The choice to put pricing in accounting proposals is a big topic in the profession. Many accounting firms struggle with whether clear pricing builds client trust or creates problems.

Recent research shows that client needs have changed a lot. Modern clients now want upfront pricing clarity rather than the old “we’ll talk about fees later” approach.

This guide looks at the good and bad points of “should accountants include pricing in proposals?”. We’ll look at different pricing models and give practical advice for making this important choice.

The Current State – Should Accountants include Pricing in Proposals?

Most accounting firms used to avoid putting specific fees in their first proposals. This approach gave them flexibility but often made potential clients unsure.

Recent studies show that firms are now checking pricing every three months. This helps them deal with rising costs and business growth.

The accounting industry is moving towards being more open about pricing. Clients now want clearer talk about costs upfront rather than finding out fees during the work.

Understanding Different Pricing Models

Fixed Fee vs Value-Based Pricing

Fixed fee pricing gives clients certainty and stops billing surprises. This model works well for standard services like yearly accounts or tax returns.

Value-based pricing focuses on the benefit given to the client rather than time spent. This model creates strong bonds and builds long-term relationships.

Package-based pricing puts multiple services into bundle deals. This approach makes client choices easier whilst ensuring complete service delivery.

Monthly Retainers vs Hourly Billing

Monthly retainers give steady cash flow and let accountants focus on client needs. Retainer deals help consultants predict income better than other pricing methods.

Hourly billing offers flexibility but can create uncertain costs for clients. This old model often leads to scope creep in accounting and unhappy clients.

The choice between these models greatly affects how pricing should be shown in proposals.

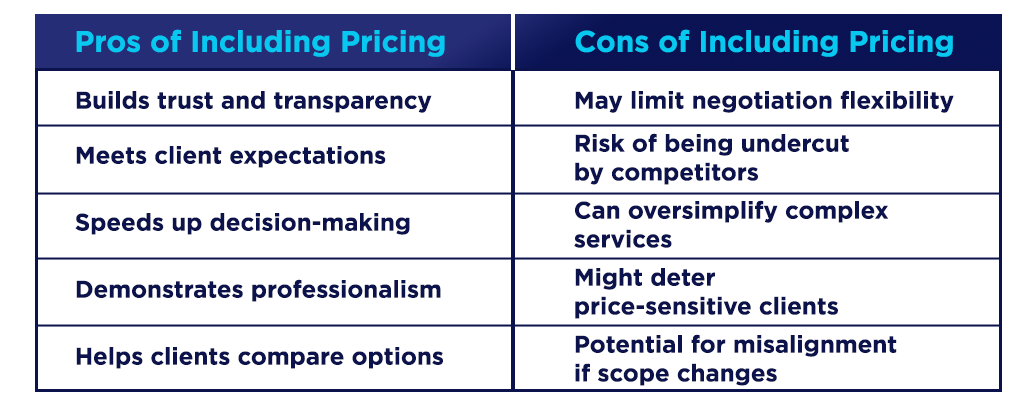

Moving ahead, let us explore pros and cons of pricing in proposals.

Related blog – Mastering Your Accounting Proposal Pricing Strategy: A Comprehensive Guide

Pros of Including Pricing in UK Proposals

Better Client Trust and Proposal Clarity

Clear pricing for accountants builds stronger client relationships from the start. Clients like knowing exactly what they’ll pay before agreeing to services.

Keeping pricing structure open is vital to building trust. This openness removes hidden costs and reduces client worry about possible overcharges.

Clear pricing helps clients make smart choices quickly. This openness often speeds up the proposal acceptance process.

Competitive Edge

Including pricing can set your firm apart from competitors who avoid upfront cost talks. This openness shows confidence in your value offer.

Clients can easily compare your services against other providers. This comparison often favours firms that clearly explain their value and pricing structure.

Open pricing reduces the time spent on back-and-forth negotiations. This efficiency helps both the accountant and the potential client.

Better Cash Flow Management

Upfront pricing talks lead to better payment terms and collections. Clients understand their money commitment before work begins.

Fixed pricing models remove disputes over billable hours. This clarity reduces admin work and improves profit.

Clear pricing enables better money planning for both parties. Clients can budget well whilst accountants can predict income reliably.

Cons of Including Pricing in UK Proposals

Risk of Price-Based Competition

Including pricing may lead to clients choosing only based on cost rather than value. This approach hurts the professional service nature of accounting.

Competitors may undercut your pricing without understanding the full scope of services. This race to the bottom damages the whole profession.

Complex jobs are hard to price correctly upfront. Underestimating scope can lead to unprofitable work.

Less Flexibility

Fixed pricing limits your ability to adjust for scope changes during the job. Extra work may need separate pricing talks.

Market conditions and client needs can change after proposal submission. Fixed pricing may not handle these changes well.

Some clients need custom solutions that don’t fit standard pricing models. These situations may need more flexible approaches.

Pricing Problems and Lost Opportunities

Price shock may cause potential clients to reject proposals without understanding the value. This reaction is common with complete service packages.

Clients may focus on individual line items rather than overall value. This detailed analysis can stop productive talks about service benefits.

Some prospects prefer to talk pricing after understanding the full scope. Early pricing talks may end conversations too soon.

Engagement Proposal pricing needs to be decided after considering various factors. Next. let us evaluate the industry research and their best Practices.

Industry Research and Best Practices in the UK

Current Market Trends

Getting new clients can cost 5 to 25 times more than keeping existing ones. This fact shows the importance of building trust through clear communication.

Professional service firms increasingly use automated proposal software to make pricing talks easier. These tools help standardise pricing whilst keeping flexibility.

Good accounting systems enable precise cost tracking which is essential for preparing accurate proposals. This accuracy supports more confident pricing choices.

Job Proposal Pricing Strategies

Successful firms often use tiered pricing structures in their accounting proposal templates with pricing. This approach offers clients choices whilst keeping profit.

Some firms present pricing ranges rather than fixed amounts. This flexibility allows for scope changes whilst giving cost guidance.

Leading practices include separate pricing for different service levels. This approach helps clients understand value differences between service tiers.

Related blog – How Value-Based Pricing in Proposals Drives Better Client Relationships

Comparison Table: Pricing Approaches

| Approach | Client Benefits | Accountant Benefits | Potential Problems |

|---|---|---|---|

| Upfront Fixed Pricing | Budget certainty, no surprises | Predictable income, less admin | Limited flexibility, scope risk |

| Price Ranges | Cost guidance, some flexibility | Scope adjustment ability | Potential for misunderstanding |

| Value-Based Pricing | Focus on outcomes, clear ROI | Higher profit potential | Hard to measure value |

| Hourly Billing | Pay for actual time used | Complete flexibility | Uncertain costs, scope creep |

| Package Pricing | Complete solutions | Higher average job value | May include unused services |

When to Include Pricing vs When to Talk Later

Include Pricing When:

Standard services with predictable scope work best with upfront pricing. Yearly accounts, tax returns, and bookkeeping services fit this category perfectly.

Clients specifically ask for pricing information in their tender documents. Failing to include pricing may remove your proposal entirely.

Your firm uses package-based pricing or monthly retainers. These models need upfront discussion to explain the value offer well.

Talk Pricing Later When:

Complex consulting jobs need detailed scope talks first. These situations benefit from discovery meetings before pricing conversations.

Clients need education about your services before understanding pricing. Some prospects need service explanations before cost talks make sense.

Highly competitive situations may benefit from value talks first. Building your expertise before pricing helps justify premium rates.

Handling Pricing Problems

Common Problems and Responses

“Your prices are too high” often shows poor value communication. Address this by reinforcing the benefits and outcomes your services deliver.

“I can get it cheaper elsewhere” needs careful handling. Focus on quality differences rather than competing only on price.

“I need to think about it” may signal budget concerns. Offer payment plans or phased implementations to address money constraints.

Strategies for Success

Prepare standard responses to common pricing problems. Practice these responses until they feel natural and confident.

Use case studies and testimonials to justify your pricing. Real client success stories show value better than features lists.

Offer alternatives when facing price resistance. Different service levels or payment terms may address client concerns.

Related blog – How to implement a three-tier pricing strategy for accounting services

FAQs

Should I include prices in my accounting proposals?

The answer depends on your service type and client expectations. Standard services benefit from upfront pricing, whilst complex consulting may need discovery first. Consider your competitive position and client knowledge. Clear pricing works well when you can clearly explain value.

Is it better to discuss pricing before or after sending a proposal?

Pre-proposal pricing talks work well for complex jobs. This approach ensures your proposal aligns with client budgets.

Including pricing in proposals works better for standard services. This openness shows confidence and builds trust.

Do clients expect pricing on proposals from accountants?

Client expectations vary by industry and job type. Many modern clients expect upfront pricing, especially for routine services.

Government and corporate clients often need pricing in formal tender processes. Failing to include pricing may remove your submission.

How to handle pricing objections in accounting proposals?

Address problems by reinforcing value rather than defending price. Use specific examples of client benefits and outcomes.

Offer alternatives such as phased implementations or different service levels. This flexibility shows willingness to work within client budgets.

What are the benefits of clear pricing in job letters?

Clear pricing reduces disputes and improves client relationships. Clear expectations prevent misunderstandings about costs.

This clarity also improves cash flow through better payment terms. Clients like knowing their money commitment upfront.

Tips for Implementation

Start Slowly

Begin with standard services where scope is predictable. Build confidence and refine your approach before tackling complex jobs.

Test different approaches with various client types. Monitor acceptance rates and client feedback to improve your strategy.

Document what works and what doesn’t. This analysis helps refine your pricing presentation over time.

Use Technology Wisely

Invest in automated proposal software to make pricing talks easier. These tools help maintain consistency whilst saving time.

Connect pricing tools with your practice management system. This connection ensures accurate cost calculations and profit analysis.

Consider client portals for ongoing pricing openness. These systems help maintain trust throughout the job lifecycle.

Monitor and Adjust

Check pricing every three months to account for inflation, business growth, and scope changes. Regular checks ensure your pricing remains competitive and profitable.

Track proposal acceptance rates by pricing approach. This data helps identify the most effective strategies for different situations.

Gather client feedback about your pricing presentation. This input guides improvements to your proposal process.

Conclusion

The answer to whether UK accountants should include pricing in proposals depends on several factors, including client expectations, service types, and the competitive landscape in the UK market.

Clear pricing helps build trust with UK SMEs and speeds up decision-making. However, complex advisory or tax planning engagements may require detailed discussions about scope before providing costs.

The key is aligning your pricing approach with the needs of your UK clients and the nature of the service. Standard compliance services, such as VAT returns, payroll, and statutory accounts, often benefit from upfront pricing, while bespoke advisory solutions may require discovery first.

Many successful UK accountants use a mixed approach: including pricing for routine services while discussing more complex work later. This flexibility ensures effective client communication while protecting profitability.

When handled well, transparent pricing distinguishes your UK firm and strengthens client relationships. Investing in clear pricing strategies can lead to better client acquisition, retention, and overall confidence in your services.

Ready to Simplify Your Accounting Proposals?

Discover how our proposal tool helps you create, customise, and send professional quotes with clear pricing in minutes.

Try Our Proposal Tool NowParul is a content specialist with expertise in accounting and bookkeeping. Her writing covers a wide range of accounting topics such as payroll, financial reporting and more. Her content is well-researched and she has a strong understanding of accounting terms and industry-specific terminologies. As a subject matter expert, she simplifies complex concepts into clear, practical insights, helping businesses with accurate tips and solutions to make informed decisions.