Many accounting and outsourcing firms lose good prospects because their pricing feels rigid. A single fixed fee does not reflect different client needs, business sizes, or service expectations. As a result, clients hesitate, delay decisions, or look for alternatives.

In today’s service market, clients expect pricing that reflects their situation. They want clarity, choice and a clear link between what they pay and what they receive. This is where client-driven pricing models become important.

This guide covers:

- Types of client-driven pricing models

- Why flexible pricing improves proposal acceptance

- How pricing affects client decisions

- Practical steps for implementation

Types of Client-Driven Pricing Models

Client-driven pricing models allow clients to select or influence how services are priced. Instead of one standard fee, firms offer structured options.

Below are the most commonly used models.

Fixed Pricing (Defined Scope Model)

Fixed pricing sets a clear fee for a defined list of services.

Example:

- Annual accounts + tax return: £X

- Monthly bookkeeping: £Y

Why Clients Like It:

- Easy to understand

- Predictable budgeting

- No surprise invoices

Limitation:

If scope changes, extra work must be charged separately.

Tiered Pricing Models (Package-Based Pricing)

Tiered pricing offers multiple service levels.

Typical Structure:

| Package | Services | Target client |

|---|---|---|

| Basic | Compliance only | Micro businesses |

| Standard | Compliance + reporting | Growing SMEs |

| Premium | Full advisory support | Established firms |

Why It Works:

Clients choose based on value and budget, not pressure.

Value-Based Pricing (Outcome-Led Pricing)

Value-based pricing links fees to business outcomes rather than hours.

Example:

- Pricing based on cash flow improvement

- Pricing linked to profit optimisation

- Pricing linked to compliance risk reduction

Why clients accept it:

They pay for results, not time.

Usage-Based Pricing (Volume-Based Model)

Fees change based on activity levels.

Common Measures:

- Number of transactions

- Number of employees

- Number of invoices

- Number of entities

Benefit:

Pricing grows only when workload grows.

Customised Pricing (Personalised Proposals)

This model adapts pricing based on detailed client assessment.

Includes:

- Service mix selection

- Reporting frequency

- Advisory involvement

- Support level

Often supported through proposal software.

Hybrid Pricing (Combined Models)

Many firms use mixed structures.

Example:

- Fixed base fee

- Plus usage-based element

- Plus advisory add-on

This balances stability and flexibility.

Why Flexible Pricing Wins More Deals?

Once clients understand pricing options, flexibility becomes a strong advantage.

Here is why.

It Matches Different Client Needs

Not all clients want the same service level. Flexible pricing allows firms to serve:

- cost-focused businesses

- growth-focused businesses

- advisory-led clients

without losing any segment.

It Reduces Price Resistance

When clients see choices, they compare value instead of questioning cost. This improves acceptance rates.

Instead of “Is this too expensive?”, clients think:

“Which option suits me best?”

It Builds Pricing Trust

Clear packages and transparent pricing reduce uncertainty. Clients understand what they are paying for and why.

This reduces pricing trust issues.

It Supports Faster Decisions

Flexible pricing shortens sales cycles. Clients do not need repeated negotiations when options are clear.

It Improves Long-Term Retention

Clients can move between tiers as their business changes. This keeps relationships stable and reduces churn.

How Pricing Models Influence Client Expectations?

Pricing structure shapes how clients view your service.

| Pricing approach | Client perception |

|---|---|

| Single fixed fee | Limited flexibility |

| Tiered pricing | Professional and structured |

| Value-based pricing | Strategic partner |

| Customised pricing | Client-focused firm |

Well-designed pricing improves client expectations in pricing and service delivery.

How to Use Pricing Models to Increase Proposal Acceptance?

Here are practical steps firms can follow.

1. Analyse Your Service Patterns

Review:

- common client profiles

- workload drivers

- recurring support needs

Use this to build realistic pricing tiers.

2. Standardise Your Packages

Create clear inclusions for each level. Avoid vague descriptions.

3. Use Proposal Software

Modern proposal software helps present personalised pricing in proposals clearly and professionally.

4. Train Teams on Pricing Conversations

Staff should explain:

- why options exist

- what value each tier offers

- when upgrades make sense

5. Review pricing annually

Update pricing based on service changes, technology use and client feedback.

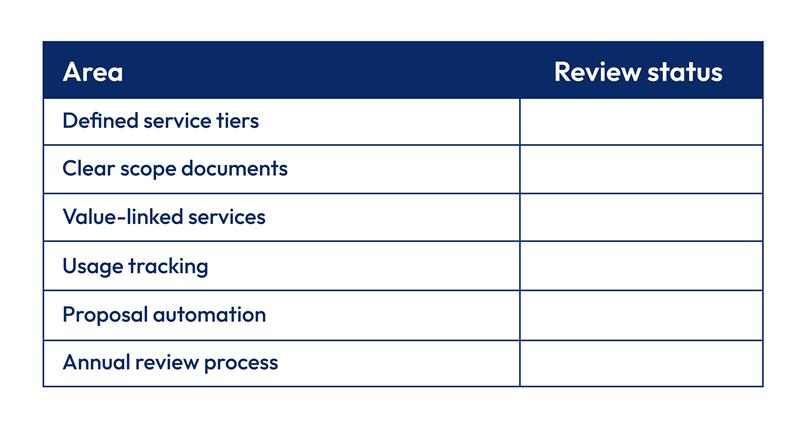

Practical Checklist for Flexible Pricing Setup

Completing this checklist improves pricing consistency and proposal success.

Conclusion

Client-driven pricing models work because they align fees with client needs, value expectations and business stages. Models such as tiered pricing, value-based pricing and customised proposals give clients control while protecting firm margins.

Flexibility wins more deals because it reduces resistance, builds trust and helps clients choose confidently. For accounting and outsourcing firms, adopting structured flexibility is now a competitive requirement, not an optional feature.

FAQs

How flexible pricing helps accountants win more proposals?

It gives clients clear options, reduces uncertainty and improves confidence in decision-making.

What are the best pricing models for accounting and outsourcing firms?

Tiered pricing, value-based pricing and hybrid models work best for most service firms.

Why do clients prefer flexible pricing options?

They want pricing that reflects their size, budget and service needs.

How do pricing models increase proposal acceptance?

Clear options and transparent value reduce negotiation and speed up approvals.

How can firms manage flexible pricing without losing control?

By standardising packages, defining scope clearly and reviewing pricing regularly.

Parul is a content specialist with expertise in accounting and bookkeeping. Her writing covers a wide range of accounting topics such as payroll, financial reporting and more. Her content is well-researched and she has a strong understanding of accounting terms and industry-specific terminologies. As a subject matter expert, she simplifies complex concepts into clear, practical insights, helping businesses with accurate tips and solutions to make informed decisions.