At Outbooks Ireland, we tackle the unique challenges of real estate accounting head-on. As your dedicated outsourced partner for real estate bookkeeping and accounting outsourcing services, we support property managers, investors, developers, realtors and landlords across Ireland. Our customised solutions handle everything from rent tracking to VAT compliance, freeing you to grow your portfolio amid rising house prices up 6.6% in the 12 months to November 2025, per the Central Statistics Office (CSO).

Our certified team, familiar with Ireland’s Companies Act 2014 and Revenue rules, delivers precise financial management. We integrate cloud tools like Xero and QuickBooks for real-time insights, ensuring compliance while boosting your efficiency.

Main Real Estate Accounting Services

The core services provided by real estate accounting firms and CPAs are listed below:

- Accounts Payable Outsourcing: Streamline vendor payments for maintenance, repairs and supplies. Our accounts payable services ensure timely processing, optimised cash flow and adherence to Irish payment terms saving you time on admin.

- Accounts Receivable Management: Handle invoicing, rent collection and delinquency for steady cash flow. We specialise in real estate receivables, reducing late payments common in multi-tenant setups.

- Real Estate Bookkeeping: Expert bookkeeping for property managers and realtors, covering rent receipts, bank reconciliations and ledger maintenance. Stay audit-ready with accurate, real-time records.

- Payroll and Data Entry: Manage staff salaries with PAYE/PRSI compliance, plus precise entry for property transactions, fees and commissions essential for property management bookkeeping.

- Management Accounts and Reporting: Generate investor-ready P&L, balance sheets, cash flow forecasts and property-level insights. Our management accounts drive smarter decisions for expansion.

- Tax and VAT Services: Navigate stamp duty, capital gains tax, corporation tax and VAT (e.g., 23% on commercial leases with option to tax; 9% reduced rate on new apartment sales from Oct 2025). We handle returns, exemptions and planning to minimise penalties.

These services use Ireland-compliant software, ensuring on-time filings and growth-focused insights. With these accounting services, you will be able to maintain compliance, optimise cash flow and scale confidently.

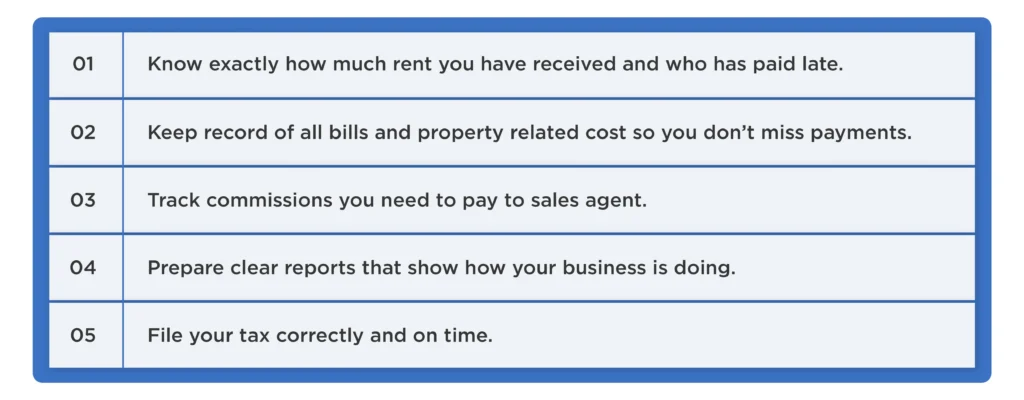

With these accounting services you will be able to:

Key Accounting Tasks for Property Managers & Realtors

There is a wide range of accounting tasks for property managers and realtors that help businesses stay financially healthy and in accordance with Irish tax laws. The key tasks include:

- Monitoring rent by keeping a complete record of all tenant rent receipts, deposits and remaining rent.

- Paying employees and contractors in accordance with Ireland’s tax and employment law.

- Regular bank reconciliation, comparing bank statements with accounting records to catch errors early.

- Financial reporting, preparing monthly, quarterly and annual reports to keep stakeholders informed.

- Tax compliance, staying current with VAT, stamp duty, capital gains tax, corporation tax and Revenue filing deadlines.

Many property professionals use real estate CPA services for expert guidance and practical support or opt for monthly bookkeeping for realtors to deal with these complex tasks.

Key Challenges in Irish Real Estate Accounting and How We Solve Them

Irish property pros face rising costs, regulatory shifts and cash flow hurdles. Common issues include:

- High stamp duty and loan constraints amid soaring prices.

- VAT complexities (e.g., residential exempt, commercial opt-to-tax).

- Rent arrears, multi-property tracking and Brexit-related cross-border taxes.

- Payroll compliance under PAYE/PRSI and evolving ESG reporting demands.

Outbooks steps in with proactive solutions: precise bookkeeping, tax optimisation and cloud integration to cut risks and enhance liquidity.

How Real Estate CPAs Benefit You?

When you hire a CPA for real estate, it can be extremely beneficial for your property business. These experts understand the Irish real estate market well and can help guide you in tax and financial matters.

Benefits of Real Estate CPA services:

- Identifying and maximising available tax deductions for expenses such as repairs, maintenance and management fees, thereby reducing taxable income.

- Advising on real estate tax services including VAT exemptions and strategies to minimise stamp duty on property transactions.

- Efficiently planning sales and purchases to minimise capital gains tax where applicable.

- Ensuring full compliance with Irish Revenue regulations to avoid costly penalties and audits.

- Providing strategic financial advice to improve cash flow and help grow property portfolios over the long term.

- Assisting property businesses during tax audits and handling detailed, complex filings.

Working with real estate CPAs not only improves bookkeeping accuracy for real estate agents but also makes it easier to plan for taxes in advance and minimise risk. This ultimately saves you money and keeps your investment safe.

How to Choose the Right Real Estate Accountant or CPA in Ireland

Choosing the right real estate accountant or CPA for your property business will determine your success. Here are some simple tips:

- Check Qualifications First: It is better if the accountant is certified from Chartered Accountants Ireland. This shows they are well aware of Ireland’s tax rules.

- Experience in Real Estate: Look for experience in real estate accounting services, including bookkeeping for real estate agents and property management bookkeeping. Accountants familiar with Irish laws on stamp duty, capital gains tax and property-specific compliance reduce risk and optimise savings.

- Technology Savvy: Verify proficiency in software like Xero, QuickBooks, Sage. Check if they offer virtual bookkeeping for real estate professionals.

- Full-Service Offering: A good real estate CPA should offer comprehensive bookkeeping for property managers and realtors; detailed tax planning and compliance; real estate CPA services with strategic financial advice; real-time reporting and audit assistance.

- Listen to Others’ Opinions: Talk to past clients and look for good reviews.

- Communication Skills: Provides advance advice, communicates clearly and keeps you informed about new tax rules.

CPA Service Pricing Models and Typical Costs in Ireland

CPAs in Ireland commonly use these pricing models:

- Hourly Rates: Usually €75 to €200 per hour depending on service complexity.

- Fixed Monthly Fees: Starting around €200-€500/month for ongoing bookkeeping and tax services.

- Project-Based Fees: Flat fees for specific tasks like year-end accounts or tax planning.

- Value-Based Pricing: Fees based on the value and complexity of advisory or strategic services.

Pricing depends on CPA experience, service scope and client needs. Clients should agree on clear fee arrangements upfront to avoid surprises. Choosing a CPA is about balancing cost with expertise, especially knowledge of Irish real estate tax laws and accounting.

Importance of ESG Reporting Trends

ESG (Environmental, Social and Governance) reporting is becoming a key part of real estate accounting in Ireland. Property businesses are now expected to monitor and report sustainability metrics to meet investor demands and regulatory requirements such as under the EU’s CSRD (phased in from 2025) helping them build a responsible and future-proof portfolio.

Ireland-Specific Insights: VAT, Tax and Trends

- VAT Nuances: Opt to tax commercial leases at 23%; reclaim input VAT correctly to avoid fines.

- Brexit Effects: We manage new customs/VAT on UK-linked deals.

- ESG Rise: Track sustainability for investor appeal under Irish regulations.

- Software Picks: Xero for collaboration; QuickBooks for VAT/payroll paired with our expertise.

Why Partner with Outbooks Ireland?

Choose us for real estate success:

- Local Expertise: Deep knowledge of Dublin, Cork, Galway markets, plus FRS 102 standards and Revenue audits.

- Security-First: Advanced encryption protects sensitive data like tenant details and financials.

- Affordable & Flexible: Hourly (€75-€200), monthly (€200-€500+), or project-based pricing scaled to your needs.

- Tech-Driven: Seamless Xero, QuickBooks, or Sage integration for cloud bookkeeping.

- Full Compliance: From VAT checklists to ESG metrics, we future-proof your operations.

- Custom Fit: Tailored for agents, landlords, or developers whether residential or commercial.

Clients gain peace of mind, tax savings (e.g., deductions on repairs/maintenance) and strategic advice to scale portfolios.

Conclusion

Effective real estate accounting is essential for running a profitable and legally compliant property business in Ireland. Staying updated with evolving tax laws, regulatory requirements like VAT and Revenue filings and leveraging modern tools such as cloud bookkeeping ensures long-term success for property managers, realtors and landlords.

Partner with Outbooks, your trusted outsourced provider for comprehensive real estate bookkeeping outsourcing, tax services, VAT compliance and management accounts. Our scalable solutions deliver precision, efficiency and strategic insights freeing you to focus on growing your portfolio without the burden of in-house accounting.

Ready to simplify your finances and scale confidently? Contact Outbooks today for a expert consultation.

Frequently Asked Questions

What are main real estate accounting services in Ireland?

What key tasks do property managers/realtors handle?

What challenges face Irish real estate accounting?

How do real estate CPAs benefit property businesses?

How do I choose the right real estate accountant or CPA in Ireland?

What pricing models do CPAs use for real estate?

What is ESG reporting in Irish real estate?

How does VAT work in Irish real estate?

What software suits Irish real estate?

Why outsource real estate accounting?

Parul is a content specialist with expertise in accounting and bookkeeping. Her writing covers a wide range of accounting topics such as payroll, financial reporting and more. Her content is well-researched and she has a strong understanding of accounting terms and industry-specific terminologies. As a subject matter expert, she simplifies complex concepts into clear, practical insights, helping businesses with accurate tips and solutions to make informed decisions.