Running a limited company in Ireland means keeping on top of Corporation Tax obligations in Ireland. Whether you’re a startup filing your first CT1 form Ireland startup or an established business managing annual returns, understanding the Corporation Tax (CT) cycle and maintaining proper bookkeeping practices is essential for staying compliant and avoiding penalties.

This guide breaks down everything you need to know about the CT cycle, CT1 filing deadlines and the bookkeeping requirements that keep your business running smoothly.

Key Takeaways

- Know your deadlines and mark them in your calendar

- Maintain accurate, real-time bookkeeping throughout the year

- Prepare iXBRL compliant accounts and Form 46G alongside your CT1

- Pay preliminary tax on time to avoid interest charges

- Keep comprehensive records for at least six years

- Consider professional accounting help, especially in your first few years

Understanding the Corporation Tax Cycle

The Corporation Tax cycle in Ireland revolves around your company’s accounting period. Your accounting period is simply the timeframe your business uses for financial reporting, usually 12 months. For many companies, this aligns with the calendar year, ending on 31st December, though you can choose a different year-end that suits your business.

According to Revenue’s official guidance, the CT cycle involves three main obligations:

- Paying preliminary corporation tax for the current year

- Filing your CT1 form with financial statements

- Paying any balance of tax still owed

All submissions and payments must be handled electronically through the Revenue Online Service (ROS). This is mandatory under Irish law, so paper returns are no longer accepted.

Important Corporation Tax Deadlines

Understanding when payments and filings are due is crucial for avoiding penalties. The deadlines depend on whether you’re classified as a small company or large company for Corporation Tax purposes.

Preliminary Tax Deadlines

Preliminary tax is a prepayment towards your current year’s Corporation Tax liability. Think of it as paying tax in advance based on either last year’s bill or an estimate of this year’s profits.

For small companies (those with a Corporation Tax bill under €200,000 in the previous year):

- Payment is due by the 23rd of the 11th month of your accounting period

- Example: If your year-end is 31st December 2025, preliminary tax is due by 23rd November 2025

For large companies (those exceeding the €200,000 threshold):

- First instalment: 23rd of the 6th month of your accounting period

- Second instalment: 23rd of the 11th month

- Example: For a 31st December year-end, payments are due on 23rd June and 23rd November

Important note: Newly formed companies don’t need to pay preliminary tax in their first accounting period if their expected Corporation Tax liability is under €200,000. However, this exemption only applies to the very first year.

CT1 Filing Deadline

Your CT1 must be filed by the 23rd of the ninth month after your accounting period ends when filing through ROS (the 21st applies to paper returns, though these are no longer accepted). This ROS extension to the 23rd provides additional time for electronic filers, as confirmed by Revenue’s payment and filing requirements.

Example: If your accounting period ends on 31st December 2025:

- Your CT1 filing deadline is 23rd September 2026

- Any balance of tax owed is also due by this date

2025/2026 CT1 Deadline Calendar

| Year-End Date | CT1 Filing Due |

|---|---|

| 31 Dec 2025 | 23 Sep 2026 |

| 31 Jan 2026 | 23 Oct 2026 |

| 28 Feb 2026 | 23 Nov 2026 |

| 31 Mar 2026 | 23 Dec 2026 |

| 30 Apr 2026 | 23 Jan 2027 |

Quick Reference Table

| Requirement | Small Company | Large Company | Example (31 Dec Year-End) |

|---|---|---|---|

| Preliminary Tax | 100% of prior year CT by 23rd of 11th month | 23rd of 6th month: 90% of current year CT 23rd of 11th month: balance | Small: 23 Nov Large: 23 Jun & 23 Nov |

| CT1 Filing | 23rd of 9th month after year-end | 23rd of 9th month after year-end | Sep 23rd |

| Balance of Tax | 23rd of 9th month after year-end | 23rd of 9th month after year-end | Sep 23rd |

How Much Preliminary Tax Should You Pay?

Small company preliminary tax calculations give you two options:

- 100% of last year’s Corporation Tax liability or

- 90% of this year’s estimated liability

Most businesses choose option 1 because it’s straightforward. You know exactly what last year’s bill was, so there’s no guesswork. If you choose option 2 and underestimate, you’ll face interest charges on the shortfall.

Large companies follow similar principles but split payments across the year to manage cash flow better.

Essential Bookkeeping Requirements for CT1 Filing

Proper bookkeeping throughout the year makes CT1 filing deadline preparation much smoother. Here’s what you need to maintain:

Real-Time Record Keeping

Irish businesses must keep accurate, up-to-date financial records. This includes:

- All sales invoices and receipts

- Purchase invoices from suppliers

- Bank statements and reconciliations

- Payroll records (if you have employees)

- Asset registers for capital allowances (plant & machinery claims)

For payroll specifically, Ireland requires real-time reporting. PAYE, PRSI and USC must be reported monthly, with payments and returns due by the 23rd of the following month when filed via ROS, as outlined in Revenue’s employer guidance.

Preparing Your Annual Accounts

Your financial statements must comply with the Companies Act 2014 and relevant Financial Reporting Standards. These accounts show:

- Your profit or loss for the year

- Your balance sheet position

- Cash flow statements (for larger companies)

- Notes explaining accounting policies and significant items

These accounts form the basis of your Corporation Tax computation. Your taxable profit starts with accounting profit, then adjustments are made for tax purposes (adding back items like depreciation, deducting capital allowances, etc.).

The iXBRL Compliant CT Return Requirement

Since mandatory e-filing regulations came into effect, Irish companies must submit financial statements in iXBRL format alongside their CT1 form. These aren’t separate submissions they’re treated as two parts of a single return.

iXBRL (inline eXtensible Business Reporting Language) is a format that makes your accounts machine-readable while still looking like normal financial statements.

iXBRL Software Options: Most modern accounting software can generate iXBRL files, including:

- QuickBooks

- Xero

- Sage

- AccountancyManager

Alternatively, your accountant can prepare these files for you.

Submitting Form 46G Alongside Your CT1

The Form 46G Third Party Return is often overlooked but equally important. Form 46G is required if you paid over €6,000 to any single Irish-resident supplier for services during your accounting period. This includes professional fees (accountants, solicitors, consultants), commissions, and similar service payments.

What’s excluded from Form 46G:

- Purchases of goods (inventory, stock)

- Salaries and wages to employees

- Utility payments (electricity, water, phone)

- Payments to non-resident suppliers

Form 46G helps Revenue track payments between businesses and ensures proper tax compliance across the supply chain. It’s due by the same deadline as your CT1 return 23rd of the ninth month after your year-end.

What Happens if You Miss Deadlines?

CT1 late filing surcharge penalties are serious and can add up quickly:

- 5% surcharge if filed within two months of the due date (maximum €12,695)

- 10% surcharge if filed more than two months late (maximum €63,485)

- Daily interest on late tax payments at 0.0219% (approximately 8% per year), applied from the due date until payment is made

According to Revenue’s guidance on late submission penalties, beyond financial penalties, late filing can also result in:

- Loss of audit exemption for your financial statements

- Restrictions on claiming loss relief, R&D Tax Credit, and other reliefs.

- Increased likelihood of a Revenue audit

The message is clear: file on time. Even if you can’t pay the full amount immediately, file your return to avoid the surcharge and arrange a payment plan with Revenue.

Special Considerations: Capital Allowances and Reliefs

When preparing your Corporation Tax computation, several reliefs and allowances can reduce your tax bill:

Capital Allowances

Instead of deducting the full cost of assets immediately, you claim capital allowances over time:

- Plant and machinery: 12.5% per year over 8 years

- Motor vehicles: Special rules apply based on emissions

- Energy-efficient equipment: Can qualify for accelerated allowances

Proper asset registers and documentation are essential for claiming these allowances accurately.

R&D Tax Credits

If your company invests in qualifying research and development, you may claim an R&D Tax Credit at 35% (increased from 30% in Finance Bill 2025) on qualifying expenditure, in addition to normal expense deductions. This represents a significant opportunity for innovative companies to reduce their tax burden.

Loss Relief

If your company makes a loss, proper bookkeeping ensures you can maximise loss relief:

- Carry forward losses indefinitely against future profits

- Carry back losses to the previous year for a tax refund

- Offset losses against other income in the current year

The Extracts from Accounts panel CT1 section of your return must clearly show how losses are being utilised, as detailed in Revenue’s guidelines on loss relief.

The Close Company Surcharge Explained

The Close Company Surcharge is an extra tax that catches some business owners off guard. If your company is controlled by five or fewer shareholders (which describes most small Irish companies) and you don’t distribute enough profits as dividends, you may face additional surcharges.

The surcharge applies as follows:

- 20% on undistributed investment and rental income (non-trading income)

- Professional service companies face additional rules: 15% surcharge on 50% of undistributed trading income, plus 20% on non-trading income

Understanding participators and dividend distribution:

Most Irish startups are close companies, meaning they’re controlled by a small number of “participators” (shareholders and certain connected persons). The close company rules are designed to prevent companies from retaining profits indefinitely to avoid personal income tax that would be due on dividends.

Practical impact for startups:

If your company provides professional services (legal, accounting, medical, engineering, consulting, etc.), you need to distribute at least 50% of relevant trading income to avoid the 15% surcharge. All close companies must also distribute investment and rental income to avoid the 20% surcharge.

Proper tax planning with your accountant can help you determine optimal dividend distribution strategies to avoid these additional charges while managing your personal tax position.

Record Retention Requirements

Understanding how long to keep business records is crucial for compliance. Based on the Taxes Consolidation Act 1997, Section 886, the requirements are:

- Tax records: Must be kept for at least 6 years after the relevant return is filed

- Company accounts and financial statements: Must be kept for at least 6 years

- Extended retention: If Revenue has an open query or audit, records must be retained until the matter is fully resolved, which may extend beyond 6 years

Keep all records well-organized and accessible, preferably with digital backups for security.

Your Complete CT1 Filing Checklist

When preparing for your CT1 filing deadline, use this checklist:

Financial Records:

- Full set of accounts prepared and finalised

- Accounts converted to iXBRL format

- All bank reconciliations completed

- Fixed asset register updated

- All invoices and receipts organised

Tax Computations:

- Corporation Tax computation prepared

- Capital allowances calculated correctly

- Any reliefs or credits claimed with supporting documentation

- Previous year’s losses applied if relevant

- Form 46G prepared showing supplier payments

Preliminary Tax:

- Previous year’s preliminary tax paid and recorded

- Current year’s preliminary tax calculation documented

- Evidence of payments via ROS available

ROS Filing:

- ROS credentials current and working

- CT1 form completed accurately

- iXBRL accounts ready to upload

- Form 46G ready to submit

- Payment arranged for any balance due

Bookkeeping Best Practices for Revenue Audit Defence

While nobody wants to think about Revenue audits, maintaining excellent bookkeeping best practices for Revenue Audit defense can save you significant stress and money if you’re ever selected for examination.

Documentation is key:

- Keep all records for at least six years

- Maintain clear audit trails showing how figures were calculated

- Store documents electronically with proper backups

- Reconcile accounts monthly, not just at year-end

Be proactive:

- Review accounts quarterly to spot errors early

- Ensure expense claims are legitimate business expenses

- Keep detailed logs for mileage claims and business travel

- Document business purposes for all entertainment expenses

Work with professionals:

- Engage a qualified accountant who understands Irish Corporation Tax

- Have accounts reviewed before submission

- Seek advice on complex transactions or unusual items

How to File First CT1 Form Ireland Startup?

If you’re a startup founder wondering how to file first CT1 form Ireland startup, here’s what you need to know:

- Register for Corporation Tax: Use form TR2 through ROS within 30 days of starting to trade

- Keep records from day one: Don’t wait until year-end to organise finances

- Choose your year-end carefully: Most startups choose 31st December for simplicity

- Understand the first-year exemption: You don’t pay preliminary tax in year one (if under €200,000 liability)

- Budget for the tax bill: Even though you don’t pay preliminary tax, you’ll owe the full amount when you file

- Consider professional help: Many startups benefit from accountant support to ensure everything is filed correctly

For startups, the first CT1 is often the most challenging because you’re learning the system. Taking time to set up proper processes from the beginning pays dividends in future years.

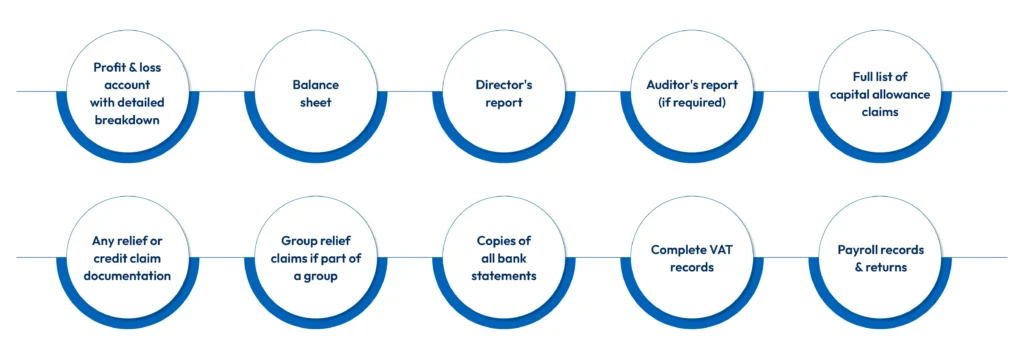

What Documents Do I Need for CT1 Filing Ireland?

Wondering what documents do I need for CT1 filing Ireland? Here’s the complete list:

Mandatory documents:

- CT1 tax return form (completed on ROS)

- Financial statements in iXBRL format

- Form 46G showing third-party supplier payments

- Corporation Tax computation

- Evidence of preliminary tax payments

Supporting documentation (keep available in case of queries):

How to Calculate Preliminary Corporation Tax for Small Companies?

Many business owners ask: how to calculate preliminary corporation tax for small companies? Let’s work through a practical example.

For Example: Your company had a Corporation Tax liability of €50,000 for the year ended 31st December 2024.

Option 1: Based on last year (easier):

- Preliminary tax for 2025 = €50,000 (100% of 2024 liability)

- Due date: 23rd November 2025

- Advantage: No calculation needed, just pay last year’s amount

Option 2: Based on current year estimate:

- Estimate 2025 Corporation Tax = €60,000

- Preliminary tax due = €54,000 (90% of estimate)

- Due date: 23rd November 2025

- Remaining €6,000 due with CT1 return by 23rd September 2026

- Risk: If you underestimate, you’ll pay interest on the shortfall

When to choose Option 2: If you expect profits to drop significantly this year, paying 90% of a lower estimate makes sense. Otherwise, stick with Option 1 for simplicity and certainty.

CT1 Filing Deadline Surcharge Penalty Calculator in Ireland

While there’s no official CT1 filing deadline surcharge penalty calculator in Ireland, you can work out potential penalties:

Late filing surcharge formula:

- If tax due is €50,000 and you file one month late = €2,500 (5% of €50,000)

- If tax due is €50,000 and you file three months late = €5,000 (10% of €50,000)

- Maximum surcharge is €12,695 (5% bracket) or €63,485 (10% bracket)

Late payment interest:

- Daily rate: 0.0219%

- Annual equivalent: approximately 8%

- Example: €10,000 unpaid for 30 days = €10,000 × 30 × 0.0219% = €65.70

Total cost of filing three months late with €50,000 tax due:

- Late filing surcharge: €5,000

- Interest on unpaid tax (90 days): €592.20

- Total extra cost: €5,592.20

This example shows why timely filing and payment matter. That €5,592 could be better spent growing your business.

Common Mistakes to Avoid

Through working with Irish businesses, several common errors appear repeatedly:

- Deadline confusion: Confusing the preliminary tax deadline (23rd of 11th month) with the CT1 filing deadline (23rd of 9th month of following year)

- Forgetting Form 46G: Focusing on the CT1 but neglecting the third-party return, which has the same deadline

- Poor expense documentation: Claiming expenses without proper invoices or business purpose documentation

- Missing capital allowances claims: Not claiming all available allowances because asset registers weren’t maintained

- Ignoring loss relief: Not carrying forward or carrying back losses properly, leaving tax savings on the table

- Cash flow surprises: Not budgeting for the tax bill because preliminary payments weren’t tracked

Conclusion

Understanding the Irish Corporation Tax cycle is essential for every limited company operating in Ireland. From knowing when preliminary corporation tax in Ireland payments are due to ensuring your CT1 filing deadline is met, staying on top of these obligations protects your business from penalties and keeps you compliant with Revenue requirements.

With proper planning and organisation, Corporation Tax filing becomes a manageable part of running your business rather than a source of stress. Start preparing early, maintain good records and don’t hesitate to seek professional guidance when needed.

By following the practices outlined in this guide, you’ll ensure smooth CT1 submissions year after year while maintaining the strong financial controls that support business growth and success.

Contact us today via call +353 212069255 or mail at info@outbooks.com.

Frequently Asked Questions

What is the CT1 form?

When is my CT1 filing deadline?

What’s the difference between preliminary tax and final tax?

How do I register for Corporation Tax?

What happens if I can’t pay my Corporation Tax on time?

Do I need an accountant for CT1 filing?

What’s iXBRL and why is it mandatory?

Can I change my accounting year-end?

Parul is a content specialist with expertise in accounting and bookkeeping. Her writing covers a wide range of accounting topics such as payroll, financial reporting and more. Her content is well-researched and she has a strong understanding of accounting terms and industry-specific terminologies. As a subject matter expert, she simplifies complex concepts into clear, practical insights, helping businesses with accurate tips and solutions to make informed decisions.