Modern accounting firms are transforming how they handle client proposals. The days of lengthy discovery calls and manual proposal creation are ending.

Today’s prospects expect instant quotes and self-service options. They want to explore services and pricing on their own terms.

Proposal automation tool technology makes this possible. API integration brings proposal builders directly to your website.

Why API Integration Changes Everything for UK Accounting Firms

API integration revolutionises client engagement for accounting firms. It eliminates friction in your process completely.

Traditional proposal methods require multiple touchpoints. Prospects must schedule calls, wait for quotes, and navigate complex processes.

Proposal API integration solves these problems instantly. Clients create proposals themselves without waiting for appointments.

Let UK Accounting Prospects Create Their Own Proposals Online

Research shows that integration capability enables proposal automation tools to be linked with other essential applications like accounting, customer relationship management, and project management. This connectivity eliminates data silos completely.

Self-service proposals work 24/7 without human intervention. Prospects can explore options at midnight or during weekends.

Your team spends less time on admin tasks. More time goes to delivering actual accounting services.

Benefits of API Integration:

| Traditional Method | API Integration Method |

|---|---|

| Phone calls required | Self-service online |

| 2–3 days turnaround | Instant proposals |

| Manual data entry | Automated processing |

| Limited availability | 24/7 access |

| High admin costs | Reduced overheads |

Outbooks Proposal Tool helps you make professional proposals fast and easy. You pick a template, add your content, and send it to clients.

Clients can sign proposals online and pay automatically. It handles pricing, creates contracts, tracks your business, and collects payments.

Everything happens in one place from start to finish. No more chasing clients for money or signatures.

The API Integration Feature for UK Accountants

Now Outbooks is launching something new that no other company offers. Proposal API for websites integration becomes reality.

For the first time, you can add the proposal tool directly to your website. This lets potential clients create their own proposals instantly.

Automated proposal creation eliminates hours of discovery calls. Accountants can focus on higher-value activities instead.

Related post – Features to Look for in Accounting Proposal Software

How Outbooks API Integration Works for UK Firms

Step 1: Simple Website Integration

Simply add the proposal generator tool to your website. The integration takes minutes, not hours or days.

Visitors go to that page and fill out basic information easily. They enter proposal type, their name, and address.

No technical knowledge required for setup. The system handles all complex processes automatically.

Step 2: Service Selection Interface

Clients click “Next” to select the services they want. The pricing calculator shows transparent costs immediately.

Available Service Categories:

Ongoing/Recurring Services:

- Advisory Services

- Bookkeeping

- C.I.S (Construction Industry Scheme)

- Company Secretarial

- Payroll Management

- VAT Returns

- Management Accounts

One-Off/Ad hoc Services:

- Advisory Bookkeeping

- Company Formation

- Tax Planning

- Audit Preparation

- Financial Consulting

- Compliance Reviews

Step 3: Review and Confirmation

On the next page, they review selected services and prices. The instant quote tool for accountants calculates everything automatically.

Clients enter their contact details including name, phone, email, and address. All information gets captured securely.

Finally, they click “Get Proposal” and receive it directly in their email. The entire process takes under five minutes.

Related post – The psychology of persuasive proposals: How to structure proposals that get accepted

Implementation Guide

Technical Requirements

Embedded proposal tool requires minimal technical setup. Most websites support simple code integration.

WordPress, Squarespace, and Wix all work perfectly. Custom websites need basic HTML embedding.

Mobile responsiveness comes built-in. Prospects can create proposals on any device easily.

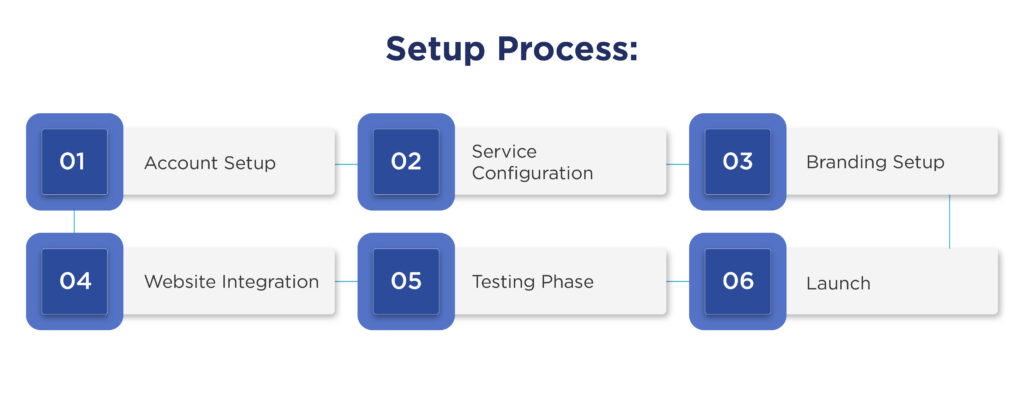

Setup Process

Steps to Implementation:

- Account Setup: Register for Outbooks API access

- Service Configuration: Define your service offerings and pricing

- Branding Setup: Upload logos and set colour schemes

- Website Integration: Add provided code to your site

- Testing Phase: Complete test proposals before going live

- Launch: Activate the tool for public use

Training Requirements

Generate proposals online requires minimal staff training. The system handles most processes automatically.

Train reception staff on handling automated leads. They’ll receive notifications for new proposals.

Sales teams learn to follow up with qualified prospects. The system identifies hot leads automatically.

Best Practices for Success

Optimising your Service Menu

Quote generation works best with clear service descriptions. Use simple language that prospects understand.

Price services competitively but profitably. Research local market rates before setting prices.

Offer package deals for multiple services. This increases average proposal values significantly.

Following Up Effectively

Automated proposal creation is just the beginning. Personal follow-up remains crucial for closing deals.

Contact prospects within 24 hours of proposal creation. Strike while interest levels are highest.

Use the proposal as a conversation starter. Discuss specific needs and customisation options.

Measuring Success

Sales proposal builder analytics reveal important insights. Track conversion rates by service type.

Monitor completion rates at each step. Identify where prospects abandon the process.

A/B test different service descriptions and pricing. Optimise based on actual performance data.

Common Implementation Challenges

Technical Concerns

Embedded quoting tool integration rarely causes technical problems. Most issues relate to user training.

Website compatibility is excellent across all platforms. Mobile performance matches desktop functionality.

Loading speeds remain fast with proper implementation. The tool doesn’t slow down website performance.

Pricing Strategy Issues

Pricing calculator for accountants requires careful consideration. Too high prices scare prospects away.

Too low prices devalue your services unnecessarily. Research competitor pricing before setting rates.

Consider offering basic, standard, and premium tiers. This gives prospects choices while maximising revenue.

Change Management

Digital client proposals represent a significant process change. Some team members may resist initially.

Start with a pilot program on one service. Prove success before rolling out completely.

Celebrate early wins and share success stories. This builds momentum for broader adoption.

Related post – How to write client focused accounting proposals that address financial goals?

Frequently Asked Questions

How long does API integration take to implement?

Can I customise the proposal templates?

What happens if prospects have questions during the process?

How do I handle complex or unusual service requests?

What about data security and privacy?

How do I measure the ROI of proposal automation?

Can the system handle multiple currencies or regions?

What if I need to change my pricing frequently?

Conclusion

Proposal automation technology is shaping the future of accounting sales in the UK. Firms that move early gain a clear competitive edge by reducing admin, speeding up client onboarding, and improving their win rates.

With API integration, your website becomes a round-the-clock sales channel where prospects can generate proposals instantly- without waiting for calls or emails.

Outbooks is leading this change with innovative API features designed specifically for accountants. By adopting these tools, your firm can simplify proposals, strengthen client engagement, and remove barriers to growth.

Start your transformation today with automated proposal technology- so your firm stays ahead while competitors are still catching up.

Ready to Automate Your Proposals?

Empower your prospects to generate their own proposals instantly. Reduce admin time, increase conversions, and scale faster with Outbooks’ Proposal API.

Try the Proposal Tool NowParul is a content specialist with expertise in accounting and bookkeeping. Her writing covers a wide range of accounting topics such as payroll, financial reporting and more. Her content is well-researched and she has a strong understanding of accounting terms and industry-specific terminologies. As a subject matter expert, she simplifies complex concepts into clear, practical insights, helping businesses with accurate tips and solutions to make informed decisions.