Managing VAT compliance in Ireland can feel overwhelming for many bookkeepers. The rules seem to change constantly, and the Irish Revenue Commissioners take these requirements very seriously.

This guide breaks down everything bookkeepers need to know about VAT compliance. It covers registration, rates, returns, and practical tips that make the job easier.

Whether you’re new to Irish VAT or need a refresher, this checklist will help keep your clients compliant and avoid costly mistakes.

When Businesses Need to Register for VAT

The first question most bookkeepers ask is simple: when does a business actually need VAT registration? The answer depends on what type of business it is.

What is the threshold for VAT in Ireland? Service businesses must register when they earn more than €42,500 in any 12-month period. This includes consultancy, marketing, and professional services.

Businesses that sell physical goods have a higher limit. They need to register when sales exceed €85,000 annually. This gives them more room before hitting the registration requirement.

These limits only apply to sales within Ireland and the EU. Exports to countries outside the EU don’t count towards these thresholds.

Quick Reference: Registration Thresholds

| Business Type | Annual Limit | Time to Register |

|---|---|---|

| Services | €42,500 | Within 30 days |

| Physical goods | €85,000 | Within 30 days |

| Voluntary | Any amount | Before trading starts |

Understanding Irish VAT Rates

How much VAT in Ireland applies to different sales? The country uses several different rates depending on what’s being sold.

The standard rate is 23% for most goods and services. This is what applies to office supplies, consultancy services, and general business transactions.

What are the 13.5% VAT rates for in Ireland? This reduced rate covers hospitality services like restaurants and hotels. It also applies to hairdressing and some property services.

There’s also a 9% rate for tourism services and temporarily for gas and electricity until October 2025. After that, utilities will likely return to the standard rate.

VAT Rates Quick Guide

| Rate | Applies To | Common Examples |

|---|---|---|

| 23% | Standard rate | Most services, office supplies |

| 13.5% | Reduced rate | Restaurants, hairdressing |

| 9% | Second reduced | Tourism, utilities (temporary) |

| 0% | Zero rate | Exports, some EU sales |

Essential VAT Compliance Checklist

How to check VAT compliance in Ireland requires regular monitoring of several key areas. This VAT compliance checklist covers the most important tasks.

Bookkeepers should check these items regularly to keep clients compliant and avoid problems with Revenue.

Before Registration Tasks

Getting ready for VAT registration takes time and planning. Foreign company directors need Personal Public Service (PPS) numbers before they can apply.

The PPS number application takes 2-6 weeks depending on how busy Revenue is. Starting this process early prevents delays later.

Revenue also wants to see proof that the business is real and actively trading. This includes customer contracts, supplier agreements, and evidence of Irish business activity.

Monthly Compliance Tasks

These tasks should happen every month without fail:

Sales and Purchase Records

- Check all sales invoices show the correct VAT rate

- Make sure purchase invoices are proper VAT receipts

- Update VAT records in the accounting system

- Verify EU customer VAT numbers are still valid

Threshold Monitoring

- Track monthly sales against VAT thresholds

- Watch for businesses approaching registration limits

- Plan for voluntary registration when beneficial

- Monitor changes in business activity

Documentation

- File all VAT invoices and receipts properly

- Keep backup copies of important documents

- Update customer and supplier VAT details

- Maintain electronic records securely

VAT Returns Ireland Process

VAT returns Ireland must be filed every two months for most businesses. The deadline is the 19th day of the second month after the period ends.

For example, January-February returns are due by April 19th. March-April returns are due by June 19th.

Most businesses must file electronically through Revenue Online Service (ROS). Paper returns are only allowed in special cases.

Filing early is always better than waiting until the deadline. Revenue’s computer systems get very busy near due dates.

Working with International Clients

International businesses face extra challenges with Irish VAT compliance. How do you ensure VAT compliance when dealing with foreign companies?

The process takes longer and requires more paperwork. Foreign directors need Irish tax numbers before the business can register for VAT.

Revenue checks international applications very carefully. They want to prevent VAT fraud, so they ask for lots of supporting documents.

Documents Revenue Wants to See

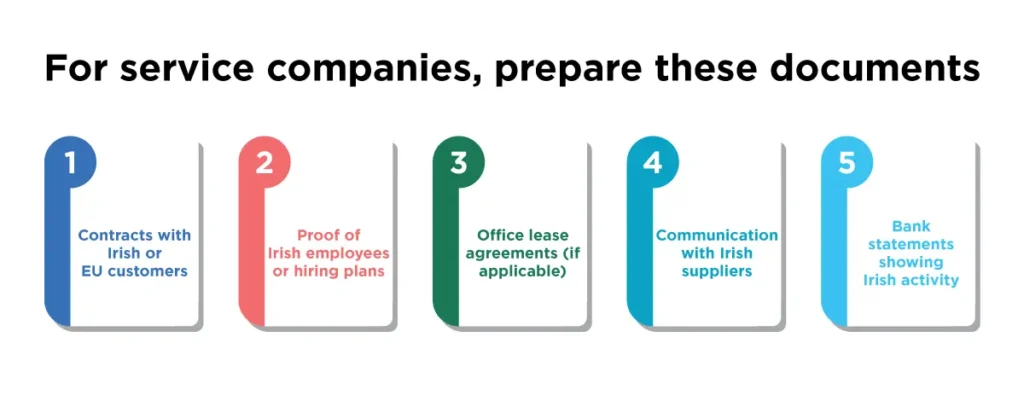

For service companies, prepare these documents:

- Contracts with Irish or EU customers

- Proof of Irish employees or hiring plans

- Office lease agreements (if applicable)

- Communication with Irish suppliers

- Bank statements showing Irish activity

For companies selling goods:

- Import and export paperwork

- Warehouse or storage contracts

- Supplier agreements

- Delivery arrangements within Ireland

- Proof of goods movement

Domestic vs EU VAT Registration

Many bookkeepers don’t know about this important difference. Basic VAT registration only covers sales within Ireland.

Companies trading with other EU countries need extra registration. This is called intra-EU VAT registration.

Without the EU registration, suppliers in other EU countries can’t give zero-rated invoices. The Irish company ends up paying foreign VAT that they can’t get back.

Proper VAT Invoice Requirements

Good invoicing is crucial for VAT compliance. Revenue can reject VAT claims if invoices are missing required information.

Every VAT invoice must include specific details. Missing even one item can cause problems during a Revenue audit.

Must-Have Invoice Information

| Information Needed | Why It’s Important | Common Mistakes |

|---|---|---|

| Sequential number | Prevents duplicates | Using random numbers |

| Issue date | Shows when liability started | Wrong or missing dates |

| Supply date | When goods/services provided | Leaving this blank |

| Supplier VAT number | Proves legitimacy | Wrong format |

| Customer details | Proper identification | Incomplete addresses |

| Clear description | What was sold | Vague descriptions |

| VAT rate applied | Correct percentage | Using wrong rates |

| VAT amount | Calculated correctly | Maths errors |

Digital Records and Storage

Electronic records are now the normal way of keeping VAT information. But there are rules about how to store and manage digital files.

Both the sender and receiver must agree to electronic invoices. This agreement should be documented and kept on file.

All VAT records must be kept for at least six years. Digital storage systems must guarantee the files will be readable for this entire time.

Cloud storage works well for this, but choose providers carefully. Make sure they’ll be in business for the long term.

Penalties for Getting It Wrong

Late VAT returns result in automatic penalties. The current rates start at 5% for first-time late filing.

Businesses that file late repeatedly face 10% penalties. Interest also builds up daily at 0.0274% on unpaid amounts.

Real Cost Examples

A company with €5,000 VAT due that files three days late pays:

- 5% penalty = €250

- Three days interest = €4.11

- Total extra cost = €254.11

Repeat late filers with the same €5,000 liability would pay:

- 10% penalty = €500

- Plus daily interest

- Much higher total cost

How to Avoid Penalties

The best way to avoid penalties is simple planning:

- Set up calendar reminders for due dates

- File returns early when possible

- Keep VAT money separate from operating funds

- Use electronic filing to avoid postal delays

- Double-check all calculations before submitting

When Voluntary Registration Makes Sense

Not every business needs VAT registration, but some benefit from registering anyway. This is called voluntary registration.

Businesses that spend a lot on office costs, equipment, or professional services often benefit. They can claim back the VAT they pay on these expenses.

Good Candidates for Voluntary Registration

- Professional service firms

- Consultancy businesses

- Companies with high office costs

- Businesses planning rapid growth

- B2B service providers

Poor Candidates for Voluntary Registration

- Retail shops selling to consumers

- Businesses with low expenses

- Companies near retirement

- Very small operations

- Cash-based businesses

Using Technology for Compliance

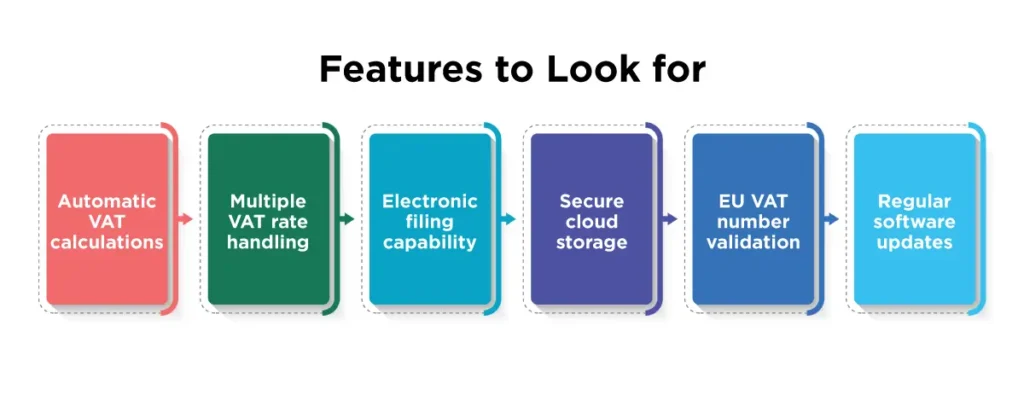

Modern accounting software makes VAT compliance much easier. The best systems calculate VAT automatically and reduce errors.

Cloud-based software allows access from anywhere. This is helpful when Revenue asks questions or needs information quickly.

Some software connects directly to Revenue systems. This makes filing returns faster and more accurate.

Features to Look For

- Automatic VAT calculations

- Multiple VAT rate handling

- Electronic filing capability

- Secure cloud storage

- EU VAT number validation

- Regular software updates

Planning for Rate Changes

VAT rates change from time to time. The temporary 9% rate on utilities ends in October 2025, for example.

Smart bookkeepers prepare for these changes in advance. This includes updating software, informing clients, and reviewing contracts.

Rate Change Preparation

- Update accounting system rates

- Check long-term customer contracts

- Inform clients about changes

- Train staff on new rates

- Review pricing strategies

Cash Flow Management

VAT compliance affects business cash flow significantly. Companies must pay VAT every two months, which requires careful planning.

The best approach is setting aside VAT money immediately when invoicing customers. This prevents accidentally spending tax money on other things.

Seasonal businesses need extra care with cash flow planning. Christmas retailers, for example, face large VAT bills in January.

Cash Flow Tips

- Open separate VAT bank accounts

- Set aside VAT money immediately

- Plan for seasonal variations

- Consider monthly VAT payments for large amounts

- Build cash reserves for unexpected bills

Common Mistakes to Avoid

Some mistakes appear over and over in VAT compliance. Learning from these common errors saves time and money.

Registration Timing Many businesses register too late. Monitor turnover carefully and register before reaching thresholds.

Invoice Errors Missing information on invoices causes problems later. Use proper invoicing software with VAT templates.

Record Keeping Poor record keeping leads to audit problems. Maintain organized files and backup systems.

Rate Applications Using wrong VAT rates is expensive. Double-check rates for different types of sales.

EU VAT Numbers Not checking EU customer VAT numbers properly results in incorrect zero-rating. Verify numbers regularly.

Building Good Revenue Relationships

Maintaining professional relationships with Revenue helps resolve problems faster. Be honest, responsive, and well-prepared for all communications.

When Revenue asks questions, respond quickly with complete information. This shows professionalism and often prevents escalation.

Keep detailed records of all Revenue communications. This helps track ongoing issues and prevents misunderstandings.

Staying Current with Changes

VAT rules change regularly, and keeping up requires ongoing effort. Subscribe to Revenue updates and professional newsletters.

Join professional associations that provide VAT training and updates. Attend seminars and webinars when possible.

Consider working with VAT specialists for complex situations. The cost of professional advice is often less than the cost of mistakes.

Final Thoughts

VAT compliance in Ireland requires systematic attention to detail. This VAT compliance checklist provides a solid foundation for keeping clients compliant.

The key is treating VAT as an ongoing responsibility, not just a monthly task. Regular monitoring, proper systems, and careful planning prevent most problems.

Remember that VAT mistakes can be very expensive. Investing in proper systems and professional development pays off through avoided penalties and reduced stress.

Good VAT compliance protects businesses and helps them grow. It’s an essential skill for every bookkeeper working with Irish companies.

Commonly Asked Questions About VAT Compliance in Ireland

What is the current VAT rate in Ireland?

When must a business register for VAT?

How long does VAT registration take?

What’s the difference between domestic and EU VAT registration?

How often must businesses file VAT returns?

What happens if VAT returns are filed late?

Should small businesses register for VAT voluntarily?

What records are required for VAT compliance?

How can businesses ensure VAT compliance when trading in the EU?

What are the most common VAT compliance mistakes?

Parul is a content specialist with expertise in accounting and bookkeeping. Her writing covers a wide range of accounting topics such as payroll, financial reporting and more. Her content is well-researched and she has a strong understanding of accounting terms and industry-specific terminologies. As a subject matter expert, she simplifies complex concepts into clear, practical insights, helping businesses with accurate tips and solutions to make informed decisions.