In most accounting practices, delays in accounting proposal sign-off are rarely caused by the service itself. Scope is usually agreed, and requirements are understood. Delays primarily arise from how accounting proposals are prepared, structured and approved.

Preparation often involves recalculating pricing, adjusting scope and responding to clarification requests, which extends timelines and reduces internal capacity. These operational factors influence overall accounting proposal success.

Key Takeaways

- How internal preparation of accounting proposals can delay approvals

- The impact of manual or partially standardised workflows

- How accounting proposal structure affects review and follow-up

- Practical approaches to improve efficiency and reduce turnaround time

Common causes of delays in accounting proposals

Pricing is calculated manually for each accounting proposal

Many firms still prepare pricing manually, even for standard compliance services. Senior personnel review requirements and calculate fees, which delays issuance. Lack of pricing visibility at an early stage increases back-and-forth before approval and is a common reason for accounting proposal signing delays.

Accounting proposal preparation depends on assigned personnel

Preparation is handled by specific staff members. If those individuals are engaged in delivery work or unavailable, accounting proposals can be delayed. This affects the practice’s ability to respond promptly to new enquiries, particularly during periods of high workload.

Basic quote forms do not present pricing clearly

Some firms rely on enquiry or quote forms that capture prospect details but do not provide structured pricing or a complete accounting proposal. Preparing the formal accounting proposal separately often introduces additional delays.

Accounting proposal approval requires clarification

When accounting proposals do not clearly outline services, pricing structure and next steps, clients request clarification. Each additional step extends approval timelines. This is an operational issue rather than a service issue.

Improving accounting proposal efficiency

Accounting proposals are operational documents representing compliance and accounting services. Efficient accounting proposals reduce internal workload without affecting service delivery.

Provide clear pricing and scope upfront

Allowing prospects to view structured pricing and service scope early reduces manual effort and follow-up. Practices can issue accounting proposals more quickly and reduce approval delays.

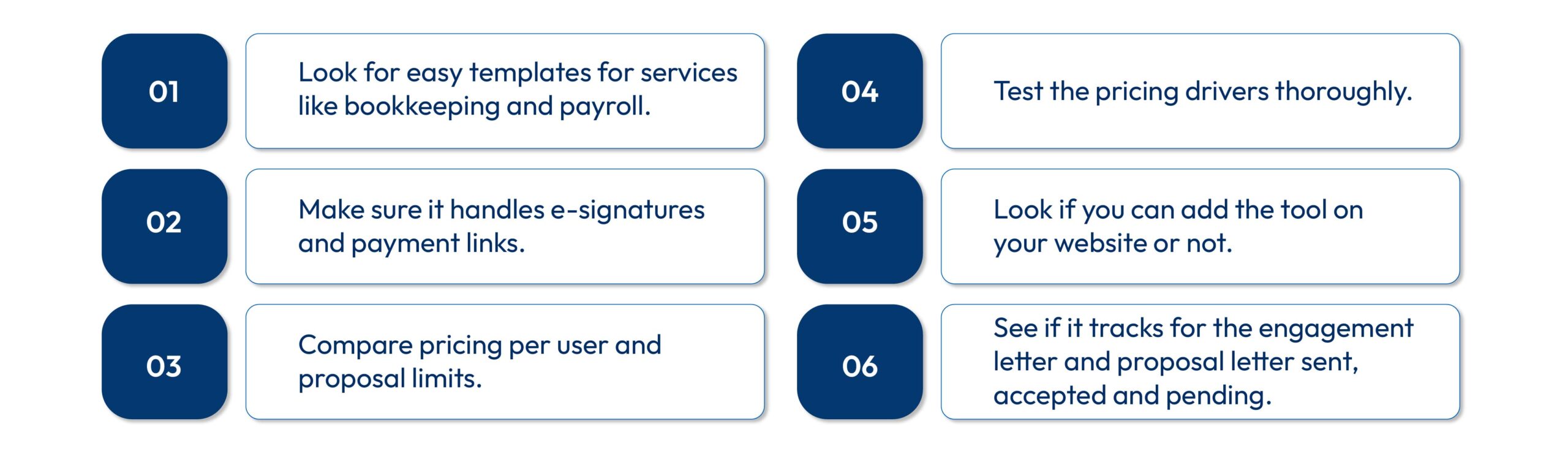

Reduce manual preparation

Standardised accounting proposal workflows and templates enable similar proposals to be prepared efficiently. This reduces repetitive work while maintaining accuracy and professional presentation.

Separate compliance from optional services

Presenting compliance services separately helps clients understand what is included and where value is added. Optional services can be presented without overcomplicating the core accounting proposal.

Structured follow-up

Follow-up should be based on accounting proposal status rather than memory. Knowing when an accounting proposal has been reviewed or approved allows firms to follow up at the appropriate time, reducing unnecessary delays.

Leveraging digital workflows

Digital accounting workflows support efficiency by reducing non-billable work, standardising accounting proposals and shortening approval cycles. Tools such as the Outbooks Proposal Tool integrate naturally into existing workflows, automating proposal generation and tracking while maintaining professional oversight.

Conclusion

Delays in accounting proposal approvals are typically operational rather than service-driven. Practices can improve turnaround time by standardising workflows, providing pricing visibility upfront, separating compliance from optional services, and implementing structured follow-up. Digital workflows and automation reduce non-billable effort while maintaining accuracy and professional presentation.

By adopting these approaches, accounting firms can increase accounting proposal efficiency, reduce internal workload, and improve overall success rates without altering pricing or service delivery.

FAQs

Why do clients delay signing accounting proposals?

Delays are typically caused by manual preparation, lack of pricing clarity, internal approvals and repeated clarification requests rather than dissatisfaction with the service.

How long should clients take to sign accounting proposals?

For standard accounting services, accounting proposals are usually approved within a few days to two weeks. Longer timelines often indicate internal process inefficiencies.

How can accounting proposal approvals be expedited?

Providing clear pricing and scope, standardising accounting proposals, and implementing structured follow-up reduces approval time. Digital workflows can significantly improve efficiency.

Do e-signatures reduce accounting proposal delays?

Yes. Eliminating manual signing steps shortens approval timelines.

How should accounting proposals be followed up?

Follow-up should be guided by accounting proposal status and timelines, not ad-hoc reminders, to maintain efficiency and professionalism.

Parul is a content specialist with expertise in accounting and bookkeeping. Her writing covers a wide range of accounting topics such as payroll, financial reporting and more. Her content is well-researched and she has a strong understanding of accounting terms and industry-specific terminologies. As a subject matter expert, she simplifies complex concepts into clear, practical insights, helping businesses with accurate tips and solutions to make informed decisions.