The deadline to file self assessment will be here soon. You might notice stressful day and nights among accountants, solo traders, small business and many other people. However if you plan everything in advance and make right use of the technology the process will not be this stressful.

Filing your self assessment may or may not need expert always but having one ensures smooth filing without missing on any important detail. But in house experts will require various add-ons like latest softwares, qualified professionals and ensuring filing timely with proper handy documents. But in-house or outsourced expert, either way you will should have some of the essentials to ensure smooth compliance. Have a look at the tools and free tips below.

Understanding Self-Assessment requirements in Ireland

Self-employed individuals must file an annual income tax return with Revenue. Tax on income earned in 2025 is due on 31 October 2026.

The self-assessment system requires you to calculate and pay your own taxes. This includes preliminary tax payments throughout the year.

For those using Revenue’s Online Service (ROS), the extended online filing and payment deadline for 2026 is expected to be mid-November, typically 13 November 2026, depending on Revenue’s annual extension schedule.

Tool 1: Cloud based accounting software

Cloud-based accounting software transforms how self-employed people manage their finances. These platforms automatically sync with your bank accounts.

Popular options in Ireland include Xero, QuickBooks and Sage Business Cloud. Each offers real-time financial tracking and reporting features.

The software generates reports needed for your self assessment tax return. This eliminates manual calculations and reduces human errors significantly.

In 2026, many platforms now integrate AI-based expense categorisation and digital receipt recognition, simplifying data entry even further.

Benefits of cloud Accounting

| Feature | Benefit |

|---|---|

| Bank Integration | Automatic transaction imports |

| Invoice Management | Professional invoicing and tracking |

| Expense Categorisation | Automatic tax category assignments |

| Real-time Reporting | Instant profit and loss statements |

| Mobile Access | Manage finances anywhere |

| AI Automation | Predictive reporting and accuracy checks |

Tool 2: Revenue Online Service (ROS)

ROS is Ireland’s official online tax filing platform. It provides a secure way to submit your self assessment tax return electronically.

The system allows you to pay taxes directly and track payment history. You can also view previous years’ returns and correspondence.

For the 2025 tax year (due in 2026), the ROS extended deadline is expected to be 19 November 2026, giving users additional time to file and pay.

In early 2026, ROS introduced enhanced two-factor authentication (2FA) to improve login security and safeguard taxpayer data.

ROS Key Features

- Electronic filing of Form 11

- Online payment options

- Tax calculation assistance

- Secure messaging with Revenue

- Historical tax return access

- Enhanced security and pre-filled data for PAYE income

Tool 3: Digital receipt management apps

Keeping track of business expenses is crucial for maximising deductions. Digital receipt apps eliminate paper clutter and organise expenses automatically.

Popular apps include Receipt Bank, Expensify and Hubdoc. These tools scan receipts and categorise them by expense type.

The apps integrate with your accounting software for seamless record-keeping. This ensures you don’t miss valuable tax deductions.

Most Irish businesses are now adopting eReceipts and eInvoicing tools in line with Revenue’s digital record-keeping standards set for 2026.

Receipt management benefits

Expense tracking becomes effortless with automatic categorisation features. Photos of receipts are stored securely in the cloud.

The software extracts key information like date, amount and supplier. This data feeds directly into your accounting system.

Tax-compliant records are maintained for Revenue’s six-year requirement period. Digital storage prevents loss of important documentation.

In 2026, smart integrations now allow automatic VAT categorisation in line with Irish tax changes.

Tool 4: Tax calculation software

Specialised tax software helps calculate complex self-assessment figures accurately. These tools understand Irish tax law and allowances.

The software handles preliminary tax calculations and balancing payments. It also calculates USC, PRSI and income tax obligations.

Professional tax software often includes audit trails and compliance checks. This reduces the risk of errors in your return.

Note: Updated 2026 versions now include automatic updates for the 2025 income tax bands, credits and USC thresholds.

Popular Tax Tools

| Software | Features | Best For |

|---|---|---|

| TaxCalc | Irish tax compliance | Professional practices |

| Sage Tax | Integrated calculations | Small businesses |

| Revenue Calculator | Official guidance | Basic calculations |

| Surf Accounts | Cloud integration with Revenue forms | Freelancers and SMEs |

Tool 5: Professional support tools

Sometimes professional help is the best investment for your tax return. Qualified accountants understand complex tax regulations thoroughly.

Many offer fixed-fee self-assessment services with guaranteed accuracy. They can identify deductions you might have missed.

Professional services include tax planning advice for future years. This helps optimise your overall tax position legally. Accountants in 2026 are increasingly using AI-driven review systems to ensure accuracy and compliance before submission.

When to seek professional help

Complex business structures require expert knowledge of tax rules. Multiple income streams can complicate your self assessment significantly.

Large expenses or capital allowances need careful calculation and documentation. Property investments add additional complexity to returns.

First-time filers often benefit from professional guidance and setup. This establishes proper systems for future years.

If your income exceeded €50,000 in 2025, consider consulting a tax professional to optimise allowable deductions and manage USC liability.

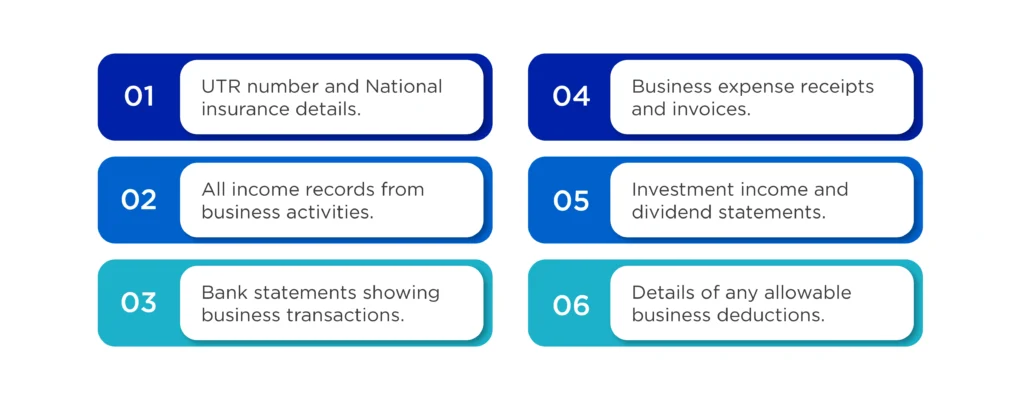

Essential information you’ll need

Before starting your self assessment tax return, gather these documents. Having everything ready speeds up the filing process considerably.

Your Unique Taxpayer Reference (UTR) number is essential for access. Revenue issues this when you register for self-assessment.

Since 2025, Revenue has digitised most correspondence, so make sure your ROS profile email and phone number are updated for 2026 filings.

Required documentation checklist

- UTR number and National Insurance details

- All income records from business activities

- Bank statements showing business transactions

- Business expense receipts and invoices

- Investment income and dividend statements

- Details of any allowable business deductions

- Any 2025 preliminary tax payment records and confirmation from ROS (if submitted earlier)

Common Self-Assessment mistakes to avoid

Missing the filing deadline triggers automatic penalties from Revenue. If you file the paper tax return early, before 31 August, Revenue will complete the self-assessment section on your behalf.

Forgetting to declare all income sources is a serious error. Revenue can cross-reference information from multiple sources.

Overlooking allowable expenses costs you money in unnecessary tax payments. Keep detailed records of all business-related costs.

Always verify your preliminary tax amount covers 90% of your 2025 liability or 100% of your 2024 liability to avoid underpayment interest in 2026.

Record keeping requirements

Proper records must be maintained for six years plus the current year. This includes all invoices, receipts and bank statements.

Digital storage is acceptable provided records remain accessible and readable. Cloud storage offers secure backup and easy retrieval.

Organised filing systems save hours during tax return preparation. Category folders help locate specific documents quickly.

Revenue now recommends maintaining all 2025 digital receipts in a compliant eReceipt format to meet their updated electronic storage guidelines introduced in 2026.

Deadlines and payment options

Understanding key dates prevents costly penalties and interest charges. Mark these important deadlines in your calendar system.

| Deadline Type | Date | Purpose | Registration |

|---|---|---|---|

| New self-assessment registration | 5 October 2026 | Registration | New self-assessment registration |

| Paper Filing | 31 October 2026 | Traditional paper submissions | Traditional paper submissions |

| ROS Filing | 13 November 2026 | Electronic filing deadline | Electronic filing deadline (subject to Revenue’s confirmed extension date)** |

| Payment Due | 31 October 2026 | Final tax payment date | Final tax payment date for 2025 income |

**If using ROS direct debit, ensure your mandate is renewed for 2026, as expired profiles can delay payments and trigger late interest.

Payment methods available

Revenue accepts payments through multiple convenient channels. Direct debit ensures you never miss payment deadlines.

Credit card payments incur small processing fees but offer flexibility. Bank transfers provide secure, immediate payment confirmation.

Online payments through ROS integrate seamlessly with your filing. This creates a complete electronic record of compliance.

From 2026, taxpayers can also make payments via Revenue’s myAccount portal using open banking for faster confirmation.

Planning for next year’s return

Start preparing for next year’s self assessment tax return immediately. Regular bookkeeping throughout the year reduces year-end stress.

Set up automatic systems for expense tracking and income recording. Monthly reconciliations catch errors before they become problems.

Consider quarterly reviews of your tax position with projections. This helps with cash flow planning and preliminary tax estimates.

Using 2026’s enhanced AI-powered accounting tools like Xero Analytics Plus or QuickBooks Smart Insights can automatically forecast next year’s tax liability.

Conclusion

Filing your self assessment can be much easier and well planned if you follow the above tools and tips. Make sure to keep the list of the documents handy with you that is required for filing the content. Further ensure some of the repetitive mistakes that you can do while filing your returns. Have both the lists handy with you to avoid any disperency.

Staying proactive with your 2026 filings will help you avoid penalties and make better use of allowable deductions.

Contact Outbooks Ireland today for expert self assessment tax return and outsourcing services: +353 212069255 or info@outbooks.com.

Frequently Asked Questions

What is the easiest way to file self-employed taxes?

Which software helps with Irish tax returns?

How to do tax returns Ireland?

How can I file my taxes online in Ireland?

What is preliminary tax Ireland?

What is Revenue self-assessment?

What are self-assessment tools Ireland?

When is the online tax return deadline Ireland?

Parul is a content specialist with expertise in accounting and bookkeeping. Her writing covers a wide range of accounting topics such as payroll, financial reporting and more. Her content is well-researched and she has a strong understanding of accounting terms and industry-specific terminologies. As a subject matter expert, she simplifies complex concepts into clear, practical insights, helping businesses with accurate tips and solutions to make informed decisions.