Clean books is important to maintain financial accuracy and get a clean picture of your business records. It will also help to ascertain if the books are audit ready or not. The requirement for bookkeeping cleanup can arise in many situations.

Preparation for a tax season, external/internal audit preparation, merger, acquisition of the business in Ireland, can be one of the reasons for bookkeeping cleanup. No matter whatever the reason is, it is important to keep your books clean and tidy. This comprehensive guide provides a step by step bookkeeping guide to help you understand the complete cleanup process.

What is Bookkeeping Cleanup?

A bookkeeping cleanup is the process where reviewing, organising, and correcting is taken care of through professional outsourced bookkeeping. The process includes correcting miscatgeorised transactions, adjusting or posting the journal entries. The sign of a good clean up is that the books should reflect the financial position of your business.

It ensures to fix the past mistakes to get a new start. By the end of the clean up your business books will be audit and tax ready. They will clearly show your business’s financial health.

This process might take several weeks to complete, depending on the volume of the transactions and the current status of your books. If you hire professional bookkeepers, they will also recommend you the option of quarterly cleanups to maintain the accuracy.

See related post: Beyond the Ledger: Navigating Effective Bookkeeping Practices

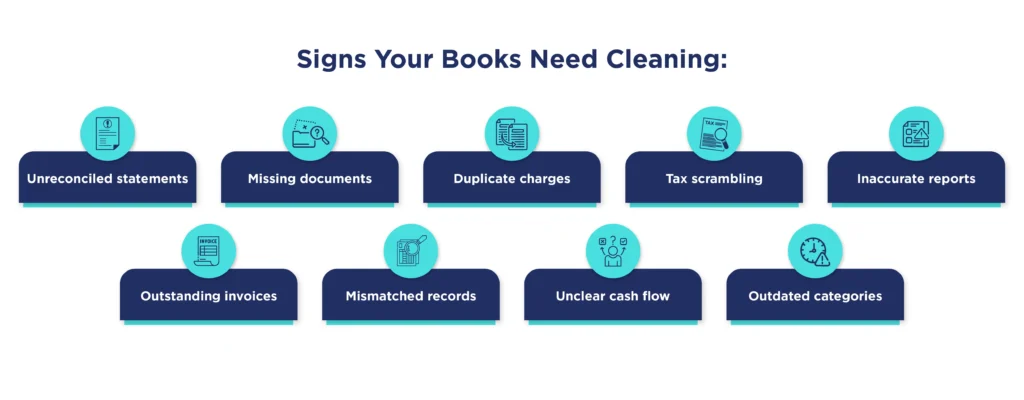

What are the signs your Business needs Bookkeeping cleanup?

Well there are a lot of possible signs which indicates that your business in Ireland needs a bookkeeping clean up. It could be financial record discrepancies, missing receipts/invoices, miscatgeorised transactions, irregular reconciliations of the bank records, cash flow problems, unclear picture of business’s financial health or difficulty in preparing audit ready records.

If you are witnessing any of the above signs, it is definate that your books definately needs a cleanup. Now that you have these signs in your books, let us see and check why it is important to cure through these reasons.

Why Bookkeeping cleanup is important?

Bookkeeping clean up is very important, if you are witnessing any of the above written reasons. Here is why:

- Clean books will help you take all decisions on time, it will also help you avoid delay in tax filing.

- You will not miss any profit opportunities.

- A cleanup doesn’t just tame the clutter; it empowers you to understand your cash flow, identify areas for growth, and ultimately, take control of your financial future.

- Bookkeeping cleanup helps you “catch up” on overdue bookkeeping work and create a set of organized, accurate books so you can confidently use your balance sheet and other statements to make decisions.

Essentially, bookkeeping cleanup transforms chaotic financial records into a reliable foundation for business success, enabling better planning, compliance, and growth opportunities.

See related post: Outsourced Bookkeeping Services: How much bookkeepers cost in Ireland?

Step-by-Step Bookkeeping Cleanup Process

Follow the given 5 step easy bookkeeping clean up process to get more clearer view to your books.

Step 1: Get all financial records at one place

Your initial step is to collect all the financial records. Gather the following documents check listed below:

Bank statements

Receipts

Invoices

Payment records

Tip: Gather all financial records to ensure comprehensive coverage. Organise documents chronologically. This systematic approach makes the cleanup process more efficient and reduces the likelihood of missing important items.

Step 2: Assess your records

The next step is to assess your records to check if there is any discrepencies or outdated categories.

- Accountants or bookkeepers can create their chart of accounts to ensure proper categorisation.

- Make sure you include each and every record and required details like bills and invoices received from vendors, purchase orders, expense reports, travel and entertainment receipts, petty cash records and more.

Assess the scope of cleanup required by reviewing recent financial statements and identifying obvious errors or discrepancies. This assessment helps determine the time and resources needed for the cleanup process.

Review all transactions and ensure they’re properly categorised according to your chart of accounts.

Misclassified expenses can significantly impact financial reporting and tax calculations.

Check for data entry errors: This point is important since bookkeeping data entry errors like transposed numbers and flip-flopped debits and credits can take a lot of time to find and fix.

See related post: Bookkeeping Solutions – Sage VS Xero

Step 3: Check for Bank Reconciliation Errors

Comparing and matching transactions recorded in the bookkeeping records with bank statements and other financial documents to ensure accuracy.

Begin with the most recent month and work backwards systematically. Identify and resolve all discrepancies before moving to the next month. Bank reconciliation ensures thorough coverage.

- Account Reconciliation

Reconcile all balance sheet accounts including assets, liabilities, and equity accounts.

Also, do not forget to verify all the outstanding invoices and bills.

3. Categorise your transactions

Next is to sort the categorisation of your transactions. Doing this is important to keep track of the debit and credit of your money. Below are some of the common categories you can get started with.

- Everything that you pay to your employees including their paychecks, bonuses, commissions, and taxes.

- Keep track of advertisement expense.

- Include day to day equipment’s like office tables, chairs, pantry items and more.

- Also, note the business trip expenses.

- Do not forget to add office rent plus electricity, water, internet, and trash service.

These are just examples – you can make your own categories that work for your business. The main thing is to be consistent and make sure your system actually helps you understand your finances.

4. Cross verify AP and AR

Note down all the missed bills and invoices. You need to make sure you clear your accounts payable and accounts receivables; this means that you need to look at two things: money you owe others and money others owe you.

If you have any unpaid bills, clear that. Check if any payment is yet to be received by the customers.

Using bookkeeping softwares will help you make this job a much easier.

When you keep track of these things, you’ll have a clearer picture of what you owe and what you’re expecting to receive.

See related post: Mastering Bookkeeping: Key Aspects and Effective Tips for Accuracy

6. Update Your Fixed Assets

Next, you need to review fixed assets like, furniture, vehicles, equipments and more. Let us explore what comes in there:

Equipment: Things like machines, computers, and office equipment that you use to run your business.

Furniture: Desks, chairs, filing cabinets, and other office furniture.

Vehicles: Any cars, trucks, or vans your company owns.

Fixed assets depreciate over time as they become outdate with time.

7. Match Your Credit Card Statements

Just like your bank statements, you need to match your credit card transactions as well. You need to match the transactions with those currently entered in books.

Remember it can be a lot more tricky because here personal and business expense can be easily merged. Be extra careful while reconcillling your credit card statements with your books.

Match each charge to an actual receipt to make sure everything is correct.

8. Review Your Payroll Records

Next and one of the most important step is to review your payroll records. You need to carefully review and match your payroll information which typically includes:

Employee wages and salaries

All the taxes you take out of employee paychecks, like federal taxes, state taxes, Social Security, and Medicare.

9. Review Your Inventory Records

If you produce your own inventory, it is important to review as in match all the stock. It also includes that you need to organize your inventory. This includes the following steps.

Check the cost you have paid for each item.

Cross verify how much you have right now, this means you need to see the current quantity present in stock.

Doing this will help you to:

- Figure out your cost of goods sold, which affects your taxes

- Spot if inventory is going missing or being stolen

- Make smart decisions about what to buy and how much to keep in stock

See related post: 5 Reasons Firms Should Outsource Bookkeeping in Ireland

10. Make Sure You’re Ready for Tax Time

The next most important step is to ensure that your books are tax ready, i.e. they are tidy, clean and ready for assessment.

- Put transactions in the right categories

Don’t leave transactions unassigned – this makes it hard to prepare your taxes. Put all your income and expenses in the right categories. Avoid vague labels like “other” or “miscellaneous” because they don’t help your tax preparer. - Fix negative numbers

Negative numbers usually mean there’s a mistake somewhere. For example, a negative number in your accounts receivable might mean you recorded a payment without recording the original invoice. Fix these problems quickly so your financial reports are accurate. - Make sure your balance sheet balances

If your balance sheet doesn’t balance, you might have problems like incorrectly closed accounts, misplaced inventory entries, or corrupted files. Also, this year’s balance sheet should match what you reported on last year’s tax return.

11. Back Up Your Data

Imagine if a power outage crashed your computer, your hard drive died, or hackers got into your system. After all the work you just did cleaning up your books, you don’t want to lose everything.

Regular backups are like insurance for your financial data. They create copies of your information so you can get everything back if something goes wrong. Make backing up a regular habit – you’ll be glad you did if disaster strikes.

12. Set Up Regular Bookkeeping Time

Just like a clean house needs regular cleaning to stay neat, your books need regular attention to stay accurate and organized. Setting up regular bookkeeping sessions helps you avoid the mess you just cleaned up.

When you set aside specific time for bookkeeping tasks, you can stay on top of categorizing transactions, balancing accounts, and monitoring your financial health. This regular maintenance prevents small problems from turning into big headaches later.

See related post: Mastering Modern Bookkeeping: Essential Techniques for Accountants

Conclusion

Effective bookkeeping cleanup is essential for maintaining financial accuracy and ensuring audit readiness. This comprehensive process requires systematic attention to detail and proper resource allocation.

Following this step-by-step bookkeeping guide helps ensure thorough cleanup and improved ongoing accuracy. Regular maintenance prevents future cleanup requirements and supports better financial decision-making.

The accounting cleanup process may seem daunting, but proper planning and execution provide significant long-term benefits. Clean books support business growth, Irish regulatory compliance, and stakeholder confidence.

Contact us today via call +353 212069255 or mail at info@outbooks.com.

FAQs about Bookkeeping Cleanup

How often should bookkeeping cleanup be performed?

What’s the difference between bookkeeping cleanup and catch-up bookkeeping?

How long does a typical bookkeeping cleanup take?

Can I perform bookkeeping cleanup myself?

What documents do I need for bookkeeping cleanup?

How much does professional bookkeeping cleanup cost?

What’s included in a bookkeeping checklist for accountants?

Will cleanup affect my historical financial data?

How can I prevent future cleanup requirements?

When should I start preparing for an audit?

Popular Bookkeeping Posts

- Cloud Bookkeeping VS. Traditional Methods: Why SMEs Should Make The Switch

- A comprehensive guide to choosing a bookkeeping partner in Ireland

- Top Tips for Efficient Bookkeeping Practices in Compliance with Irish VAT Laws

- The role of outsourced bookkeeping in Ireland’s growing green economy

- How to reduce bookkeeping costs for Irish startups through outsourcing

Parul is a content specialist with expertise in accounting and bookkeeping. Her writing covers a wide range of accounting topics such as payroll, financial reporting and more. Her content is well-researched and she has a strong understanding of accounting terms and industry-specific terminologies. As a subject matter expert, she simplifies complex concepts into clear, practical insights, helping businesses with accurate tips and solutions to make informed decisions.