In today’s competitive UK accounting landscape, generic proposal templates simply won’t suffice. Customised accounting proposals have become essential tools for UK accountancy firms seeking to differentiate themselves and improve client acquisition rates.

This article explores how customised proposals can transform your accounting sales process and significantly boost conversion rates, based on current industry research and best practices.

The Current State of Client Acquisition for UK Accounting Firms

Recent industry data reveals concerning trends for UK accounting firms:

- 63% of potential clients review proposals from at least three firms before making a decision

- Generic proposals result in average conversion rates of only 21–27%

- 78% of prospects cite “lack of personalisation” as a key reason for rejecting proposals

These statistics highlight the urgent need for accounting firms to adopt more sophisticated client onboarding strategies and proposal development processes.

Related blog – Customising Your Accounting Proposal: Understanding the Scope of Work

Why Customised Accounting Proposals Matter for UK Clients

They Demonstrate Understanding

Bespoke accounting proposals show prospects that you’ve taken time to understand their specific business challenges. This goes beyond merely inserting their name and company details throughout a template.

A recent survey of UK accountancy clients found that 72 % value ‘understanding of their business

They Establish Value Proposition

Customised proposals allow you to clearly articulate your unique value proposition in relation to the client’s specific needs. This positions your firm as a strategic partner rather than a mere service provider.

According to a recent AccountingWEB survey, firms that clearly articulate client-specific value in their proposals see 38% higher conversion rates.

They Build Trust Early

Tailored proposals establish credibility and trust from the outset. This lays the foundation for stronger client relationships and improves retention rates over time.

Related post – From Draft to Deal: The Proposal Process for accountants

Key Elements of Winning Accounting Proposals for UK Firms

1. Personalised Executive Summary

Begin with a concise executive summary that demonstrates your understanding of the client’s specific challenges. This should reflect information gathered during discovery meetings and research.

A study found that proposals with personalised executive summaries have a 40% higher acceptance rate.

2. Problem-Solution Framework

Effective winning proposals clearly articulate the client’s pain points and provide tailored solutions. The framework should follow this structure:

- Specific client challenge identified during discovery

- How this challenge impacts their business (with quantifiable metrics where possible)

- Your unique approach to solving this challenge

- Expected outcomes and timeline

This approach shows deep understanding and positions your firm as a problem-solver rather than just a service provider.

3. Value-Based Pricing Options

Customised proposals should include flexible pricing options based on the value delivered, not just time spent. A research found that 67% of clients prefer value-based pricing to hourly rates.

This approach allows clients to self-select based on their needs and budget while clearly demonstrating the value of each option.

4. Relevant Case Studies

Include brief case studies that showcase similar clients you’ve helped in the same industry or with comparable challenges. According to Proposify’s State of Proposals report, elements such as interactive pricing tables can increase close rates by 6%, while proposal design and images boost close rates by 23%. Including e-signatures and dynamic pricing options can also significantly increase acceptance and close rates, depending on the context.

Focus on tangible results and outcomes rather than just listing services provided.

5. Clear Next Steps

End your proposal with a specific action plan outlining the client onboarding strategy and implementation timeline. This creates momentum and reduces the likelihood of delays in decision-making.

Research shows that proposals with clear next steps and timelines close 32% faster than those without.

Related post – The psychology of Accounting Proposals: What clients really want?

Implementing a Customised Proposal Framework for UK Accounting Practices

Step 1: Thorough Discovery Process

Effective CPA client acquisition techniques begin with comprehensive discovery meetings. These should uncover:

- Business objectives and strategy

- Current financial pain points

- Decision-making criteria

- Budget and timeline considerations

- Previous experiences with accountants

This information forms the foundation of your customised proposal. Dedicate at least 60-90 minutes to discovery before creating any proposal.

Step 2: Research and Preparation

Before drafting, conduct additional research into:

- The client’s industry trends and challenges

- Regulatory considerations specific to their sector

- Competitor analysis

- Potential growth opportunities

This additional context enables deeper proposal personalisation and demonstrates your commitment to understanding their business environment.

Step 3: Draft and Review

When creating your proposal:

- Begin with a clear structure and outline

- Incorporate specific client language and terminology

- Focus on outcomes rather than just services

- Include visual elements that enhance understanding

- Have a colleague review for clarity and errors

The most effective proposals balance comprehensiveness with conciseness. Research shows that proposals between 5-10 pages have the highest acceptance rates.

Step 4: Professional Presentation

Your proposal presentation should reflect your brand’s professionalism. Consider:

- Consistent branding throughout

- High-quality design elements

- Interactive digital formats where appropriate

- Mobile-friendly versions for on-the-go executives

Proposal management software can significantly streamline this process while ensuring consistency and professionalism.

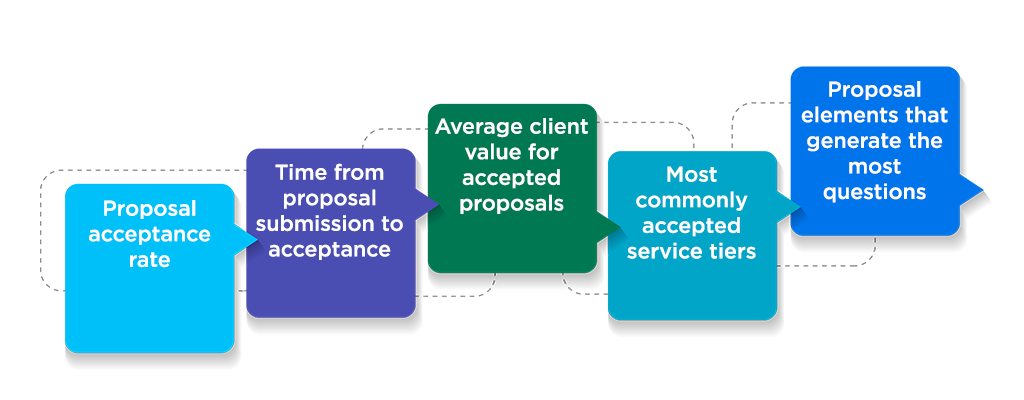

Measuring Proposal Success

To refine your accounting client engagement approach, track these key metrics:

Regular analysis of these metrics enables continuous improvement of your proposal process.

Case Study: Harrison & Partners

Harrison & Partners, a mid-sized accounting firm in Leeds, transformed their client acquisition rate through customised proposals:

Before:

- Used standard proposal templates

- 22% acceptance rate

- Average onboarding time: 5.2 weeks

- Client churn rate: 18% in year one

After implementing customised proposals:

- Developed industry-specific proposal frameworks

- 47% acceptance rate (114% increase)

- Average onboarding time: 2.8 weeks

- Client churn rate: 7% in year one

This transformation required investment in discovery processes and proposal development but yielded significant returns through improved conversion and retention.

The Role of Technology in Proposal Creation

Modern technology solutions can significantly enhance your proposal management capabilities:

Proposal Software

Dedicated proposal management software like Practice Ignition, Proposify, or Better Proposals offer:

- Customisable templates

- Digital signature capabilities

- Analytics and tracking

- Integration with CRM systems

- Automated follow-ups

According to Accounting Today UK, firms using dedicated proposal software see 32% higher acceptance rates and 41% faster decisions.

CRM Integration

Integrating your proposal process with your CRM system creates a seamless prospect-to-client journey. This integration enables:

- Automatic capture of prospect information

- Tracking of proposal status

- Scheduled follow-ups

- Reporting on conversion metrics

This integrated approach significantly enhances business development for accountants by creating a systematic, data-driven acquisition process.

Building a Proposal Library

Developing a comprehensive proposal library can significantly improve efficiency while maintaining customisation:

- Create industry-specific sections addressing common challenges

- Develop service descriptions that can be easily tailored

- Compile relevant case studies organised by industry and challenge

- Design flexible pricing models for different client sizes and needs

This library approach enables rapid customisation without sacrificing quality or thoroughness.

Effective Follow-Up Strategies

The proposal is just the beginning of your accounting client engagement process. Effective follow-up strategies include:

- Scheduled check-in 2-3 days after proposal delivery

- Specific questions addressing potential concerns

- Additional value-added resources relevant to their challenges

- Clear next steps for moving forward

Research shows that 80% of sales require five follow-up contacts, yet 44% of salespeople give up after just one follow-up.

Realted post – How technology in accounting changing proposal writing for accountants?

Conclusion

Customised accounting proposals represent a significant opportunity for UK firms to improve client acquisition rates and build stronger client relationships from the outset.

By investing in discovery, personalisation, and professional presentation, accounting firms can transform their proposals from generic documents into powerful business development for accountants tools that drive growth and differentiation.

The most successful firms view proposal development not as an administrative task but as a strategic opportunity to demonstrate value and build trust with prospective clients.

FAQs

How long should an accounting proposal be?

Research indicates that the optimal length for accounting proposals is 5-10 pages. This provides sufficient detail while remaining focused and digestible.

What is the average acceptance rate for accounting proposals?

Industry benchmarks suggest 20-30% for generic proposals, while highly customised proposals can achieve 40-50% acceptance rates.

How can we implement customised proposals without significantly increasing workload?

Develop a modular approach with industry-specific components that can be rapidly assembled and customised. Proposal management software can significantly streamline this process.

What’s the most important element of a successful accounting proposal?

According to research, demonstrating a clear understanding of the client’s specific challenges and providing tailored solutions is the most influential factor in proposal success.

How quickly should we follow up after sending a proposal?

Best practice suggests making initial contact within 2-3 business days, then following a structured follow-up process if no response is received.

Should we include pricing in our proposals?

Yes, but consider offering tiered options rather than a single price point. This empowers clients to choose their preferred level of engagement while demonstrating the value of each option.

How can we measure the effectiveness of our proposal process?

Track metrics including proposal acceptance rate, time to decision, average client value, and first-year retention rates. Compare these against industry benchmarks to identify improvement opportunities.

How can smaller accounting firms compete with larger firms in the proposal process?

Smaller firms can often deliver more personalised proposals with greater attention to detail. Leverage this advantage by demonstrating deeper understanding of the prospect’s specific industry and challenges.

Make Every Proposal Count with Outbooks

Customise, send, and win more clients — all from one powerful proposal tool. Save time and stand out with professionally branded quotes.

Parul is a content specialist with expertise in accounting and bookkeeping. Her writing covers a wide range of accounting topics such as payroll, financial reporting and more. Her content is well-researched and she has a strong understanding of accounting terms and industry-specific terminologies. As a subject matter expert, she simplifies complex concepts into clear, practical insights, helping businesses with accurate tips and solutions to make informed decisions.