Payroll tax compliance is a vital responsibility for every employer in Ireland. It means following the government’s rules to make sure payroll taxes are calculated correctly, deducted from employees’ wages, and paid to the Revenue Commissioners on time. Staying compliant protects businesses from costly fines and legal trouble.

This payroll guide explains key payroll compliance rules under Irish payroll legislation 2025, helping employers understand their duties clearly and avoid common mistakes.

Key Takeaways for 2025

| Compliance Area | Key Update or Rule | Employer Action Required |

|---|---|---|

| Automatic Enrolment | Mandatory workplace pension auto-enrolment begins in 2025. | Automatically enroll eligible employees and contribute to their pensions. |

| National Minimum Wage | Updated minimum wage applies from 1 January 2025. | Review all pay rates to ensure compliance. |

| Real-Time Reporting (RTS) | Employers must report payroll data before or on payday. | Use Revenue‑approved payroll software. |

| Record Retention | Payroll records must be kept for at least six years. | Maintain GDPR‑compliant digital records. |

| Reporting Deadlines | Consistent PAYE submissions every pay period. | Avoid late filings to prevent penalties. |

What is Payroll tax compliance?

Payroll tax compliance involves more than just paying taxes. Employers must calculate the right amounts for income tax, PRSI (Pay Related Social Insurance), and USC (Universal Social Charge). Employers also need to report payroll information regularly to Revenue and keep detailed records of all payments. This process ensures employees’ taxes are up to date and that employers meet all legal requirements.

Payroll taxes impact both employee earnings and employer obligations. Failure to comply can result in penalties, interest charges, and damage to reputation. Therefore, understanding payroll tax compliance is the first step toward managing payroll correctly.

Main payroll taxes and statutory deductions

In Ireland, there are three main payroll taxes every employer must handle carefully. These are:

- PAYE (Pay As You Earn): This is the income tax deducted from an employee’s paycheck. Employers are responsible for calculating and deducting the right amount based on the employee’s tax credits and tax rates.

- PRSI (Pay Related Social Insurance): This is a social welfare contribution paid by both employers and employees. PRSI helps fund social welfare benefits like illness, unemployment, and pensions.

- USC (Universal Social Charge): USC is a tax charged on gross income before any tax credits. Unlike PAYE or PRSI, only employees pay USC, but employers must deduct it accurately.

Here is a simple overview of who pays each tax:

| Payroll Tax Type | Employer Pays | Employee Pays | Purpose |

|---|---|---|---|

| PAYE (Income Tax) | No | Yes | Taxes income |

| PRSI | Yes | Yes | Social insurance support |

| USC | No | Yes | Additional charge on income |

In 2025, payroll tax rates and bands remain in effect with some changes following the Budget announcements. Employers must stay updated on these rates to deduct the correct amounts from each employee’s pay.

Employer payroll obligations and reporting deadlines

Besides deducting payroll income taxes, employers have important reporting and record-keeping duties. Irish payroll law requires that employers submit payroll data to Revenue in real-time before or on the employees’ payday. This system is called Real Time Reporting (RTS) under PAYE Modernisation.

Employers must ensure all employee pay, tax credits, and deductions details are correct in these regular submissions. Failure to report on time can lead to penalties. Payroll reporting deadlines depend on the employer’s payroll frequency but must be consistent and timely.

Employers must provide detailed payslips to each employee. Payslips should clearly show gross pay, each statutory deduction (like PAYE, PRSI, USC), net pay, and employer contributions. Keeping detailed payroll records is mandatory; business owners should keep records for at least six years.

Irish payroll legislation changes in 2025

The Irish government has introduced new payroll rules in 2025, including the introduction of automatic enrolment payroll for workplace pensions. This means employers must automatically enroll eligible employees in a pension scheme and contribute alongside the employee.

Another key update is the increase in the National Minimum Wage to €13.50 per hour for employees aged 20 and over, effective from January 1, 2025. Employers must update their payroll systems to ensure all payments meet this new legal minimum.

Employers should update their payroll policies and software to reflect these changes and ensure full compliance. Regularly reviewing payroll legislation ensures that any budget-related tax rate changes or reporting rules are implemented on time.

Data security and digital record-keeping

Under GDPR, employers must protect all employee payroll data, including tax details, bank information and pay records.

Key best practices include:

- Storing payroll data securely on encrypted, access-controlled systems.

- Maintaining digital backups in Revenue‑approved formats.

- Keeping records only as long as required (six years minimum).

- Ensuring employee data access is limited to authorised personnel.

Digital record‑keeping also simplifies payroll audits and compliance checks.

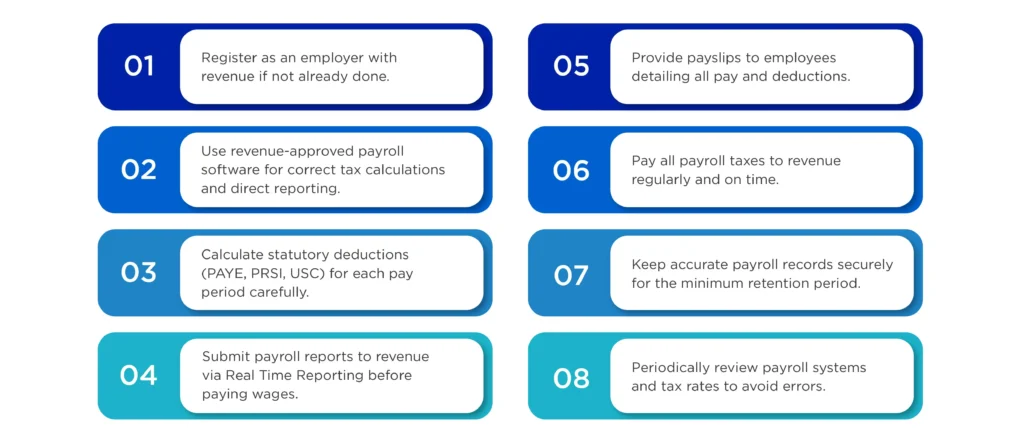

Step-by-Step Payroll Compliance Checklist for Employers

Here is a simple checklist to keep payroll compliance on track:

Common Payroll mistakes checklist

| Common error | Impact | How to avoid? |

|---|---|---|

| Missing Real-Time Reporting deadlines | Revenue penalties and compliance risk | Automate submissions through approved software |

| Using outdated tax rates | Incorrect deductions and arrears | Regularly check Revenue updates |

| Omitting employee PRSI or USC | Underpayment of statutory obligations | Validate calculations every pay period |

| Poor record-keeping | Audit and GDPR issues | Keep digital backups and clear audit trails |

| Not issuing compliant payslips | Violates WRC requirements | Automate payslip generation through payroll software |

Automation & Outsourcing Benefits

Outsourcing payroll or adopting a modern, automated system can significantly simplify compliance, especially for SMEs.

- Automation benefits: Modern payroll software automates complex PAYE, PRSI and USC calculations, manages Real Time Reporting submissions, and ensures compliance with the latest tax bands, saving time and reducing mathematical errors.

- Outsourcing Benefits: Payroll providers handle tax deductions, real-time submission to Revenue, payslip generation and record-keeping. They remain up to date with the latest legislation, including the latest Auto-Enrolment and minimum wage changes, helping businesses avoid costly mistakes.

Digital onboarding and real-time reporting trends

Ireland’s payroll landscape is becoming increasingly digital. Employers now benefit from:

- Digital onboarding tools that register new employees directly with Revenue.

- Seamless integration between HR and payroll systems for real-time reporting.

- Cloud-based payroll platforms that update tax bands, PRSI classes, and USC rates automatically.

Implementing digital onboarding ensures new hires are correctly registered before their first payday, helping avoid compliance delays.

How can Payroll Services help employers?

Outsourcing payroll can simplify compliance. Payroll providers handle tax deductions, submission to Revenue, payslip generation and record-keeping. They keep up to date with the latest legislation and help businesses avoid costly mistakes.

Conclusion

Payroll compliance is a key part of running a business in Ireland. Employers must follow all rules for payroll tax deductions, reporting, and record keeping to stay on the right side of the law. The changes in Irish payroll legislation 2025 mean employers should keep payroll systems up to date and consider expert help if needed. By following a clear payroll compliance checklist, employers can focus on growing their business while avoiding costly payroll mistakes.

Contact us today via call +353 212069255 or mail at info@outbooks.com.

FAQs about Ireland payroll taxes

What are the main income and payroll taxes employers must manage?

How often must employers report payroll details to Revenue?

What happens if employers miss payroll reporting deadlines?

Can payroll compliance change in the middle of the year?

Is outsourcing payroll a good option for small businesses?

Parul is a content specialist with expertise in accounting and bookkeeping. Her writing covers a wide range of accounting topics such as payroll, financial reporting and more. Her content is well-researched and she has a strong understanding of accounting terms and industry-specific terminologies. As a subject matter expert, she simplifies complex concepts into clear, practical insights, helping businesses with accurate tips and solutions to make informed decisions.