In today’s fast-paced world, modern UK accounting firms have to deliver multiple proposals on a daily basis. Doing this work manually often results in delays and a bundle of errors. To save time and avoid issues like these, it is better to automate the process.

Proposal automation for accountants is a smart and effective solution. In this guide let us explore some of the measurable returns of investing in client proposal automation. We’ll examine real cost, time saving, and strategic benefits backed by industry research.

Understanding proposal automation in UK accounting practices

Accounting proposal software transforms how firms create, send and track client proposals. These tools eliminate repetitive tasks and standardise proposal quality across all client interactions.

Traditional manual processes involve creating proposals from scratch for each client. This approach leads to inconsistencies and delays in client onboarding procedures.

Client proposal automation streamlines the entire workflow from initial enquiry to signed engagement. Companies typically see positive ROI within months through faster deal closure and higher win rates.

Key components of automated proposal systems

Modern proposal generation tools include several essential features that transform traditional workflows:

- Template libraries with pre-approved content and legal compliance

- Dynamic pricing calculators that adjust automatically based on service scope

- Electronic signature integration for immediate client approval

Proposal workflow automation tracks each stage of the proposal lifecycle automatically.

Measuring ROI: Time saving analysis for UK accounting firms

One hour saved per week translates into significant annual cost savings per person in accounting firms.. This makes even small efficiency gains financially meaningful for practices.

Research shows that proposal software streamlines the proposal creation process, allowing accountants to use templates, pre-designed layouts, and standardised content to quickly generate accounting proposals.

Time saved using proposal tools in accounting firms varies by firm size and complexity. However, most firms report substantial reductions in administrative overhead.

Financial impact assessment for UK accounting practices

It requires examining both direct cost savings and revenue improvements through faster response times.

Time in most firms is worth about $242 per hour per professional, making efficiency improvements immediately valuable. Partner and senior staff time represents the highest cost component.

If a solution saves even a few minutes per proposal, the cumulative effect across multiple proposals creates significant annual savings.

Investment recovery timeline

Most accounting practices recover their automation investment through:

- Reduced labor costs on proposal preparation

- Faster client onboarding and revenue recognition

- Improved conversion rates from quicker responses

- Enhanced capacity for additional client work

Accounting proposal process automation case studies demonstrate that firms typically achieve positive ROI within 6-12 months of implementation.

Revenue enhancement through faster response times

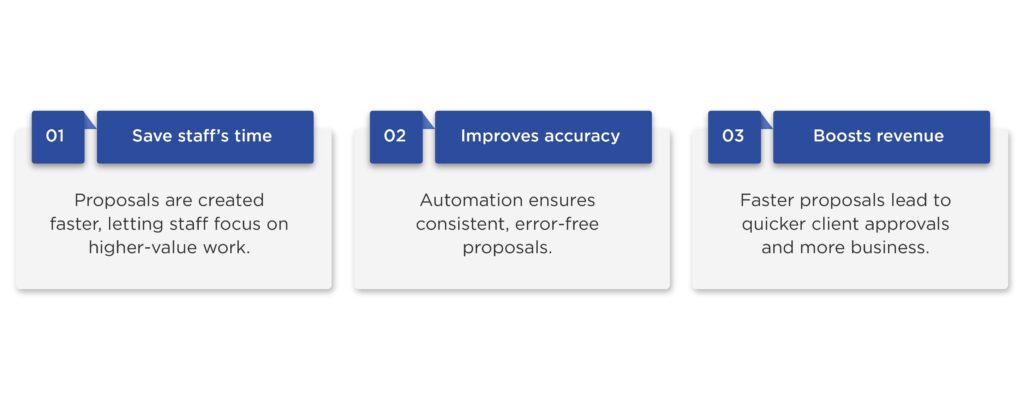

Benefits of automating client proposals for accountants extend beyond cost savings to revenue generation opportunities.

Faster proposal turnaround time becomes a competitive advantage in saturated markets where prospects evaluate multiple firms simultaneously.

Quick responses demonstrate professionalism and efficiency to potential clients. This perception influences their decision-making process significantly.

Professional service response expectations

Industry research suggests that prospects expect faster responses from professional service providers:

- Same-day responses improve client perception

- Multi-day delays reduce conversion likelihood

- Standardised proposals maintain quality whilst speeding delivery

- Electronic signatures eliminate posting and courier delays

Firms implementing automation report improved client satisfaction scores and higher proposal acceptance rates.

Non billable hours reduction

Reduce admin hours in accounting with proposal software, which can directly help increase firm profitability by freeing professionals for billable work.

Non-billable hours in accounting include proposal preparation, follow-up communications, and document management tasks. These activities consume significant time without generating revenue.

Accounting client onboarding tools integrated with proposal systems create seamless client experiences. New clients progress from prospect to active engagement more efficiently.

Proposal automation also helps in:

Administrative Efficiency Improvements

Automation redistributes professional time allocation:

Manual Process Time Distribution:

- Proposal creation and revision cycles

- Client follow-up and communication management

- Document formatting and compliance checking

- Internal coordination and approval processes

Automated Process Time Distribution:

- Strategic client relationship development

- Complex advisory service delivery

- Business development and networking activities

- Quality review and continuous improvement

This shift allows senior staff to focus on revenue-generating activities and strategic client relationship building.

Quality and consistency improvements

Manual vs automated proposals reveal significant quality differences beyond time savings that impact client perception and firm reputation.

Automated systems ensure consistent messaging and compliance across all client engagements. Template-based approaches eliminate errors common in manual proposal creation.

Brand consistency improves when all proposals follow standardised formats and messaging. Clients perceive greater professionalism from uniform proposal presentation.

Error reduction benefits

Common proposal errors reduced through automation include:

- Pricing calculation mistakes and inconsistencies

- Service description variations and inaccuracies

- Legal language omissions or outdated terms

- Formatting inconsistencies across different proposals

These improvements protect firms from liability whilst enhancing client confidence in the firm’s attention to detail.

Implementation costs for UK accounting firms

Accounting practice management software with proposal capabilities requires careful evaluation of total implementation costs including ongoing expenses.

Initial software licensing typically ranges from £1,500-8,000 annually depending on firm size, user count, and features required for effective operation.

Setup and customisation costs vary from £2,000-6,000 for template development, system integration, and workflow configuration.

Technology integration benefits

Modern proposal workflow automation integrates with existing accounting systems to create seamless client experiences from initial contact through service delivery.

Integration with CRM systems maintains client communication history and tracks proposal performance over time for continuous improvement.

Connection to billing systems enables automatic service setup once proposals receive client approval, reducing manual data entry requirements.

Measuring success metrics

ROI of proposal software measurement requires tracking multiple performance indicators beyond simple time savings calculations.

Key performance indicators include proposal creation time, client response rates, conversion percentages, and overall client satisfaction scores.

Regular measurement enables continuous improvement and justifies ongoing investment in automation technology and training.

Performance tracking framework

Essential metrics for ROI calculation:

| Metric Category | Key Indicators | Measurement Method |

| Efficiency | Time per proposal, proposals per week | Time tracking, workflow analytics |

| Effectiveness | Conversion rates, client feedback | CRM reporting, satisfaction surveys |

| Quality | Error rates, revision cycles | Quality audits, client communications |

| Revenue | Deal size, client lifetime value | Financial reporting, client analysis |

Regular monitoring enables data-driven decisions about process improvements and additional automation investments.

Future-proofing UK accounting practices with proposal automation

Accounting client onboarding tools continue evolving with technological advances including artificial intelligence and machine learning capabilities.

Modern systems adapt to changing client expectations and regulatory requirements through regular updates and feature enhancements.

Scalable solutions grow with firm expansion without requiring complete system replacement or extensive reconfiguration.

Technology evolution considerations

Future developments likely to impact proposal automation:

- AI-powered content generation and personalisation

- Enhanced integration capabilities with emerging software

- Mobile-optimised client interaction interfaces

- Advanced analytics for proposal performance optimisation

Selecting vendors with strong development roadmaps ensures long-term value from automation investments.

Best Practices for implementation success

Successful automate proposals in accounting initiatives require careful planning, stakeholder engagement, and change management throughout the organisation.

Staff training and process documentation ensure consistent adoption and maximum benefit realisation from automation investments.

Regular review and optimisation maintain system effectiveness and identify opportunities for continuous improvement.

Implementation success factors

Critical elements for successful automation adoption:

- Executive sponsorship and change management support

- Comprehensive staff training and ongoing education

- Clear process documentation and quality standards

- Regular performance measurement and system optimisation

These factors determine whether firms achieve their expected ROI targets and continue deriving value from automation investments.

Conclusion:

Proposal automation has shifted from a nice-to-have to an essential tool in the UK accounting sector. With rising compliance requirements from HMRC, ACCA, and ICAEW, firms need solutions that deliver speed, accuracy, and professionalism.

Automating client proposals in the UK not only reduces admin time but also improves win rates, client satisfaction, and revenue growth. Most firms see ROI within 6–12 months, proving the value of investing in technology that aligns with UK market needs.

What is the typical ROI timeline for proposal automation in accounting firms?

How much time can proposal automation actually save?

What are the main cost components of proposal automation implementation?

How does proposal automation improve client conversion rates?

Can proposal automation integrate with existing accounting systems?

What metrics should firms track to measure proposal automation success?

How does proposal automation support firm growth and scalability?

Parul is a content specialist with expertise in accounting and bookkeeping. Her writing covers a wide range of accounting topics such as payroll, financial reporting and more. Her content is well-researched and she has a strong understanding of accounting terms and industry-specific terminologies. As a subject matter expert, she simplifies complex concepts into clear, practical insights, helping businesses with accurate tips and solutions to make informed decisions.