accounting in Ireland?

Who can use postponed accounting?

Do I still need to pay import VAT at the border?

What documents should I keep?

Can postponed VAT accounting improve cash flow?

Parul is a content specialist with expertise in accounting and bookkeeping. Her writing covers a wide range of accounting topics such as payroll, financial reporting and more. Her content is well-researched and she has a strong understanding of accounting terms and industry-specific terminologies. As a subject matter expert, she simplifies complex concepts into clear, practical insights, helping businesses with accurate tips and solutions to make informed decisions.