Many accounting firms lose potential clients without realising their proposal process in accounting firms is to blame. If your team spends too much time creating proposals or makes avoidable mistakes, you’re likely missing opportunities this explains why accounting proposals fail to convert clients. The good news? Simple improvements to your digital proposal workflow can make a big difference.

Why Proposal Problems Hurt Your Firm in the UK Market

Poor proposal processes create several issues, including common proposal mistakes in accounting practices:

Wasted Time with Manual Drafting

- Staff spend hours drafting proposals from scratch instead of using quoting software for accounting

- Chasing approvals eats into productive work time

- Manual processes slow everything down

Missed Opportunities from Slow Responses

- Clients expect quick responses-delays damage client communication in accounting

- Slow proposals make you look unprofessional

- Many prospects choose firms that use proposal automation.

Quality Concerns and Compliance Risks

- Manual errors damage your credibility

- Inconsistent pricing confuses clients

- Poor formatting creates bad impressions

Related post – From Draft to Deal: The Proposal Process for accountants

What UK Accounting Clients Really Want in Proposals

Today’s accounting clients expect:

- Professional, easy-to-understand proposals (hint: engagement letter automation helps)

- Quick turnaround times (enabled by accounting practice growth tools)

- Clear pricing and service details

- Simple approval processes

- Digital delivery options

Firms that meet these expectations win more business.

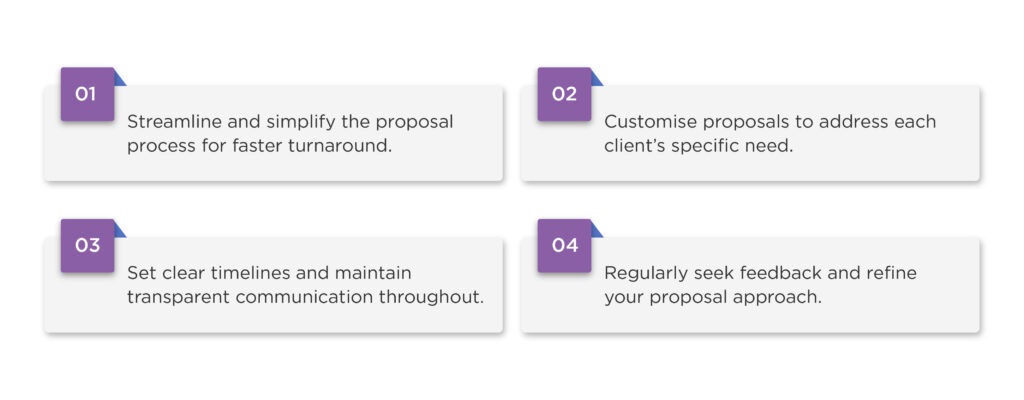

Four Steps to Better Proposals for UK Accountants

1. Use Professional Templates

- Create standard formats for different services

- Include your branding for consistency

- Make sure they’re easy to read and understand

Benefits:

- Saves hours of drafting time

- Ensures consistent quality

- Makes your firm look more professional

2. Automate Repetitive Tasks

- Save standard service descriptions in your proposal tool as reusable blocks.

- Automate basic calculations

- Create reusable content sections

Benefits:

- Reduces manual errors

- Speeds up proposal creation

- Lets staff focus on client communication in accounting

3. Simplify Approvals

- Make proposals easy to review

- Use clear formatting for important details

- Use a single clear call‑to‑action (e.g., “Accept proposal”) and an online signature to speed approvals.

Benefits:

- Faster client decisions

- Less time spent following up

- More closed deals

4. Improve Client Experience

- Send proposals digitally (leveraging digital proposal workflow)

- Make them mobile-friendly

- Keep language clear and simple

Benefits:

- Clients appreciate the convenience

- Easier for clients to say yes

- Builds your professional image

Related post – What is proposal management and its challenges for small businesses

Key Features

Look for proposal software for accountants that offers:

- Custom templates that match your services

- Easy editing so anyone can make updates

- Brand consistency across all documents

- Simple sharing options for clients

- Organised storage of past proposals

Getting Started with Improvements

First Week:

- Review your current proposal process in accounting firms

- Identify what takes the most time

- Note common proposal mistakes in accounting practices

Second Week:

- Create or improve templates (or adopt best tools to automate proposals for accountants)

- Set up standard service descriptions

- Train staff on new processes

Third Week:

- Start using the improved system

- Get feedback from your team

- Make small adjustments as needed

Fourth Week:

- Review results with your team

- Celebrate time savings

- Plan next improvements

Realted post – How to format an engagement letter

Common Mistakes to Avoid

Mistake: Completely manual proposal creation

Fix: Automate repetitive tasks with your proposal tool.

Mistake: Inconsistent formatting

Fix: Use professional templates

Mistake: Unclear pricing

Fix: Create standard pricing structures

Mistake: Slow response times

Fix: Streamline approvals with engagement letter automation

Mistake: Making clients work too hard

Fix: Simplify review/acceptance via digital proposal workflow

The Bottom Line

How to improve your accounting proposal process: Small, practical steps help your firm:

- Save time with accounting proposal automation

- Win more clients through better client communication in accounting

- Present a professional, compliant image

- Reduce errors in VAT and pricing calculations

- Simplify workflows with a digital proposal process aligned with HMRC and MTD requirements

The best UK firms don’t just deliver great service – they make it easy for clients to choose them. By optimising your proposals with UK-ready tools, you remove barriers to growth while ensuring compliance and professionalism from the very first interaction.

Realted post – The hidden costs of managing proposals without automation

Frequently Asked Questions

Do we need expensive software to improve?

How long to see results?

Will staff need extensive training?

Will staff need extensive training?

Can we keep our branding?

What’s the first change to make?

Stop losing clients to slow proposals

Try Outbooks Proposal Tool – create, send, and get approvals faster with ready templates and automated workflows.

Parul is a content specialist with expertise in accounting and bookkeeping. Her writing covers a wide range of accounting topics such as payroll, financial reporting and more. Her content is well-researched and she has a strong understanding of accounting terms and industry-specific terminologies. As a subject matter expert, she simplifies complex concepts into clear, practical insights, helping businesses with accurate tips and solutions to make informed decisions.