Are you self employed in Ireland and looking to maximise your self employed business tax deductions? Being self employed Ireland gives you freedom and control over your work. It’s also very easy to become self employed Ireland – you can register as self employed Ireland in just a few simple steps through Revenue’s ROS system.

But when you’re registered as self employed Ireland, it also means managing your own taxes. One of the best ways to reduce your self employed tax Ireland bill is by claiming allowable business expenses Ireland and understanding key tax deductible expenses Ireland that apply to your situation.

This complete guide explains:

- Revenue mileage rates for self employed car expenses

- Self employed tax rates Ireland you need to know

- Allowable expenses and tax write offs you can claim

- Working from home tax relief self employed rules

- Self employed and tax credits you qualify for

- How to fill out Form 11 step-by-step

It includes simple calculations showing exactly how to pay less tax Ireland through tax credits and small business tax deductions. Whether you’re a freelancer, sole trader, or contractor, these self employed tax deductions can save you thousands legally.

Keep reading to discover business expenses Ireland that directly lower your taxable income and put more money back in your pocket!

Self Employed Tax Rates Ireland 2026

Before claiming tax deductible expenses Ireland, understand your self employed tax rates Ireland structure. Unlike PAYE employees, self employed Ireland individuals pay income tax Ireland through Form 11 with additional obligations.

2026 Tax Breakdown for Self Employed:

- Income Tax: 20% standard rate (€42,000 single allowance), 40% higher rate

- PRSI Class S: 4% on all income

- USC: 0.5%-8% progressive rates

- Preliminary Tax: Pay 90%+ of next year’s liability by Oct 31

Example Tax Calculation (€60,000 after tax Ireland target):

Gross Income: €75,000

Less Expenses: -€15,000

Taxable Income: €60,000

Income Tax: €14,200 (20% on first €42k, 40% on balance)

PRSI Class S: €2,400 (4%)

USC: €3,100

Earned Income Credit: -€2,000

Total Tax: €17,700

Key Dates for Self Employed Tax Ireland:

- Preliminary Tax: Due Oct 31 (current + next year)

- Balance Payment: Due Nov 15

- Form 11 Deadline: Oct 31 (paper) / Nov 15 (online)

Pro Tip: Use self employed tax allowance (Earned Income Credit €2,000) + allowable business expenses Ireland to stay in lower tax bands. Proper planning with self-assessment tax returns keeps more of your €60,000 after tax Ireland target achievable.

The Golden Rule: “Wholly & Exclusively”

When claiming tax deductible expenses Ireland, the most important rule is that they must be wholly and exclusively for business purposes. This Revenue principle determines what qualifies as allowable expenses for self employed Ireland.

What This Means in Practice?

- 100% Business Use: Printer ink used only for work = fully deductible

- Mixed Use: Family vacation = not deductible

- Partial Business Use: Home office taking 15% of house = claim 15% of utilities

Example – Car Expenses Split:

Total Car Costs: €6,000/year (fuel, insurance, service)

Business Use: 70% (based on mileage log)

Business Deduction: €4,200 (70% × €6,000)

HMRC Tests for Allowable Expenses:

- Direct Business Purpose: Does it help generate income?

- No Personal Benefit: Not just convenient for you personally

- Proper Documentation: Receipts + usage proof

Common Mistakes to Avoid:

- Claiming full home internet when 20% is business use

- Personal meals “while meeting clients”

- Private phone calls on business line

Pro Tip: For self employed car expenses, maintain detailed mileage logs showing business trips vs personal. This proves the business portion during Revenue audits.

Allowable Business Expenses Ireland (Complete List 2026)

Here are the most common allowable business expenses Ireland that self employed Ireland can claim. Each includes real examples showing tax write offs and small business tax deductions:

1. Advertising Costs

If you spend money on promoting your business, like online ads or flyers, you can claim this as an expense.

Example: You spend €2,000 on a social media campaign. This €2,000 reduces your taxable income as tax deductible expenses Ireland.

2. Office Supplies

Items like pens, paper and printer ink are deductible if used for work.

Example: You buy office supplies worth €300. This €300 is allowable expenses for self employed expenses.

3. Software Costs

Subscriptions or licenses for software used in your business can be claimed.

Example: You pay €50 per month for accounting software, totaling €600 annually. Fully deductible as business expenses Ireland.

4. Rent

If you rent office space, the full rent is deductible.

Example: You rent an office for €1,000 per month, totaling €12,000 annually. This €12,000 reduces taxable income.

5. Business Insurance

Insurance premiums for protecting your business are deductible.

Example: You pay €800 annually for professional indemnity insurance. This amount is allowable business expenses Ireland.

6. Wages Paid to Employees

Salaries paid to employees (but not yourself) are deductible expenses.

Example: You hire an assistant and pay them €30,000 per year. This reduces your taxable income by €30,000.

7. Subcontractor Costs

Payments made to freelancers or subcontractors are deductible if they help with your business directly.

Example: You hire a web designer for €5,000 to create a website. This €5,000 is self employed business expenses.

8. Bank Charges and Loan Interest

Fees from your business bank account or interest on loans are deductible.

Example: You pay €200 in bank charges and €500 in loan interest annually. Together €700 tax write offs.

9. Accountancy Fees

Fees paid to an accountant for preparing tax returns are deductible.

Example: You pay an accountant €1,500 annually for tax advice and filing services. Fully deductible.

10. Home Office Expenses

If you work from home as self employed Ireland, you can claim home office expenses using 2 simple methods. Choose whichever is easier for you.

Method 1: Flat Rate (Easiest – No Receipts Needed)

Revenue gives fixed percentages based on your work hours:

- 10+ hours/week: Claim 30% of electricity, heating, broadband

- 5-10 hours/week: Claim 10% of utilities

- Less than 5 hours: No claim allowed

Example (€3,000 total annual utilities):

30% flat rate × €3,000 = €900 deduction

No receipts, no calculations, audit-proof!

Method 2: Actual Costs (Room Size Method)

Measure your office space vs total house, claim that % of bills.

Simple Steps:

- Measure your office area (e.g., 10m²)

- Measure total house area (e.g., 100m²)

- Business use = 10%

- Apply 10% to electricity, heating, internet bills

Example:

- Office = 10m², House = 100m² → 10% business use

- Electricity €2,000 × 10% = €200 deduction

- Heating €1,200 × 10% = €120 deduction

- Internet €600 × 10% = €60 deduction

- Total: €380 deduction

What Counts as Home Office Space?

- Dedicated room or office area

- Regular business use (not kitchen table)

- Store work equipment there

Which Method Should You Choose?

Flat Rate 30%: €900 deduction (easy)

Actual Costs 10%: €380 deduction (more work)

→ Choose Flat Rate unless your office is huge!

Keep It Simple: Use 30% flat rate + save receipts for 6 years. Perfect for self employed tax deductions Ireland!

11. Self Employed Car Expenses or Motor Expenses): Revenue Mileage Rates

Self employed motor expenses using revenue mileage rates in 2026 (simplest method):

- Cars (≤1500cc): 51c/km first 6,000km, 38c/km after

- Cars (1501cc+): 61c/km first 6,000km, 46c/km after

- Vans: 61c/km first 6,000km, 46c/km after

- Motorcycles: 23c/km

Example 1 (Mileage): 5,000km × €0.51 = €2,550 deduction

Example 2 (Actual): €5,000 total costs × 60% business = €3,000 deduction

12. Capital Allowances

Self employed Ireland claim capital allowances on big purchases (computers, equipment) over 8 years:

€2,000 computer → 12.5% = €250/year deduction × 8 years

- Common Items: Computers, furniture, tools (all 12.5%/year)

- Rules: Business use only, claim on Form 11, keep receipts 6 years.

- Example: €3,000 laptop + €1,000 desk = €500 Year 1 deduction

Tip: Buy early in tax year for max self employed tax deductions Ireland.

13. Working From Home Tax Relief

Self employed Ireland working from home can claim working from home tax relief self employed through two methods. This covers allowable expenses like utilities based on business use.

Method 1: Actual Costs (Percentage Method)

Claim portion of household bills based on office space usage.

Example: Your home office takes up 10% of your house area, annual electricity bill €2,000.

Deduction: 10% × €2,000 = €200 for electricity. Add heating, broadband using same 10% ratio.

Method 2: Revenue Flat Rate (Simpler)

Fixed daily rates set by Revenue – no receipts needed.

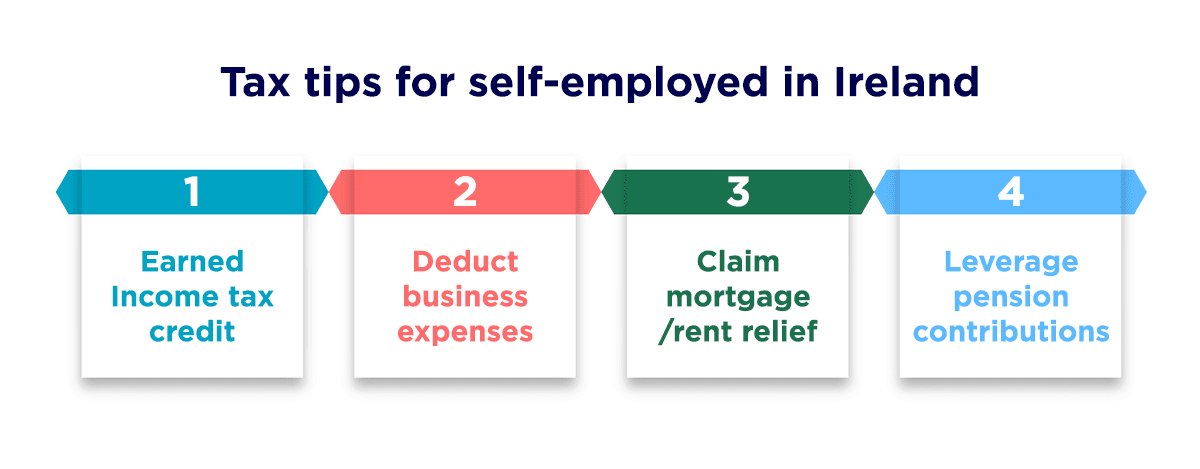

Self Employed Tax Allowances & Credits You Qualify For

Self employed Ireland can claim these self employed and tax credits alongside expenses:

1. Earned Income Tax Credit (Primary self employed tax allowance)

- Value: €2,000 (2026)

- Who: All self employed tax Ireland sole traders, freelancers, contractors

- How: Automatic on Form 11

- Impact: Directly reduces tax bill by €2,000

2. Mortgage Interest Tax Credit

- Value: Up to €1,250 (increased 2026 mortgage interest vs 2024)

- Who: Homeowning self-employed with qualifying pre-2013 mortgage

- Requirements: €80k-€500k owed Dec 31, 2024

3. Rent Credit

- Value: €1,000 single / €2,000 couple (2026)

- Who: Self-employed tenants (20% of annual rent, capped)

4. Medical Expenses Relief

- Value: 20% of qualifying unreimbursed costs

- Who: Self-employed with doctor visits, prescriptions, hospital costs

5. Pension Contributions Relief

- Value: Up to 40% tax relief on contributions

- Who: Self-employed saving for retirement

- Example:

- Tax Before Credits: €12,000

- Earned Income Credit: -€2,000

- Rent Credit: -€1,000

- Medical Relief: -€400 (20% of €2,000)

- Final Tax: €8,600 (saved €3,400)

Claim Process: All via Form 11 or myAccount. Self employed tax allowance (Earned Income Credit) applies automatically.

Pro Tips: Combine with self-assessment tax returns for maximum self employed tax deductions Ireland.

Example Calculation: Self Employed Tax Savings

Let’s see how to pay less tax Ireland with self employed tax deductions in action:

Scenario: Freelancer earning €75,000 gross

GROSS INCOME: €75,000

MINUS ALLOWABLE EXPENSES:

- Advertising: -€2,000

- Office supplies: -€300

- Software: -€600

- Accountancy fees: -€1,500

- Revenue mileage (10,000km): -€5,100

- Home office (30%): -€900

- TOTAL EXPENSES: -€10,400

TAXABLE INCOME: €64,600

INCOME TAX (20% band up to €42,000):

€42,000 × 20% = €8,400

€22,600 × 40% = €9,040

TOTAL INCOME TAX: €17,440

PRSI Class S (4%): €64,600 × 4% = €2,584

USC: €3,250 (approx)

SUBTOTAL TAXES: €23,274

MINUS TAX CREDITS:

- Earned Income Credit: -€2,000

FINAL TAX BILL: €21,274

TAX SAVINGS ACHIEVED:

Without deductions: €30,000 tax

With deductions: €21,274 tax

SAVED: €8,726.

Note: €10,400 expenses + €2,000 credit = €8,726 real tax savings for self employed Ireland.

How to Fill Out Form 11 – Step by Step (As Self-employed)?

Self employed Ireland file taxes using Form 11 through Revenue’s ROS. Here’s exactly how to fill out Form 11 for maximum self employed tax deductions Ireland:

Step 1: Income Section (Page 1)

- Total Trading Income: €75,000 (gross receipts)

- Less Allowable Expenses: -€10,400

- NET PROFIT: €64,600 ← Enter here

Step 2: Expenses Schedule (Page 11)

- Advertising: €2,000

- Accountancy Fees: €1,500

- Motor Expenses: €5,100 (revenue mileage rates)

- Home Office: €900

- Other Expenses: €900

- TOTAL EXPENSES: €10,400

Step 3: Motor Expenses Details (Schedule D)

- Method: Revenue mileage rates

- Kilometers: 10,000km

- Rate: 51c/km first 6k, 38c after

- TOTAL: €5,100

Step 4: Capital Allowances (Page 13)

- Computer €2,000 × 12.5% = €250

- Office furniture €1,000 × 12.5% = €125

- TOTAL CAPITAL ALLOWANCES: €375

Step 5: Tax Credits (Page 3)

- Earned Income Credit: €2,000

- Rent Credit: €750 (if qualifies)

Step 6: Preliminary Tax (Page 15)

- Current Year Tax: €21,274

- Next Year Estimate: €22,000

- PRELIMINARY TAX: €20,500 (90% of next year)

- TOTAL PAYMENT DUE: €41,774 (Oct 31)

Key Deadlines:

- Online Form 11: Nov 15

- Paper Form 11: Oct 31

- Preliminary Tax: Oct 31

Pro Tip: Use self-assessment tax returns service to auto-populate Form 11 correctly. Perfect for accounting for the self employed.

Record Keeping: A Must for Self Employed Ireland

To claim self employed tax deductions Ireland successfully and survive Revenue audits, proper records are essential:

What You Must Keep (6 Years Minimum):

- All receipts/invoices for allowable business expenses Ireland

- Detailed mileage logs for revenue mileage rates claims

- Utility bills for working from home tax relief self employed

- Bank statements showing business transactions

- Capital asset purchase receipts (€2,000+ items)

Mileage Log Template (Required):

| Date | Client | Purpose | Start Odometer | End Odometer | Kms |

| 01/01 | ABC Ltd | Meeting | 45,200 | 45,250 | 50km |

Spreadsheet Tracking (Recommended):

| Category | Date | Supplier | Amount | Receipt # | Notes |

|---|---|---|---|---|---|

| Advertising | 15/03 | €500 | R001 | Q1 campaign | |

| Motor | 20/04 | 2,000km | €1,020 | ML001 | Revenue rates |

Revenue Audit Triggers to Avoid:

- Missing receipts for large claims

- No mileage logs (most common rejection)

- Home office claims without space measurements

- Round number expenses (€1,000 exactly)

Digital Tools: Use accounting software for automatic categorisation + audit-ready reports.

Pro Tip: Good records = smooth self-assessment tax returns + confidence during Revenue audits.

Final thoughts

Tax rules change frequently and self employed tax Ireland compliance is complex. Hiring an accountant or tax advisor ensures you claim every allowable expense, revenue mileage rate and self employed tax credit while staying compliant.

Outbooks Ireland Services for Self Employed:

- Self-assessment tax returns – Perfect Form 11 filing

- Year-end accounts & CT returns – Audit-ready records

- Tailored accounting services – Maximise deductions

- Payroll services – If you hire staff

Ready to Save Thousands? Reach out at Email info@outbooks.com or call +353 21 2069255 for expert self employed Ireland tax planning.

Parul is a content specialist with expertise in accounting and bookkeeping. Her writing covers a wide range of accounting topics such as payroll, financial reporting and more. Her content is well-researched and she has a strong understanding of accounting terms and industry-specific terminologies. As a subject matter expert, she simplifies complex concepts into clear, practical insights, helping businesses with accurate tips and solutions to make informed decisions.