Understanding accountant fees is vital for your business success. The economy is uncertain and business costs are rising.

Raw material prices change daily. Interest rates are hard to predict. A chartered accountant can help you navigate these challenges.

For startups, controlling costs is essential. Knowing reasonable accounting fees in Ireland helps you budget better.

Factors That Influence Accounting Costs

Business Size and Turnover

Your company’s size directly affects accounting fees. Larger businesses need more complex services.

Here’s a simple rule: budget 4% of your annual turnover for accounting costs. This applies to service companies.

For product companies, use 4% of total profit. This gives you a realistic starting point.

| Business Type | Calculation Method | Example |

|---|---|---|

| Service Company | 4% of annual turnover | €65,000 turnover = €2,600 fees |

| Product Company | 4% of total profit | €65,000 profit = €2,600 fees |

Types of Services Required

Different services have different costs. Basic bookkeeping costs less than financial consulting.

Cloud accounting solutions often cost less. Online accountants have lower overheads.

This means lower fees for you. Technology helps reduce costs for everyone.

Current Accountant Hourly Rates in Ireland (2026)

Based on recent market research, here are typical hourly rates:

| Service Type | Hourly Rate Range | Average Rate |

| Basic Bookkeeping | €25-€35 | €30 |

| Tax Preparation | €40-€60 | €50 |

| Financial Consulting | €120-€150 | €135 |

| Chartered Accountant | €50-€200 | €125 |

In Ireland, accountant fees vary widely depending on the type and size of your business, the complexity of services required, and the accountant’s experience. Here’s a detailed overview:

Typical Fee Ranges

- Basic bookkeeping services: Usually charged at €25-35 per hour.

- Tax planning and consulting: Can cost €120-150 per hour or more.

- Annual self-assessment tax return for self-employed individuals: Typically a once-off fee of €250-350.

- Monthly accounting packages: Range from €95 to €250 per month depending on business complexity.

Fees Based on Business Size and Type

| Business Type | Typical Monthly Fee / Annual Fee | Services Included |

|---|---|---|

| Sole traders / small businesses | Around €40 per month for software + occasional accountant review | Bookkeeping automation with software (Xero, QuickBooks), periodic VAT review, annual tax filing |

| Limited companies (€50k-€250k turnover) | Approx. €195 to €360 per month | Corporation tax returns, confirmation statements, payroll, VAT submission, personal tax support |

| Limited companies (~€1 million turnover) | Around €600 per month | Full tax support, cash flow management, payroll, management reports, funding advice |

For freelancers or self-employed with simple needs (e.g., invoicing one client and filing yearly tax return), fees can be as low as €200 for the first year, rising to about €600 in subsequent years for more comprehensive services.

Factors Affecting Fees

- Business complexity: More transactions, employees, VAT registration, and statutory filings increase fees.

- Services required: Bookkeeping, tax returns, payroll, VAT, auditing, and financial consulting all add to costs.

- Accountant qualifications and experience: Higher expertise generally means higher fees but potentially better service.

- Billing structure: Hourly rates (€25-150), fixed monthly fees, or retainer models are common.

Example Fees from Firms

- Income tax returns for individuals typically start at €250+ VAT.

- Sole trader accounts preparation can start from €700 depending on records and complexity.

- Larger companies requiring statutory accounts, payroll, VAT, and CRO filings will pay more, often negotiated on a case-by-case basis.

- For small sole traders or freelancers, expect to pay around €200-350 annually for basic tax return services.

In short,

- For small limited companies, monthly fees typically range from €195 to €360.

- Larger businesses with more complex needs may pay €600 or more per month.

- Hourly rates vary from €25 for bookkeeping to over €150 for specialist tax advice.

Engaging a qualified accountant is advisable to ensure compliance and optimize tax liabilities, and fees should be viewed as an investment in your business’s financial health.

If you want a precise quote, accountants usually require details such as business size, turnover, number of employees, and specific services needed.

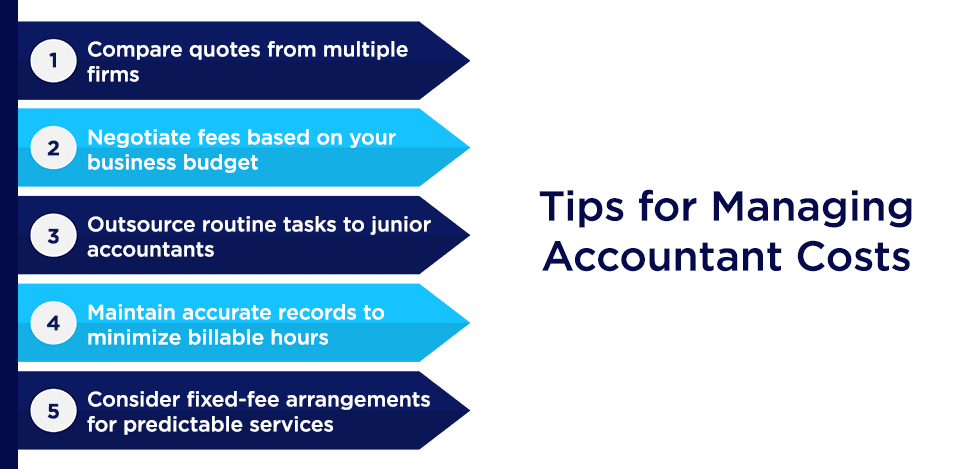

Cost-Saving Strategies

Use Accounting Software

Modern software reduces costs significantly. Cloud-based solutions are most effective.

They help your accountant work faster. This means lower fees for you.

Popular options include QuickBooks and Xero. These integrate with your accountant’s systems.

Benefits of Outsourcing vs Hiring Staff

Outsourcing often costs less than hiring. Full-time staff need salaries, pensions, and benefits.

Outsourced accountants bring expertise immediately. No training costs or recruitment fees.

| Option | Annual Cost | Benefits |

| Full-time Accountant | €35,000-€60,000 | Dedicated resource |

| Outsourced Service | €3,000-€25,000 | Expertise & flexibility |

Regular Financial Reviews

Quarterly reviews help control costs. They identify problems early.

This prevents expensive mistakes later. Your accountant can spot issues quickly.

Regular reviews improve your business planning. They help you make better decisions.

Choosing the Right Accountant

Questions to Ask

Before hiring, ask these questions:

- What’s your hourly rate?

- Do you offer fixed-price packages?

- What software do you use?

- How often will we meet?

- What’s included in your service?

Red Flags to Avoid

Watch out for these warning signs:

- Unusually low prices

- No clear fee structure

- Poor communication

- No professional qualifications

- No insurance coverage

Regional Variations in Ireland

Dublin vs Rural Areas

Dublin accountants typically charge more. Higher overheads mean higher fees.

Rural accountants often offer better value. But they may have fewer specialised services.

| Region | Typical Hourly Rate |

| Dublin | €50-€200 |

| Cork/Galway | €40-€150 |

| Rural Areas | €30-€120 |

Outsourced vs Traditional Firms

Outsourced firms often charge less. They have lower overheads.

Traditional firms offer face-to-face meetings. Some businesses prefer this approach.

Choose based on your needs and budget. Both can provide excellent service.

When to Hire an Accountant

Warning Signs You Need Help

Consider hiring an accountant if:

- Your turnover exceeds €50,000

- You’re making tax mistakes

- You’re spending too much time on books

- You need business advice

- You’re planning to expand

Benefits of Professional Help

Professional accountants offer many advantages:

- Expert tax knowledge

- Time savings

- Reduced stress

- Better business decisions

- Compliance assurance

Final Recommendations

Start with basic services and expand as needed. Build a relationship with your accountant. They become a valuable business partner. Their advice can transform your business. Remember: cheap isn’t always best. Quality accounting services pay for themselves.

Frequently Asked Questions

How much does a small business accountant cost in Ireland?

Are accounting fees tax deductible in Ireland?

Should I hire a local or online accountant?

How often should I meet with my accountant?

What’s the difference between a bookkeeper and an accountant?

Can I change accountants if I’m not happy?

Do I need a chartered accountant?

How much does VAT return preparation cost?

What should be included in accounting fees?

Are there any hidden costs I should know about?

Accountants Popular Posts

- The 5 Best Small Business Accountants in Ireland

- Online Accountants: Simplified Bookkeeping and Accounting in Ireland

- Mastering Modern Bookkeeping: Essential Techniques for Accountants

- Unlocking Financial Potential: Dublin Accountants’ Expertise for Growth

- Dublin Accountants: Your Partner in Financial Excellence

Parul is a content specialist with expertise in accounting and bookkeeping. Her writing covers a wide range of accounting topics such as payroll, financial reporting and more. Her content is well-researched and she has a strong understanding of accounting terms and industry-specific terminologies. As a subject matter expert, she simplifies complex concepts into clear, practical insights, helping businesses with accurate tips and solutions to make informed decisions.