For UK accounting firms, having a complete client onboarding process is essential. It ensures compliance with HMRC and UK anti-money laundering regulations, supports Making Tax Digital (MTD) requirements, and builds smooth communication with clients – forming the foundation of a long, successful relationship.

What Is Client Onboarding for Accounting Firms in the UK?

Client onboarding is a process where new clients taken onboard. The process covers everything from initial post-proposal client process to the time of client utilising the services.

Key Objectives of Client Onboarding for UK Accountants

Following are the key objectives of the client onboarding:

- Ensure every client feels welcomed and informed

- Collect and verify all required data smoothly

- Clearly communicate expectations and services

- Comply fully with anti-money laundering and industry standards

- Set up efficient systems for ongoing engagement

Related blog – How to Streamline Client Onboarding with Digital Accounting Proposals

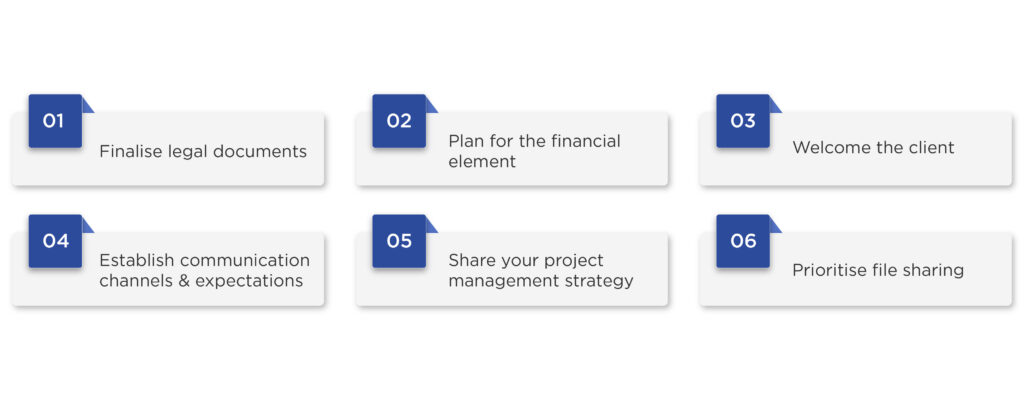

Stages of the Accounting Client Onboarding Process

| Stage | Purpose |

|---|---|

| Proposal Follow-Up | Confirm proposal acceptance, clarify fees, address queries |

| Information Collection | Gather business and personal information using digital onboarding checklist |

| Compliance & AML Checks | Validate identity, conduct legal background checks |

| Engagement Letter Sent | Specify services, deadlines, and terms for both parties |

| Accounting Client Intake | Enter client data into accounting practice workflow systems |

| Welcome Pack Sent | Provide guidance materials, deadlines, and points of contact |

| System Setup | Integrate data using client onboarding software and accounting CRM integration |

| Assignment of Service Team | Notify client of team members and introduce key contacts |

| Regular Updates Initiated | Send onboarding emails for accounting clients and confirm progress |

Comprehensive Digital Tools for Onboarding

Modern accounting firms use various digital tools and automation strategies:

- Client onboarding software: Manages proposal acceptance, document collection, and reminders

- Automated onboarding workflow: Streamlines the process and tracks progress for every task

- Accounting CRM integration: Stores client information for easy retrieval and smooth handover

- Digital onboarding checklist: Ensures every step is completed, reducing errors and omissions

Sample Digital Onboarding Checklist

| Task | Assigned To | Status |

|---|---|---|

| Client intake questionnaire | Client | Not Started |

| Anti-money laundering compliance | Firm | In Progress |

| Receipt of previous tax records | Client | Complete |

| Data entry into workflow tools | Firm | In Progress |

| Welcome kit delivery | Firm | Sent |

| Signed engagement letter | Client | Pending |

Related post – From Draft to Deal: The Proposal Process for accountants

Delivering a Strong Client Welcome Pack

A well-prepared welcome kit for new accounting clients helps clients settle in quickly. Include:

- Service summary and scope of engagement

- Points of contact with direct phone and email

- Digital onboarding checklist

- Calendar of reporting and tax deadlines

- Answers to common client queries

- Instructions for secure file transmission

Post-Proposal Client Journey

| Step | Description |

|---|---|

| Proposal Approved | Client confirms acceptance of accounting services |

| Initial Consultation | Meeting arranged to answer questions and outline next steps |

| Collection of Documents | Gather needed personal, financial, and compliance data |

| AML/Compliance Checks | Verify ID and conduct anti-money laundering checks |

| Welcome Pack Sent | Welcome materials and procedures delivered to client |

| Engagement Letter Signed | Contractual agreement finalised |

| System Integration | Data entered into accounting CRM and practice management |

| Assignment of Service Team | Service team introduced, communicating roles and contacts |

| Regular Progress Updates | Scheduled onboarding emails and progress reports sent |

Streamlining the Process for Virtual and Small Accounting Firms

- Use secure virtual meeting software to replace in-person consultations

- Leverage cloud-based accounting practice workflow systems

- Standardise communication with client communication templates and onboarding emails

- Automate file collection and signature requests to save time

Ensuring Seamless Handover from Sales to Service

- The sales team provides a comprehensive handover to the client service team

- Introduce the client directly to their new point of contact

- Use written onboarding materials to reduce repetition and errors

Best Practices for Onboarding UK Accounting Clients

- Keep instructions and checklists simple and easy to follow

- Use reminders and automated notifications for deadlines and missing documents

- Regular feedback: check in at intervals (such as 30 and 60 days) to answer queries and ensure satisfaction

- Monitor the process to identify bottlenecks or frequent client questions, then adjust the workflow as needed

Sample Welcome Email Template

Dear [Client Name],

Welcome to [Your Firm Name]. We are pleased to have you onboard and look forward to working with you.

Attached you will find your customised onboarding checklist and welcome pack.

If you have any questions at any stage, please contact your main adviser, [Contact Name], at [Contact Email].

Best regards,

The [Your Firm Name] Team

Advanced Automation and Client Lifecycle Management

- Automated onboarding workflow solutions keep track of every step and set reminders

- Client onboarding software consolidates data and provides a secure platform for communication

- Accounting client intake process can be templated and adjusted for different client types or sizes

- Regular review of the client journey after proposal approval helps identify improvement areas for a seamless client lifecycle management for accountants

Handling Sensitive and Complex Client Onboarding

- Establish secure document sharing portals with encryption

- Schedule extra calls for clients with complex holdings or international regulatory considerations

- Work with legal advisers on custom engagement letters if needed

Retaining and Engaging Clients Post-Onboarding

- Maintain regular communication beyond onboarding (newsletters, timely updates, offers for additional services)

- Request feedback about the onboarding experience and use client suggestions to improve your accounting client onboarding process

Related post – How automated engagement letters simplify client onboarding

Frequently Asked Questions (FAQs)

How do you onboard new accounting clients efficiently?

What is the best onboarding process for small accounting firms?

What are the immediate steps after a proposal is signed?

How can onboarding be automated for accounting clients?

What should be included in a comprehensive client welcome pack?

How to keep clients engaged after the proposal sign-off?

How does the onboarding process differ for virtual accounting firms?

Conclusion

A detailed and client-centric client onboarding process is vital for the lasting success of any UK accounting practice. By combining structured steps, the right digital tools, and clear, friendly communication, firms can transform new clients into long-term partners. Importantly, aligning onboarding with HMRC requirements, VAT accuracy, Making Tax Digital (MTD) rules, and UK anti-money laundering (AML) regulations ensures your firm stays fully compliant. By continually refining the onboarding process, your practice can remain efficient, compliant, and a trusted adviser for every UK client.

Simplify Your Client Onboarding Process Today

Let prospects generate proposals instantly and start onboarding clients in under 5 minutes with our automated proposal tool.

Try Our Proposal ToolParul is a content specialist with expertise in accounting and bookkeeping. Her writing covers a wide range of accounting topics such as payroll, financial reporting and more. Her content is well-researched and she has a strong understanding of accounting terms and industry-specific terminologies. As a subject matter expert, she simplifies complex concepts into clear, practical insights, helping businesses with accurate tips and solutions to make informed decisions.