A payroll proposal is your key to winning new clients in today’s competitive market. Whether you’re an accountant or payroll service provider, mastering how to write a payroll proposal matters for your business growth. This comprehensive payroll proposal guide shows you exactly what to include to close more deals and secure long-term clients.

What is a payroll Proposal?

A payroll proposal is a formal document outlining your payroll services to prospective clients.

It explains how you’ll handle their payroll processing proposal needs and management tasks efficiently.

The proposal for payroll services details costs, timelines and deliverables with complete clarity.

Think of it as your sales pitch combined with a detailed service agreement.

It demonstrates your professionalism and expertise to potential clients seeking reliable solutions.

Why your payroll Proposal matters?

A professional payroll proposal sets you apart from competitors immediately in crowded markets. Clients need to see your value proposition before they commit to working together.

Your accounting proposal shows you understand their specific business challenges and pain points. Without a strong proposal, you risk losing clients to better-prepared competitors daily.

Learning the best payroll proposal format for accountants includes clear pricing structures and comprehensive scope.

Key components of a winning payroll Proposal

Cover letter

Your cover letter creates the crucial first impression with prospects when pitching services. Address the client’s specific payroll challenges and pain points directly with empathy. Keep it personal and show you’ve researched their business thoroughly before reaching out.

Mention how your payroll solutions proposal addresses their unique operational situation effectively. This section should be brief but impactful for maximum effect on decision-makers.

Executive summary

Summarise your payroll processing proposal in clear, simple terms here without jargon. Highlight the main benefits clients will gain from your proposal for payroll management services.

Focus on how you’ll solve their payroll management problems quickly and efficiently. Include key points about accuracy, compliance and significant time savings offered.

This section of your comprehensive payroll proposal guide hooks busy decision-makers immediately.

Company overview

Present your credentials and experience in payroll management services clearly and confidently. Show your track record of helping similar businesses succeed with payroll operations.

Include relevant certifications, years of experience and client testimonials that build confidence. Mention any specialisations like payroll proposal for small businesses expertise you’ve developed.

This builds trust and credibility with potential clients immediately upon review.

Understanding client needs

Demonstrate you’ve listened to their specific payroll challenges carefully during discovery meetings. Outline the problems they’re facing with current payroll processes right now.

Show empathy and understanding of their operational pain points clearly throughout. This section proves you’re not using a generic template approach for proposals.

Personalisation is crucial for a professional payroll proposal that converts prospects effectively.

Proposed solutions

Detail exactly how your payroll outsourcing proposal solves their identified problems comprehensively. Break down each service you’ll provide in clear, understandable terms for stakeholders.

When crafting your payroll proposal for clients, include:

- Direct deposit setup and management for all employees seamlessly

- Tax filing and compliance with HMRC PAYE requirements

- Attendance tracking and detailed labour cost reporting systems

- Benefits administration including insurance and comprehensive health programmes

- Quarterly and yearly accounting reconciliations completed with precision

Explain your payroll automation proposal features and cutting-edge technology platforms used.

Show how these solutions save time and reduce costly errors significantly.

For UK businesses, ensure compliance with Real Time Information (RTI) reporting standards to HMRC.

Service delivery timeline

Provide a realistic timeframe for implementing your payroll services to clients.

Following the steps to write an effective payroll proposal, break implementation into clear phases.

Include:

- Initial setup and complete system configuration period

- Data migration and employee information transfer process

- Testing phase before going live with services

- Training sessions for client staff members

- Ongoing support and regular review meetings

A clear timeline shows professionalism and strong project management skills consistently.

This helps clients understand your methodology when learning how to create a winning payroll proposal.

Pricing structure

Your payroll proposal pricing must be transparent and easy to understand immediately.

Break down your payroll service pricing proposal by service component or employee count clearly.

Consider offering tiered options for different budget levels available to prospects.

Terms and conditions

Clearly state the legal framework governing your service agreement with clients. Include confidentiality clauses to protect sensitive employee information and payroll data.

Outline cancellation policies and notice periods required by both parties clearly. Specify liability limitations and your responsibilities under the contract terms.

Address data protection compliance with UK GDPR requirements explicitly throughout.

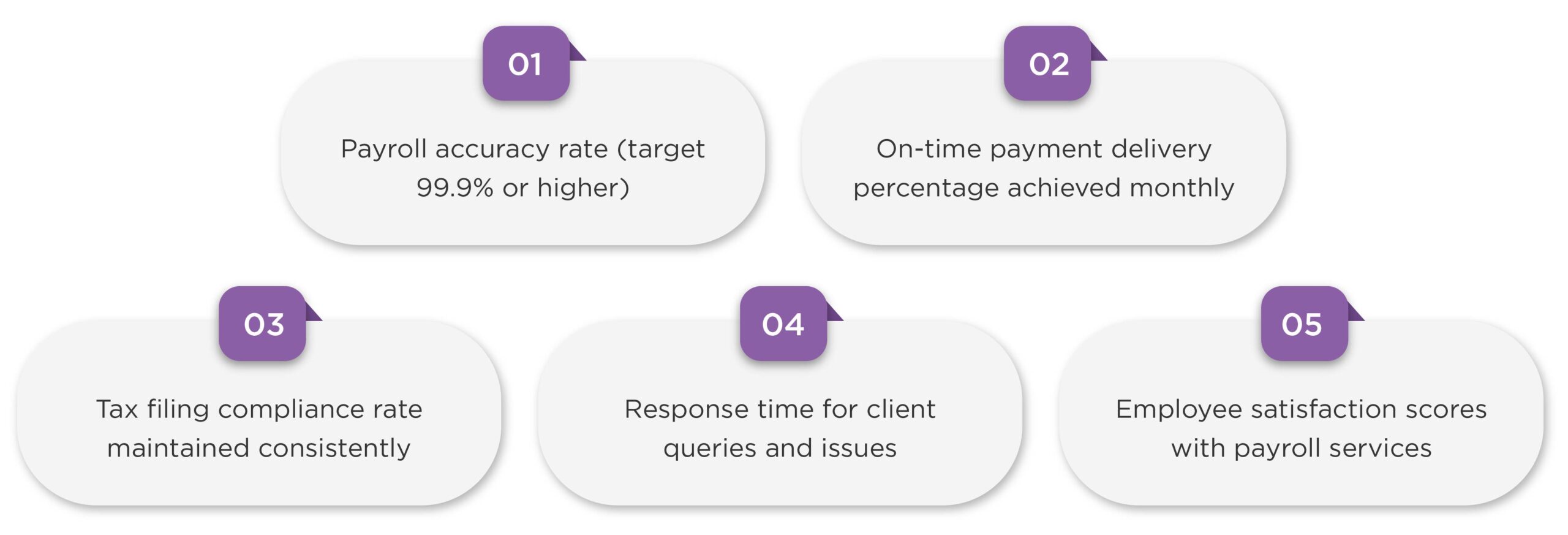

Performance metrics

Define how you’ll measure success in your proposal for payroll management services clearly.

Include key performance indicators like:

- Payroll accuracy rate (target: 99.9% error-free processing)

- On-time payment delivery (target: 100% compliance)

- Compliance filing accuracy with HMRC deadlines met

- Response time to client queries (target: within 2 hours)

- Employee self-service portal adoption rates

This shows accountability and commitment to delivering results measurably to clients.

Top 5 accounting proposal metrics to track in 2025 – Learn which KPIs matter most for measuring proposal success and improving your win rates.

How to create a winning payroll Proposal?

Research your client thoroughly

Understand their industry, size and specific payroll challenges completely before drafting. Look at their current payroll setup and identify improvement areas systematically.

Research competitors to position your payroll proposal for clients effectively in market. The more you know, the better your proposal will resonate with decision-makers.

Use professional templates and tools

Start with a free payroll proposal template for businesses structure as foundation. Modern tools like Outbooks Proposal streamline the entire proposal creation process significantly.

Outbooks Proposal enables accountants to automate proposal management with customisable templates efficiently.

The platform integrates seamlessly with accounting software for efficient workflow management daily.

Templates save time whilst ensuring you don’t miss critical sections consistently.

Make sure it looks polished and professional throughout every page delivered.

Focus on benefits, not just features

Don’t just list what you do explain why it matters to their business. Show how your services save time, reduce stress and prevent costly errors.

Quantify benefits wherever possible with specific numbers and percentages for impact. Help clients visualise the positive impact on their business operations clearly.

Include visual elements

Add charts, graphs and tables to break up text effectively throughout. Visual elements make complex information easier to digest quickly for stakeholders.

Proofread carefully

Spelling and grammar mistakes destroy credibility instantly with clients reviewing proposals. Have colleagues review your proposal before sending it out to prospects.

Check all numbers, dates and client-specific details for accuracy thoroughly. A polished proposal reflects the quality of your services delivered consistently.

Using Outbooks Proposal for payroll proposals

Streamline your Proposal creation process

Outbooks Proposal tool is specifically designed for accountants and bookkeepers nationwide. The platform helps you craft professional-looking proposals in minutes effortlessly.

It includes automated engagement letters and consistent pricing features built-in seamlessly. The software addresses common challenges that 86% of accountants face daily.

Key features for payroll Proposals

Outbooks Proposal offers several advantages for creating payroll proposals effectively:

Customisable templates: Pre-built templates tailored for payroll services specifically designed.

Scope of work definition: Easily factor in SLAs, transaction counts and staff numbers.

E-signature integration: Clients can sign proposals digitally from anywhere instantly.

Payment streamlining: Accept payments directly through the proposal platform seamlessly.

Professional branding: Customise proposals to match your firm’s brand identity perfectly.

Benefits of using Proposal software

Digital proposal tools like Outbooks dramatically improve your conversion rates significantly. Faster signing times mean you can onboard clients more quickly than competitors.

Automated workflows reduce administrative burden on your team significantly every day. The platform ensures consistency across all proposals sent to clients consistently.

Integration with accounting software eliminates duplicate data entry tasks completely.

Payroll Proposal tips for different client types

Payroll Proposal for small businesses

Small businesses need affordability and simplicity in their payroll solutions immediately. Focus on ease of use and quick setup processes that minimise disruption.

Highlight how you handle everything so they can focus on growth priorities. Offer flexible pricing that scales as their business expands gradually over time.

Payroll Proposal for UK businesses

Emphasise your knowledge of UK tax regulations and HMRC requirements specifically. Mention compliance with Making Tax Digital and PAYE requirements thoroughly.

Show familiarity with auto-enrolment pension schemes and workplace pension regulations. Demonstrate expertise in handling cross-border payroll issues if relevant to prospects.

Payroll Proposal for startup businesses

Startups need cost-effective solutions with room to grow quickly as they scale. Offer simplified packages with essential services only at first to minimise costs.

Highlight your scalability and ability to adapt as they expand operations. Include flexible terms that accommodate their uncertain early growth phase challenges.

Payroll Proposal for accountants

If you’re offering services to accounting firms, emphasise integration capabilities extensively. Show how your systems work with popular accounting software seamlessly together.

Highlight white-label options if you offer them for their clients nationwide. Focus on how you support their practice growth and service expansion goals.

Engagement letter: Everything you need to know – Discover how to create professional engagement letters that protect your practice and set clear expectations.

Advanced strategies for payroll Proposals

Include case studies

Real examples of how you’ve helped similar businesses build credibility immediately. Show specific results like time saved or errors reduced quantifiably with data. Case studies provide social proof that your services deliver results consistently.

Offer a trial period

Consider offering a discounted first month or trial period initially to prospects. This reduces perceived risk for hesitant clients significantly today effectively. Once they experience your service quality, retention rates increase dramatically afterward.

Add value-added services

Differentiate yourself by offering extras competitors don’t provide regularly to clients.

This might include:

- Free initial payroll audit and compliance check thoroughly

- Employee self-service portal access for queries conveniently

- Regular compliance updates and regulatory guidance proactively

- Dedicated account manager for personalised support always

Extra value justifies premium pricing and improves client satisfaction rates significantly.

Create multiple package options

Give clients choices to increase conversion rates substantially overall in negotiations. Offer good, better, best options at different price points clearly displayed. Most clients choose the middle option, but having choices matters psychologically.

Ultimate guide to accounting proposal software – Compare features and benefits of digital proposal tools designed for accounting firms.

Technology and automation in payroll Proposals

Highlight your payroll automation Proposal

Modern clients expect technology-driven solutions for efficiency gains significantly today. Explain the software and systems you use for processing payroll accurately.

Show how automation reduces errors and speeds up processing times dramatically. Mention mobile apps or online portals for employee access convenience daily.

Integration capabilities

Detail how your systems integrate with their existing software platforms seamlessly.

Common integrations include:

- Accounting software like Xero, QuickBooks, Sage compatibility perfectly

- Time and attendance tracking systems seamlessly connected

- HR management platforms for employee data synchronisation automatically

- Banking systems for direct deposit processing efficiently

- Pension and benefits administration platforms integrated

Seamless integration saves time and eliminates duplicate data entry tasks completely.

Tools like Outbooks Proposal integrate with major accounting platforms automatically.

Data security and compliance

Address cybersecurity measures protecting sensitive payroll information always comprehensively. Mention encryption, backup procedures and access controls implemented thoroughly throughout.

Highlight UK GDPR compliance and data protection certifications you maintain consistently. Security concerns are paramount when handling employee personal information daily.

Payroll compliance considerations for UK businesses

Understanding UK payroll regulations

UK employers must comply with specific payroll reporting requirements mandatorily to HMRC. The Real Time Information system requires real-time reporting to HMRC authorities regularly.

Your proposal should demonstrate knowledge of PAYE, National Insurance and tax deductions. Mention your familiarity with HMRC’s online services and reporting platforms.

Registration requirements

Explain that new businesses must register with HMRC as employers properly. This registration covers PAYE, National Insurance, and other employment tax requirements.

Your proposal should outline how you’ll handle registration for new clients. Demonstrate understanding of UK payroll compliance standards throughout comprehensively.

Statutory requirements

Address statutory obligations including National Minimum Wage, holiday entitlements and Statutory Sick Pay. Show knowledge of employment contract requirements under UK employment law.

Include workplace pension arrangements and auto-enrolment obligations in offerings. Your expertise in UK payroll regulations sets you apart from competitors.

Payroll Proposal for different industries

Payroll for hospitality sector

Address tip management and variable hour scheduling complexities specifically for venues. Mention experience with high staff turnover and seasonal workers effectively.

Show understanding of industry-specific regulations and requirements clearly throughout.

Payroll for healthcare providers

Highlight expertise in handling complex shift patterns and on-call payments accurately. Address pension schemes and healthcare-specific requirements if applicable correctly.

Mention understanding of professional registration and compliance issues thoroughly.

Payroll for construction companies

Detail experience with CIS (Construction Industry Scheme) compliance requirements specifically. Address management of subcontractors and varied payment structures competently.

Show capability handling site-based workers and multiple locations effectively.

How to write a payroll Proposal: Step-by-step process

Step 1: Schedule discovery call

Meet with the potential client to understand their needs completely firsthand. Ask detailed questions about current processes and pain points experienced daily.

Take notes on specific requirements and preferences mentioned clearly throughout.

Step 2: Analyse their current situation

Review their existing payroll setup and identify improvement opportunities available. Calculate potential time and cost savings your services would provide measurably.

Identify compliance risks or issues they may be facing currently with HMRC.

Step 3: Develop custom solutions

Create service packages tailored to their specific needs identified earlier precisely. Don’t force them into standard packages if custom solutions fit better.

Flexibility shows you’re genuinely interested in solving their problems effectively.

Step 4: Build the Proposal document

Use professional templates as a starting point for consistency always throughout. Platforms like Outbooks Proposal provide ready-made templates for payroll services.

Customise every section to reflect their business and your solutions specifically. Include all key components discussed earlier in this comprehensive payroll proposal guide.

Step 5: Review and polish

Check for errors, inconsistencies and missing information thoroughly everywhere carefully. Ensure pricing is accurate and all dates are correct throughout document.

Have someone else review it for clarity and professionalism shown consistently.

Step 6: Present and follow up

Send the proposal via email with a professional cover message attached. Using e-signature tools speeds up the approval process significantly for both parties.

Follow up within 2-3 business days to answer questions promptly. Be prepared to negotiate or adjust based on their feedback received.

Conclusion

Creating a winning payroll proposal requires research, customisation and clear value demonstration. Focus on understanding client needs and showing exactly how you’ll solve problems.

Use this comprehensive payroll proposal guide and payroll proposal tips provided here for success. Remember that how to create a winning payroll proposal involves both art and science.

Professional presentation, transparent pricing and strong follow-up will help you close more deals. Leveraging modern tools like Outbooks Proposal streamlines the entire process significantly.

Whether you’re creating a payroll proposal for small businesses, payroll proposal for startup businesses, or established companies, these principles apply universally.

Frequently asked questions

What should I include in a payroll proposal?

Include a cover letter, executive summary, company overview and client needs analysis. Detail your proposed solutions, timeline, pricing structure and terms and conditions.

Add performance metrics, case studies, and your contact information for completeness.

How long should a payroll proposal be?

A typical proposal ranges from 10-20 pages depending on complexity needed. Keep it concise but comprehensive enough to address all concerns fully.

Quality matters more than quantity in effective proposal writing always.

How do I price my payroll services in a proposal?

Price based on employee count, service complexity and market rates locally. Research competitor pricing to position yourself competitively yet profitably overall.

Consider tiered pricing options to appeal to different budget levels available. Transparency in pricing builds trust and reduces negotiation friction later significantly.

What makes a payroll proposal stand out from competitors?

Personalisation, clear value demonstration and professional presentation make differences immediately.

Include specific examples of how you’ve helped similar businesses succeed recently. Offer unique value-adds that competitors don’t provide to clients regularly. Strong follow-up and responsive communication throughout the process matter greatly.

Should I include a contract in my payroll proposal?

It’s better to keep the proposal and contract as separate documents. The proposal sells your services, whilst the contract covers legal terms.

Reference that a detailed service agreement will follow upon acceptance clearly. This keeps the proposal focused on benefits rather than legal language.

How quickly should I send a payroll proposal after meeting a client?

Send your proposal within 24-48 hours whilst you’re fresh in their mind. Quick turnaround demonstrates professionalism and eagerness to work together immediately.

Delays may cause clients to lose interest or engage competitors instead. Balance speed with quality don’t rush and make careless mistakes obviously.

Payroll proposal

Can I use templates for my payroll proposal?

Yes, templates are excellent starting points for consistent professional quality always. However, always customise extensively to match each client’s specific needs thoroughly.

Generic, obviously templated proposals rarely win competitive bids successfully today. Use templates for structure, but make the content uniquely relevant always.

What’s the difference between a payroll proposal and payroll agreement?

A proposal is a sales document outlining services and costs persuasively. An agreement is a legal contract defining terms once accepted formally.

The proposal convinces clients to choose you; the agreement protects both parties. Always send the proposal first, then the agreement after acceptance received.

How do I handle pricing objections in payroll proposals?

Justify your pricing by clearly demonstrating the value and ROI provided. Show cost savings through error reduction, time savings and compliance benefits.

Offer flexible payment terms or scaled packages to accommodate budgets better. Compare your pricing to the cost of handling payroll in-house currently.

Should I include references in my payroll proposal?

Yes, include 2-3 client references or testimonials for social proof effectively. Get permission from references before including their contact information publicly always.

Brief testimonials within the proposal work well for building immediate credibility. Offer to provide full references upon request if space is limited.

How can proposal software help me win more clients?

Proposal software like Outbooks Proposal streamlines creation and delivery processes dramatically. Professional templates ensure consistent quality across all proposals sent out.

E-signature integration speeds up approval times and reduces administrative burden. Tracking features let you know when clients view proposals for timely follow-up.

What UK payroll compliance issues should I address in proposals?

Mention Real Time Information (RTI) reporting requirements to HMRC authorities clearly. Address PAYE, National Insurance and income tax calculation and submission processes.

Include data protection compliance with UK GDPR regulations throughout. Reference your knowledge of statutory requirements under UK employment law.

Parul is a content specialist with expertise in accounting and bookkeeping. Her writing covers a wide range of accounting topics such as payroll, financial reporting and more. Her content is well-researched and she has a strong understanding of accounting terms and industry-specific terminologies. As a subject matter expert, she simplifies complex concepts into clear, practical insights, helping businesses with accurate tips and solutions to make informed decisions.