Managing self-assessment tax returns is becoming increasingly complex for accountants. Growing client expectations, strict HMRC compliance rules, and tight filing deadlines put pressure on firms, particularly during peak periods.

For small practices, limited companies and independent professionals, handling large volumes of client data, engagement approvals, and pricing agreements manually can lead to delays, errors, and frustrated clients.

Proposal software offers a structured solution that streamlines the entire self-assessment workflow, improves client communication, and reduces administrative burdens.

This guide covers:

- Simplifying the self-assessment tax return process with proposal software

- Common challenges in managing self-assessment clients

- Benefits of digital proposals and streamlined client onboarding

- Clear self-assessment pricing and engagement letters

- Compliance support with HMRC deadlines

- How tools like the Outbooks proposal platform improve daily operations

Why Self-Assessment Work Remains Challenging?

Self-assessment tax returns involve more than form submission. Accountants must collect accurate data, confirm engagement terms, agree fees and meet strict filing schedules.

Key challenges include:

- Incomplete client information

- Unclear service scope

- Late document submission

- Manual engagement letters

- Disputes over fees

- Missed deadlines

According to HMRC, millions of taxpayers still submit close to the January filing deadline highlighting why structured systems are essential.

Without a structured system, these issues slow down service delivery and affect client trust.

How Proposal Software Transforms the Self-Assessment Tax Returns Workflow?

A clear workflow is essential for managing high volumes of tax clients. Proposal software helps create a repeatable and controlled self-assessment workflow.

1. Faster Client Onboarding

Client onboarding becomes simpler when proposals, documents and engagement letters are sent digitally. Clients can review and approve services online without delays.

Benefits include:

- Reduced follow-ups

- Faster approvals

- Better first impressions

- Clear service confirmation

Digital proposals allow clients to provide all required information upfront, making it easier for accountants to start preparing self-assessment tax returns immediately.

2. Clear Engagement Letters and Service Scope

Engagement letters for self-assessment protect both the accountant and the client. Proposal software ensures engagement letters are:

- Automatically attached

- Standardised

- Easy to update

- Stored securely

This reduces misunderstandings and helps avoid disputes later.

3. Transparent Self-Assessment Pricing

Unclear pricing is a common cause of conflict. Proposal software allows firms to present self-assessment pricing clearly before work begins.

Features include:

- Fixed-fee options

- Tiered service plans

- Add-on services

- Digital approval

Clear pricing ensures clients know exactly what services they are paying for, reducing confusion when handling self-assessment tax returns.

4. Automated Proposal Acceptance

Proposal acceptance automation removes delays caused by manual signatures and email approvals. Clients can approve proposals online in minutes.

This supports faster service delivery and improves cash flow.

5. Better Self-Assessment Client Management

With centralised records, firms can track:

- Approved services

- Signed engagement letters

- Client history

- Outstanding actions

This improves self-assessment client management and reduces administrative errors.

Start simplifying your self-assessment tax return workflow today with the Outbooks proposal tool.

Key Benefits of Using Proposal Software for Self-Assessment

- Streamlined client onboarding and approvals

- Clear engagement letters and service scope

- Transparent pricing with digital approval

- Faster workflow and reduced administrative burden

- Improved compliance and reduced risk of missed HMRC deadlines

- Centralised tracking of client history and outstanding actions

Tools like the Outbooks proposal tool help accountants manage proposals, approvals, and records efficiently, making self-assessment work faster and more reliable.

How Automation Enhances Self-Assessment Efficiency?

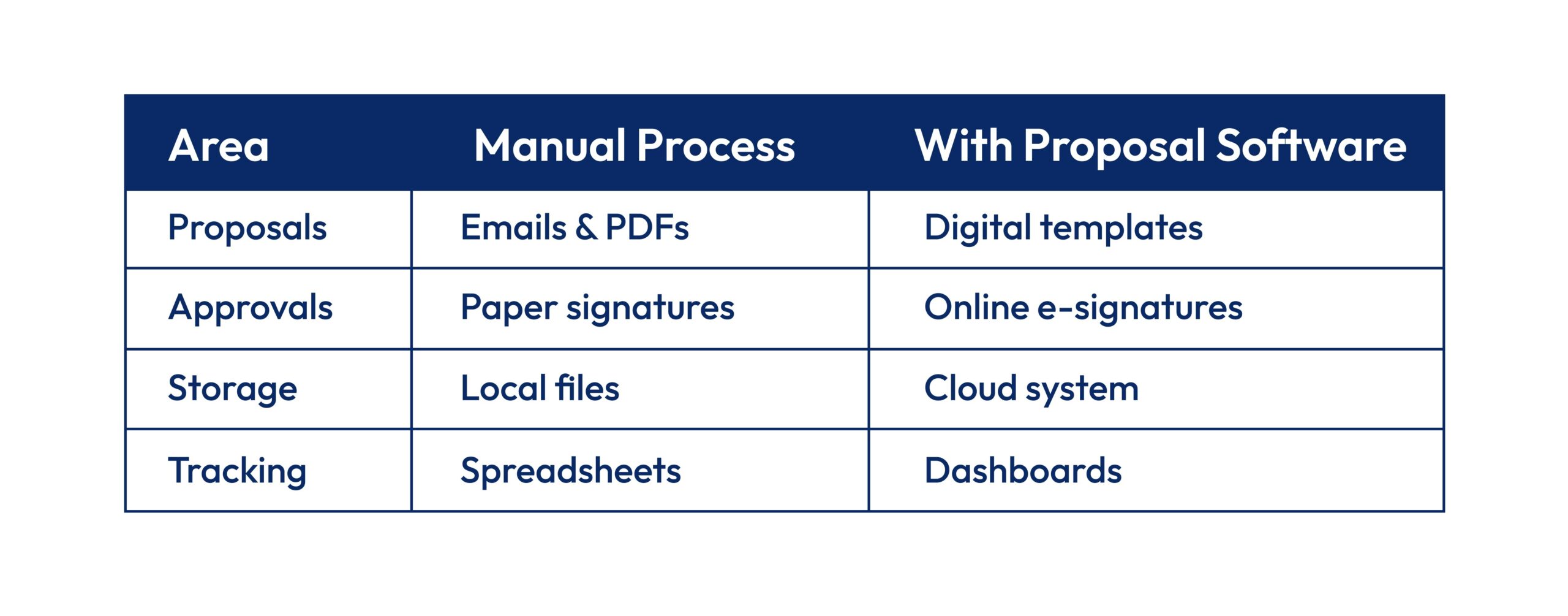

Automation accounting tools now support many non-technical tasks in tax practices. Proposal software plays an important role in this transition.

Key automation benefits include:

Automation allows accountants to focus more on advisory work and compliance. As tools streamline repetitive tasks, allowing accountants to focus on accurate preparation of multiple self-assessment tax returns.

How Proposal Software Supports Compliance and Deadlines?

Meeting HMRC self-assessment deadlines is critical. Proposal software helps by:

- Recording approval dates

- Storing signed agreements

- Tracking client status

- Maintaining audit trails

This reduces compliance risks and supports internal reviews.

Choosing the Right Proposal Software

When selecting proposal software with e-signatures, firms should consider:

- Ease of use

- Security standards

- Custom templates

- Integration options

- Support services

The right software supports a smooth process for creating proposals, tracking approvals, and managing self-assessment tax returns efficiently.

Conclusion

Proposal software simplifies the self-assessment tax return process by improving client onboarding, engagement letters, pricing clarity and workflow automation.

Tools like the Outbooks proposal streamline proposals, approvals, and client records, reducing administrative burden.

For firms aiming to deliver accurate, timely and professional Self-Assessment services, adopting proposal software is a practical way to reduce pressure, improve compliance and enhance client satisfaction.

Frequently Asked Questions (FAQs)

What is proposal software?

Proposal software is a digital platform that helps accountants create, send and manage service proposals. It includes features like e-signatures, templates, automated reminders and secure client record storage, simplifying self-assessment client management.

How proposal software helps self-assessment?

It streamlines client onboarding, allows proposals and engagement letters to be approved digitally and keeps all records securely organised for easier self-assessment client management.

How do accountants manage self-assessment clients?

Accountants collect client data, issue engagement letters, track deadlines and prepare returns efficiently using digital systems and structured workflows.

How to standardise self-assessment proposals?

Using accounting proposal templates with clear service scope, pricing and timelines ensures consistency across all client proposals.

What is the best proposal software for self-assessment accountants?

The best tools provide e-signatures, customisable templates, automated reminders and a centralised platform for managing proposals and client approvals.

How to avoid disputes in self-assessment work?

Disputes are minimised by issuing clear engagement letters, confirming service scope and fees upfront and obtaining client approval before starting work.

Can proposal software help meet HMRC self-assessment deadlines?

Yes, it tracks approvals, monitors outstanding documents and keeps workflows aligned with official HMRC self-assessment deadlines, reducing late filing risks.

Is proposal software suitable for both small and large accounting firms?

Absolutely, small firms benefit from professional client management, while larger firms can manage high volumes of Self-Assessment clients efficiently.

Parul is a content specialist with expertise in accounting and bookkeeping. Her writing covers a wide range of accounting topics such as payroll, financial reporting and more. Her content is well-researched and she has a strong understanding of accounting terms and industry-specific terminologies. As a subject matter expert, she simplifies complex concepts into clear, practical insights, helping businesses with accurate tips and solutions to make informed decisions.