Gone are the days of printing, posting, and waiting weeks for signed proposals. Modern accounting practices demand efficiency, and e-signatures for proposals have become essential. The proposal e-signature tool transforms how accountants handle client approvals. Let us explore how Outbooks proposal tool can simplify the process of e-signature.

Gone are the days of printing, posting, and waiting weeks for signed proposals. Modern accounting practices demand efficiency, and e-signatures for proposals have become essential. The proposal e-signature tool transforms how accountants handle client approvals. Today, many firms are embracing advanced proposal software for accountants to simplify every stage of the approval process – from creation to digital signing. Let us explore how Outbooks proposal tool can simplify the process of e-signature.

Why E-signatures matter for UK Accounting firms?

Traditional paper-based processes create unnecessary delays for accounting firms. Clients expect swift, professional service without bureaucratic hurdles.

E-signatures have become a valuable tool for accountants, offering a wide range of benefits according to recent industry research.

Digital signatures for accountants reduce processing time from days to hours. This efficiency boost helps firms simplify client approvals whilst maintaining legal compliance. Modern clients appreciate the convenience of signing documents from any location.

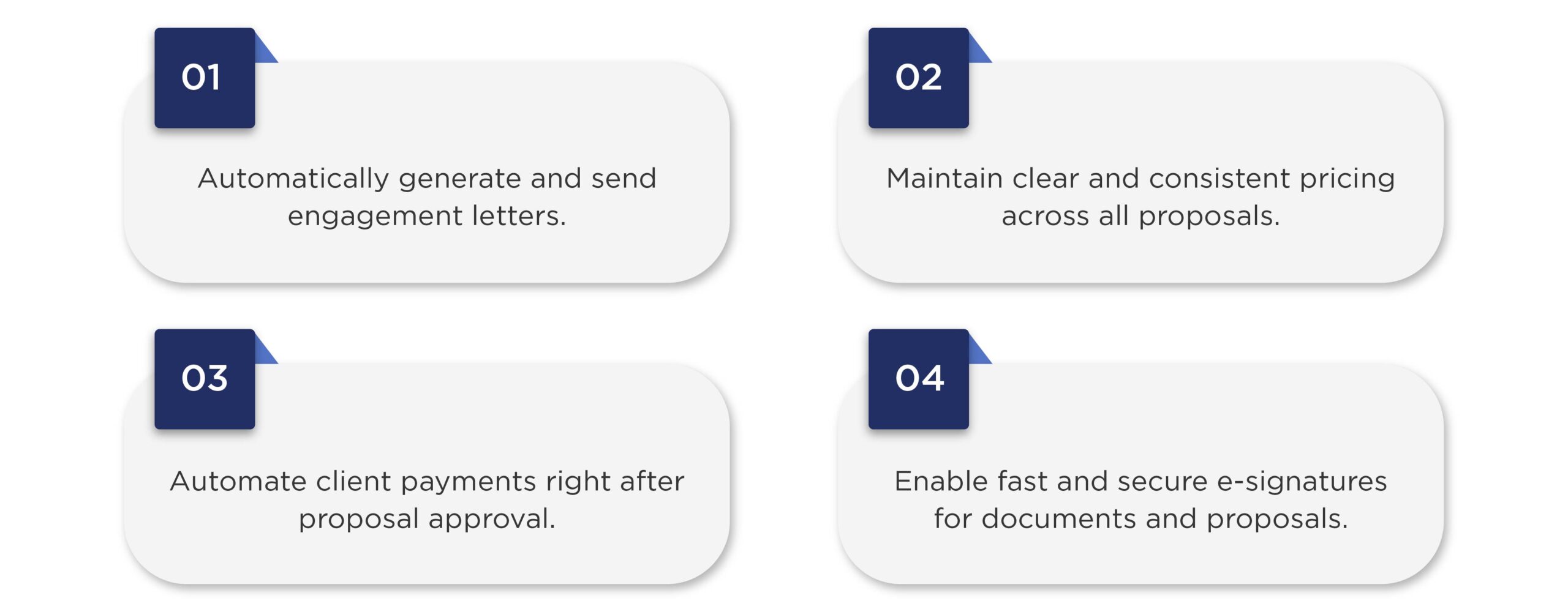

Other significant features of the Outbooks Proposal Tool and its e-signature function include:

The Outbooks Proposal Tool advantage for UK Accountants

Outbooks Proposal offers seamless integration of e-signature functionality within accounting workflows. As a premier accounting proposal and pricing software, it streamlines the entire process. Built specifically for accounting professionals, the platform understands industry requirements perfectly. Proposal signing has never been more intuitive or user-friendly. Clients receive branded, professional documents that enhance your firm’s reputation.

Key benefits of Digital Proposal Signatures

The paperless proposal process offers numerous advantages for accounting firms.

First, it accelerates client onboarding by removing postal delays.

Second, it provides secure electronic signatures with full legal validity.

Third, it helps streamline approvals through automated tracking and reminders.

Fourth, it enables complete accounting workflow automation for better efficiency.

Related Post – Transform your proposal & onboarding process with accounting proposal software

Time Saving Comparison

| Process | Traditional Method | E-signature Method | Time Saved |

| Document preparation | 30 minutes | 15 minutes | 50% |

| Sending to client | 2-3 days | Instant | 100% |

| Client signing | 5-10 days | Same day | 90% |

| Return processing | 2-3 days | Instant | 100% |

How to simplify client approvals with E-signatures?

Understanding how to simplify client approvals with e-signatures requires strategic implementation.

Start by selecting the e-signature tool for accounting proposals that best suits your needs.

Outbooks Proposal excels in this area with purpose-built accounting features. Train your team on the new digital workflow processes. Educate clients about the benefits and security of electronic signatures. Create templates for common proposal types to maximise efficiency.

Getting Proposals signed faster

Accountants can get proposals signed faster by following several key strategies.

Use mobile-optimised signature interfaces for busy clients on the go.

Send automated reminder emails to clients with pending signatures.

Provide clear instructions and support for first-time digital signers.

Implement e-signatures in accounting proposal software consistently across all client interactions.

Track signature status in real-time to follow up appropriately.

Client adoption rates

| Client Demographics | Adoption Rate | Average Signing Time |

| Under 35 years | 95% | 2 hours |

| 35-55 years | 85% | 4 hours |

| Over 55 years | 70% | 8 hours |

Security & UK Legal Compliance for E-signatures

Electronic signatures maintain the highest standards of security and document integrity. Modern e-signature platforms use encryption and audit trails for complete security. Legal frameworks across the UK recognise electronic signatures as valid contracts. Outbooks Proposal ensures compliance with relevant data protection regulations. Digital certificates provide tamper-evident proof of signature authenticity. Detailed logs track every interaction with signed documents.

The Digital Signature benefits for client proposals

Enhanced client experience leads to higher satisfaction and retention rates. Professional appearance creates positive first impressions with potential clients. Immediate confirmation reduces anxiety about proposal status for both parties. Environmental benefits appeal to sustainability-conscious clients and firms. Cost savings from reduced printing, postage, and administrative overhead. Improved cash flow through faster contract execution and project commencement.

Implementation best practices

Successful adoption requires careful planning and staff training. Choose software that integrates seamlessly with existing accounting systems, and create standardised templates for consistent branding. Establish clear protocols for handling signature exceptions or technical issues. Monitor adoption rates, gather feedback, and provide ongoing support to help clients adapt to digital processes.

Implementation timeline

| Week | Activity | Responsibility |

| 1-2 | Software selection and setup | IT Team |

| 3-4 | Staff training and testing | Management |

| 5-6 | Template creation | Proposal Team |

| 7-8 | Client communication | Account Managers |

| 9+ | Full deployment | All Staff |

Cost benefit analysis

The financial impact of implementing e-signature solutions proves overwhelmingly positive. Reduced administrative costs offset software subscription fees within months. Faster turnaround times enable firms to handle more proposals simultaneously.

Improved client satisfaction leads to increased referrals and repeat business. Lower error rates reduce costly revisions and delays. Staff productivity increases as manual processes become automated.

Common challenges and solutions

Some clients may resist change from familiar paper-based processes. Provide patient support and clear instructions to ease the transition. Technical difficulties can occasionally disrupt the signing process. Choose reliable software with excellent customer support capabilities.

Clients may have legal concerns about electronic signature validity. Educate them about the robust legal frameworks that support digital signatures. Integration with existing systems may also require technical expertise, so choose platforms that offer seamless integration with popular accounting software.

Future of Digital Signatures in Accounting

The industry continues evolving towards completely digital workflows. Artificial intelligence will further streamline proposal creation and approval processes.

Mobile-first approaches will become standard as client expectations change. Integration with other business systems will create comprehensive digital ecosystems.

Enhanced analytics will provide deeper insights into client behaviour patterns. Blockchain technology may provide additional security and verification layers.

Conclusion

E-signatures have transformed how UK accounting firms handle proposals. Gone are the delays of printing, posting, and waiting weeks for client signatures.

The Outbooks Proposal Software for Accountants shows clear results: faster signing times and instant document processing. Clients can sign from anywhere, boosting satisfaction and speeding up cash flow.

The benefits are simple: less paperwork, lower costs, and happier clients. Security and legal compliance give firms confidence, while professional branding improves their image.

As the industry moves toward fully digital workflows, e-signatures are no longer optional. They’re essential for competitive accounting practices.

Related post – From Draft to Deal: The Proposal Process for accountants

FAQs

Are electronic signatures legally binding in the UK?

How secure are e-signatures compared to handwritten signatures?

Can elderly clients use e-signature technology effectively?

What happens if a client cannot access their email to sign?

How long do electronically signed documents remain valid?

Can e-signatures be used for all types of accounting documents?

What training do staff need for e-signature implementation?

How do e-signatures integrate with existing accounting software?

What backup procedures exist if e-signature systems fail?

How do clients receive and sign proposals electronically?

Simplify client approvals for your UK Accounting Firm

Outbooks Proposal Tool is designed for UK accountants- secure, HMRC-recognised e-signatures, faster onboarding and compliant workflows.

Book a Free DemoParul is a content specialist with expertise in accounting and bookkeeping. Her writing covers a wide range of accounting topics such as payroll, financial reporting and more. Her content is well-researched and she has a strong understanding of accounting terms and industry-specific terminologies. As a subject matter expert, she simplifies complex concepts into clear, practical insights, helping businesses with accurate tips and solutions to make informed decisions.