Running payroll for your small business in Ireland can feel overwhelming. Between calculating taxes, staying compliant with PAYE Ireland rules and managing employer payroll expenses correctly, it is easy to make costly mistakes. The good news is that with the right strategies and tools, you can control payroll cost for small business operations and avoid the errors that often affect new employers.

This guide explains what small businesses need to know about Ireland payroll requirements, including statutory obligations, hidden payroll cost in Ireland that companies often overlook and the steps that help prevent payroll mistakes in Ireland employers face every year.

Key Takeaways

Managing payroll cost for small business in Ireland effectively comes down to three main principles:

- Use modern payroll software for small business in Ireland or outsource to professionals. The time and error reduction pays for itself many times over.

- Keep up with Revenue regulations, payroll tax compliance requirements and employment law updates. Prevention is cheaper than penalties.

- Invest in good systems now. As your business grows, proper payroll management becomes even more critical and valuable.

Always remember:

- The true cost of employment is 120-150% of base salary.

- Small errors can lead to big penalties.

- Good record-keeping supports strong payroll compliance standards in Ireland

- Professional help often cost less than DIY mistakes.

- Monthly payroll reduces cost and administrative burden.

Why Payroll Costs Matter?

Payroll cost for small business operations in Ireland influences cash flow, employee satisfaction and long-term compliance. When payroll is managed well, employers avoid penalties, reduce admin time and maintain accurate records that support decision-making. When payroll is handled poorly, even small errors can trigger Revenue audits, surprise liabilities and higher payroll cost than expected.

Understanding statutory employer cost, hidden expenses and compliance obligations helps small businesses plan better and control spending. With the right software, outsourcing support and strong internal systems, payroll management becomes simpler, more predictable and more cost efficient.

Understanding the True Cost of Payroll in Ireland

When you hire an employee in Ireland, the salary you agree to pay is just the beginning. The actual cost of employment typically ranges from 120% to 150% of the base salary. Let’s break down what makes up these payroll cost.

Mandatory Employer Cost

- Employer PRSI (Pay Related Social Insurance): As of 2025, employers must contribute:

- 8.9% on weekly earnings up to €527

- 11.15% on weekly earnings above €527 This is a direct additional cost on top of the employee’s salary. For example, hiring someone at €20 per hour means your actual cost is €20 plus employer PRSI.

- PAYE (Pay As You Earn): While this is deducted from employee wages, you’re responsible for calculating and remitting it to Revenue. Income tax in Ireland has two rates:

- 20% (standard rate) on income below thresholds

- 40% (higher rate) on income above thresholds

- USC (Universal Social Charge): This applies to employees earning more than €13,000 annually and is calculated at progressive rates. Like PAYE, you deduct this from employee wages and pay it to Revenue. For 2025, the Universal Social Charge (USC) rates in Ireland are progressive and applied on income bands as follows:

- 0.5% on the first €12,012 of income

- 2% on income from €12,013 to €27,382

- 3% on income from €27,383 to €70,044

- 8% on income above €70,044

- Statutory Benefits: Employers must provide:

- 4 weeks (20 working days) of paid annual leave

- 5 days of statutory sick leave in Ireland at 70% pay (maximum €110 per day)

- Public holiday pay (9 days per year)

- Maternity, paternity and parental leave entitlements

Hidden Payroll Cost in Ireland

Many small business owners underestimate these additional expenses:

- Time and Administrative Cost: Payroll management involves:

- Collecting and verifying employee information, calculating hours, and more.

- Calculating hours and overtime

- Processing payslips and maintaining records

- Submitting real-time reports to Revenue each pay period

- Handling employee pay queries

- Compliance and Record-Keeping: Payroll records must be maintained for at least 6 years. Non-compliance risks audits, fines and penalties.

- Benefits-in-Kind (BIK) Reporting: Taxable non-cash benefits like company cars and health insurance must be calculated and reported accurately.

- Equipment and Software: Providing for remote workers can include daily tax-free allowances (up to €3.20) for home office expenses.

- Training and Development: Onboarding and ongoing training impact payroll budgets.

- Employee Turnover: Recruiting and training replacements can add 30-50% to base salary cost.

Understanding these employer payroll expenses helps you create a more accurate payroll budget.

How to Save Money on Payroll Cost?

Now that you understand the full scope of payroll expenses, let’s look at proven strategies to reduce cost without compromising employee satisfaction or compliance.

1. Invest in Payroll Software

Manual payroll is time-consuming and error-prone. Payroll software benefits include:

- Automates tax and deduction calculations

- Ensures real-time compliance and automatic tax rate updates

- Reduces admin time by 50-70% with features like payslip generation and self-service portals

Popular payroll software in Ireland:

- BrightPay (€199/year for up to 3 employees)

- Sage Payroll (€10+ VAT/month for 5 employees)

- SimplePay (cloud-based, full compliance)

- Payback (fixed pricing for unlimited companies/employees)

Look for software with Revenue approval, ROS integration, employee self-service, good support and free trials.

2. Consider Outsourcing Payroll

Outsourcing can save on:

- In-house payroll salaries and benefits

- Payroll software licenses and training

- Time spent on administration

Payroll outsourcing in Ireland services reduce administrative pressure and ensure payroll tax compliance.

Outsource if:

- You lack in-house payroll expertise

- Payroll is complex or growing

- You spend over 4-5 hours monthly on payroll

- Compliance errors or Revenue flags occur

It also helps reduce the overall cost of payroll services in Ireland companies pay long term.

3. Optimise Workforce Structure

- Balance Full-Time and Part-Time Staff

- Assess whether all positions need to be full-time.

- Use part-time staff for peak periods or specialised tasks.

- Consider job-sharing arrangements to optimise workforce flexibility.

- Explore Flexible Work Options

- Remote work reduces office space cost significantly.

- Flexible schedules improve employee satisfaction without increasing cost.

- Hybrid models combine the benefits of remote and office work.

- Consider Contract Workers for Specific Projects

- Use contractors for short-term or specialised needs to reduce payroll expenses.

- Contractors typically do not attract employer PRSI or require benefits.

- Be cautious about worker misclassification to avoid compliance issues.

- Review your Staffing Needs Regularly

- Conduct quarterly reviews to assess staffing levels.

- Ensure you are not overstaffed and each role adds value to the business.

4. Leverage Government Tax Incentives

Tax incentives such as R&D credits and remote working relief support payroll tax reduction efforts for small employers.

- R&D Tax Credit

- If your business conducts research and development activities, you may qualify for significant tax credits that reduce your overall tax burden.

- Remote Working Relief

- Employers can pay up to €3.20 per day tax-free to employees working from home.

- This amount doesn’t attract employer PRSI, making it more cost-efficient than equivalent salary increases.

- Training and Education Credits

- Certain professional development expenses may qualify for tax relief, reducing your training cost.

- Work with your Accountant

- A qualified accountant can help identify all available incentives and ensure you are claiming everything you are entitled to.

5. Choose the Right Payroll Frequency

Your payroll schedule affects administrative cost and cash flow:

- Monthly Payroll

- Lowest administrative burden by processing payroll only 12 times per year.

- Significantly cheaper if you outsource since monthly services cost less than weekly.

- Better for managing cash flow.

- Weekly Payroll

- Higher administrative cost due to more frequent processing.

- Increased chance of errors.

- May be necessary for hourly workers or certain industries.

- Recommendation:

- If your business allows, monthly payroll is advised to reduce cost while meeting legal requirements.

6. Implement Employee Self-Service

Modern payroll systems include portals where staff can:

- View payslips online.

- Update personal information.

- Submit time-off requests.

- Access tax documents. Benefits include:

- Reduces administrative queries by up to 60%.

- Eliminates paper payslip cost.

- Ensures employees have accurate, up-to-date information.

- Frees up time for strategic tasks.

7. Maintain Organised Digital Records

Good record-keeping is both a legal requirement and a cost saver:

- Centralised Digital System:

- Store employee data including hours worked, pay rates, deductions and tax information securely in the cloud.

- Benefits:

- Quick access during Revenue audits.

- Easy identification of cost-saving opportunities.

- Reduces time spent searching for information.

- Prevents errors from incomplete or messy records.

- What to keep:

- Employee contracts and personal details.

- Payroll records (wages, hours, deductions).

- Tax submissions and confirmations.

- Benefits-in-Kind calculations.

- Leave records and attendance.

- Retention:

- All records must be kept for at least 6 years.

Common Payroll Errors and How to Avoid Them?

Even small mistakes can lead to hefty fines, employee dissatisfaction and Revenue audits. Here are the most common errors Irish employers make and how to prevent them.

1. Incorrect PAYE Modernisation Reporting

Since 2019, Ireland requires real-time reporting through PAYE Modernisation. Employers must submit payroll information to Revenue on or before the employee’s payday. Many businesses still struggle with this requirement.

- Consequences:

- Late submission penalties

- Revenue compliance flags and audits

- Complex corrections if errors are found

- How to avoid it:

- Use Revenue-approved payroll software that handles real-time submissions automatically

- Set up a strict internal schedule to review and submit data for every pay run through Revenue Online Service (ROS)

- Double-check figures before submission, corrections are complicated

- Never assume you can fix errors later

2. Misclassifying Workers

Some employers incorrectly treat employees as independent contractors to avoid PAYE responsibilities and employer PRSI contributions.

- Consequences:

- Revenue penalties

- Backdated employer PRSI payments

- Tax arrears

- Legal action from misclassified workers

- How to avoid it:

- Understand Revenue’s strict criteria for employment status

- If someone works set hours, uses your equipment and you control their work, they’re likely an employee

- When in doubt, consult with an accountant or employment lawyer

- Properly document contractor relationships

3. Incorrect PRSI and USC Calculations

PRSI classes, USC thresholds and income bands change frequently. Using outdated rates or misclassifying employees under the wrong PRSI category leads to underpayments or overpayments.

- Consequences:

- Revenue scrutiny

- Backdated payments

- Employee disputes

- Compliance penalties

- How to avoid it:

- Keep up with Ireland’s annual Budget announcements that adjust rates

- Use automated payroll systems that auto-update rates (check PRSI rates regularly)

- Accurately classify each employee under the correct PRSI category from day one

- Review and verify calculations regularly

4. Failing to Report Benefits-in-Kind (BIK)

Non-cash benefits, such as company cars, health insurance, gym memberships, or subsidised meals, are taxable. Many employers overlook BIK reporting or assume certain benefits are tax-free.

- Consequences:

- Revenue penalties

- Backdated charges for unreported benefits

- Loss of employee trust due to unexpected tax bills

- How to avoid it:

- Identify all BIK provided to employees at the start

- Calculate their taxable value using Revenue’s specific formulas and guidance

- Include BIK as “notional pay” in payroll calculations so it’s taxed correctly through PAYE

- Keep detailed records of mixed-use assets

- Report BIK on time through ROS

5. Inadequate Record-Keeping

Incomplete or disorganised employee records make it impossible to prove compliance during Revenue audits.

- Consequences:

- Inability to defend against Revenue queries

- Fines for missing documentation

- Time wasted reconstructing records

- Potential for missing deductions or overpayments

- How to avoid it:

- Maintain comprehensive records for each employee (contracts, PPSN, tax details, hours, pay rates)

- Use digital systems with automatic backups

- Keep records for at least 6 years as required by law

- Review record-keeping processes quarterly

6. Missing Overtime Calculations

Failing to properly account for and pay overtime leads to wage disputes and compliance issues.

- Consequences:

- Employee dissatisfaction and turnover

- Wage disputes and potential legal action

- Compliance penalties from the Workplace Relations Commission

- How to avoid it:

- Track all hours worked using time-tracking software

- Clearly communicate overtime policies in employment contracts

- Calculate overtime rates correctly (typically 1.5x or 2x regular pay)

- Review overtime patterns monthly to identify staffing issues

7. Ignoring Statutory Leave Entitlements

Not properly accounting for or paying statutory sick leave, annual leave, public holidays and parental leave.

- Consequences:

- Legal action from employees

- Workplace Relations Commission claims

- Backdated payments

- Reputational damage

- How to avoid it:

- Understand current statutory requirements (they change frequently)

- Track all leave types separately in payroll systems

- Pay sick leave at the correct rate (70% of normal pay, up to €110 daily)

- Account for leave cost in the budget

8. Late or Incorrect Tax Submissions

Missing Revenue deadlines or submitting incorrect information. Automated systems help maintain accurate payroll tax compliance.

- Consequences:

- Automatic penalties and interest charges

- Revenue audits

- Loss of good standing with Revenue

- Stress and time spent on corrections

- How to avoid it:

- Use software that automates Revenue submissions

- Set reminders for all tax deadlines

- Submit early to allow time for any issues

- Review submissions before finalising

- Keep proof of submission

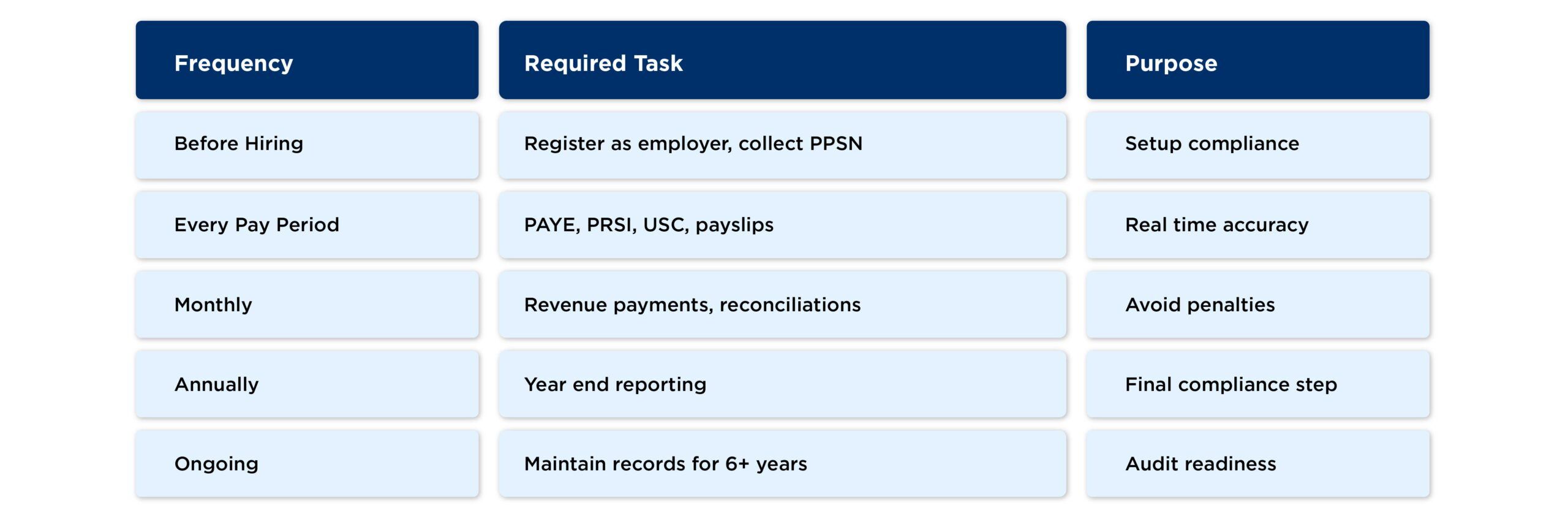

Payroll Compliance Checklist for your Business

Compliance isn’t just about avoiding penalties it protects your business and employees. Use this checklist to ensure you’re meeting all requirements with relevance to payroll compliance in Ireland.

Before Hiring

- Register as an employer with Revenue through ROS or myAccount

- Obtain your Tax Registration Number (TRN)

- Set up your PAYE system

- Choose your payroll frequency

- Select payroll software or service provider

For Each Employee

- Collect PPSN (Personal Public Service Number)

- Get completed Tax Credit Certificate from Revenue

- Obtain signed employment contract

- Record bank details for payment

- Store emergency contact information

- Classify correct PRSI category

Every Pay Period

- Calculate gross pay accurately

- Apply correct PAYE, PRSI and USC rates

- Include any BIK in calculations

- Deduct any voluntary contributions (pension, health insurance)

- Generate and distribute payslips

- Submit real-time report to Revenue before or on payday

- Make payment to employees on agreed date

Monthly

- Review and accept Revenue’s payroll summary

- Pay all deducted taxes to Revenue

- Reconcile payroll accounts

- Review overtime and leave patterns

- Check for any compliance updates

Annually

- Complete year-end payroll reporting

- Issue P60s to all employees

- Submit any required annual returns

- Review and update payroll policies

- Conduct internal payroll audit

- Update for new tax rates and thresholds

Ongoing

- Maintain accurate records for 6+ years

- Stay informed about payroll legislation changes

- Train staff on payroll procedures

- Review payroll cost and look for savings opportunities

- Update software regularly

When to get Professional Help?

While many small businesses can manage payroll in-house with good software, certain situations call for professional assistance:

Consider professional help when:

- You’re starting your first payroll and unsure about requirements

- You’ve received notices or queries from Revenue

- Your business is growing rapidly

- You have complex payroll situations (multiple pay rates, international employees, unusual benefits)

- You’re spending more than 10% of your time on payroll

- You’ve made mistakes that cost money

- You’re planning significant business changes (expansion, restructuring)

Professional payroll outsourcing in Ireland partners offer reliable support and reduce employer payroll expenses long term.

Conclusion

Payroll is more than an administrative task. It affects your compliance position, employee satisfaction and long-term financial stability.

Understanding payroll cost for small business operations in Ireland helps you make informed decisions, reduce errors and manage employer statutory cost effectively.

Whether you upgrade software, outsource or strengthen internal systems, the goal is clear: smoother Ireland payroll management with fewer risks and better financial control.

Contact us today via call +353 212069255 or mail at info@outbooks.com.

Frequently Asked Questions

What are the main hidden payroll cost small businesses in Ireland should be aware of?

How does incorrect PAYE Modernisation reporting affect small business payroll compliance?

What are the best ways to minimise payroll errors and avoid Revenue penalties?

How can investing in payroll software help reduce payroll administration cost?

When should a small business consider outsourcing payroll to save money?

Why is maintaining organised digital payroll records essential for compliance?

What strategies can small businesses use to optimise workforce structure and manage payroll cost?

Parul is a content specialist with expertise in accounting and bookkeeping. Her writing covers a wide range of accounting topics such as payroll, financial reporting and more. Her content is well-researched and she has a strong understanding of accounting terms and industry-specific terminologies. As a subject matter expert, she simplifies complex concepts into clear, practical insights, helping businesses with accurate tips and solutions to make informed decisions.