Running a business in Cork requires proper financial management. Many business owners struggle with complex paperwork and tax obligations. Professional outsourced accounting & bookkeeping services in Cork can solve these problems effectively.

In this blog we will explore how accounting services can help in this.

Why Cork businesses need professional accounting support?

Small businesses face growing compliance demands in Ireland. VAT returns, payroll submissions and CRO filings create significant pressure. Accountants Cork specialise in managing these obligations efficiently.

Business owners often spend 8-10 hours weekly on bookkeeping tasks. This time could be better used for business growth. Professional support frees up valuable time for core activities.

Current market rates in Cork

| Service Type | Hourly Rate | Monthly Package |

|---|---|---|

| Basic Bookkeeping | €40-€50 | €200-€400 |

| Full Accounting | €50-€75 | €400-€800 |

| Payroll Services | €20-€30 | €150-€300 |

| Tax Preparation | €75-€100 | €300-€600 |

Professional bookkeeping services in Ireland typically charge around €40 per hour, making outsourcing more affordable than hiring full-time staff.

Benefits of outsourced accounting services

Accountancy firms Cork offer several advantages over in-house solutions. Cost savings represent the primary benefit for most businesses. Outsourcing eliminates salary, PRSI and overhead expenses.

Expert knowledge ensures compliance with Irish tax regulations. Professional accountants in Cork stay updated on changing requirements. This reduces audit risks significantly.

Access to modern accounting software comes included. Cloud-based platforms provide real-time financial visibility. Business owners can monitor cash flow anytime.

Cost Comparison: In-House vs Outsourced

| Cost Factor | In-House Bookkeeper | Outsourced Service |

|---|---|---|

| Annual Salary | €35,000-€45,000 | €15,000-€25,000 |

| PRSI (11.05%) | €3,900-€5,000 | Included |

| Training Costs | €2,000+ | Not required |

| Software Licenses | €1,000+ | Included |

| Total Annual Cost | €40,000-€55,000 | €15,000-€25,000 |

Essential services for Cork businesses

Bookkeeping services in Cork cover all fundamental requirements. Daily transaction recording ensures accurate financial records. Bank reconciliation prevents discrepancies and errors.

Also, Payroll services in Cork handle employee payments and submissions. PAYE modernisation requires real-time reporting. Professional services manage these obligations automatically.

VAT filing remains complex for many businesses. Bi-monthly or quarterly submissions need accuracy. Local accounting experts in Cork ensure timely, correct filings.

Service packages available

Best accountancy firms in Cork offer flexible service levels:

- Starter Package (€200-€400/month)

- Basic transaction recording

- Bank reconciliation

- Monthly reports

- Growth Package (€400-€600/month)

- Full bookkeeping service

- VAT return preparation

- Payroll management

- Complete Package (€600-€1000/month)

- Full accounting service

- Tax planning advice

- Management reporting

How to choose an accountant in Cork Ireland?

Choosing an accountant requires careful consideration. Experience with similar businesses proves valuable. Check qualifications and professional memberships carefully.

Technology platforms matter significantly today. Modern firms use Xero, QuickBooks, or Sage systems. Integration capabilities streamline business processes effectively.

Response times affect business operations. Choose firms offering prompt communication. Regular meetings ensure ongoing alignment with objectives.

Key questions to ask potential providers

- What experience do you have with my industry?

- Which accounting software do you recommend?

- How quickly do you respond to queries?

- What backup systems do you have in place?

- Can you provide client references?

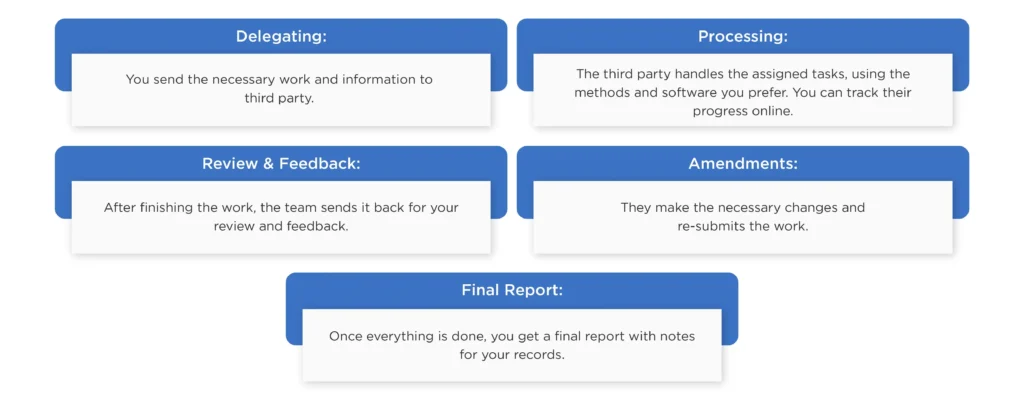

Here is how the process works regarding outsourced accounting work:

Technology and modern accounting

For accounting and bookkeeping services cloud technology is a total game changer. Real-time access improves decision-making capabilities. Mobile apps allow invoice processing anywhere.

Automated bank feeds eliminate manual data entry. This reduces errors and saves time. Tax & bookkeeping integration streamlines compliance processes.

Document management systems store receipts securely. Scanning apps make expense tracking simple. Everything remains accessible for audit purposes.

Popular accounting software

| Software | Monthly Cost | Best For |

|---|---|---|

| Xero | €20-€40 | Small businesses |

| QuickBooks | €15-€35 | Service companies |

| Sage | €25-€50 | Manufacturing |

| FreeAgent | €15-€25 | Freelancers |

Compliance & Audit support

Audit firms in Cork provide essential compliance support. Revenue audits can occur without warning. Proper records reduce investigation time significantly.

CRO filings require annual attention. Late penalties start immediately after deadlines. Professional services track all important dates.

Corporate tax planning in Cork maximises allowable deductions. Expert advice identifies saving opportunities. This improves overall profitability substantially.

Compliance calendar for Cork businesses

| Month | Key Deadlines |

|---|---|

| January | PAYE Annual Return |

| March | Corporation Tax (CT1) |

| May | VAT Return (Quarterly) |

| September | Annual Return (CRO) |

| November | Income Tax Return |

Conclusion

Professional accountants Cork Ireland provide essential business support. Outsourcing offers significant cost and time savings. Expert knowledge ensures proper compliance.

Modern technology improves financial visibility substantially. Accounting Cork services adapt to business needs. Growth becomes easier with proper support.

Consider professional outsourced accounting services for your business. The benefits far outweigh the costs. Start with a consultation to explore options.

Contact us today via call +353 212069255 or mail at info@outbooks.com.

FAQs

What’s included in basic bookkeeping services?

How quickly can I switch to outsourced accounting?

Do I need to visit the accountant’s office regularly?

What happens if I’m not satisfied with the service?

Can outsourced accountants handle Revenue audits?

How do I ensure my financial data remains secure?

What size business benefits most from outsourcing?

Can I still have control over my finances?

Parul is a content specialist with expertise in accounting and bookkeeping. Her writing covers a wide range of accounting topics such as payroll, financial reporting and more. Her content is well-researched and she has a strong understanding of accounting terms and industry-specific terminologies. As a subject matter expert, she simplifies complex concepts into clear, practical insights, helping businesses with accurate tips and solutions to make informed decisions.