Deciding whether you need a bookkeeper, an accountant, or a CPA is essential when making financial decisions for your business. Each role supports a different part of your accounting function, and choosing the wrong one can affect compliance, reporting accuracy, and how efficiently work gets done.

Small business owners, company directors, and accountants often face this decision when managing tax compliance, financial reporting, and ongoing bookkeeping support. The overlap between these roles is not always clear, especially as businesses grow or take on more complex requirements.

This guide explains the difference between a bookkeeper, an accountant, and a CPA, outlines who does what in practice, and helps you decide when each professional is needed.

In this guide, we cover:

- The core responsibilities of bookkeepers, accountants, and CPAs

- How bookkeeping differs from accounting and tax services

- When businesses should involve a CPA

- How to choose the right support at different stages

Bookkeeper vs Accountant vs CPA

Before looking at each role in detail, it helps to understand how they fit together.

| Role | Primary Focus | Typical Work |

|---|---|---|

| Bookkeeper | Day-to-day records | Transactions, reconciliations |

| Accountant | Reporting and compliance | Financial statements, reviews |

| CPA | Tax and regulatory matters | Tax filing, audits, advisory |

Bookkeeping supports accounting. Accounting supports tax and compliance. A CPA steps in where regulation and certification are required.

What does a Bookkeeper Do?

Bookkeepers handle the daily financial records that keep accounts organised and up to date. Their work forms the base for all reporting and tax preparation.

Bookkeeping Responsibilities Include:

- Recording sales, expenses, and payments

- Bank and credit card reconciliations

- Maintaining the general ledger

- Managing invoices and bills

- Supporting payroll records

A typical bookkeeping tasks list focuses on accuracy and consistency rather than analysis.

When Do Businesses Need a Bookkeeper?

- High transaction volumes

- Regular invoicing and payments

- Ongoing reconciliation needs

- Early-stage or growing businesses

Many businesses use outsourced bookkeeping services to maintain records without hiring in-house staff.

What does an Accountant Do?

Accountants work with the records prepared by bookkeepers. Their role is focused on review, interpretation, and compliance.

Accountant Responsibilities Include:

- Preparing financial statements

- Reviewing reconciled accounts

- Supporting budgeting and forecasting

- Advising on accounting standards

- Assisting with tax planning

This is where the difference between bookkeeper and accountant becomes clear. Bookkeepers record activity. Accountants interpret and report it.

Financial Reporting vs Bookkeeping

Bookkeeping shows what happened. Accounting explains what it means for the business.

Businesses often rely on accountants at month-end, quarter-end, and year-end reporting stages.

What does a CPA Do?

A CPA is a licensed professional authorised to handle regulated work. Not all accountants are CPAs.

CPA Role in Tax Filing Includes:

- Preparing and filing tax returns

- Representing clients with tax authorities

- Supporting audits and reviews

- Providing regulated tax advice

CPA services for small business are often used during tax season, audits, or when complex tax matters arise.

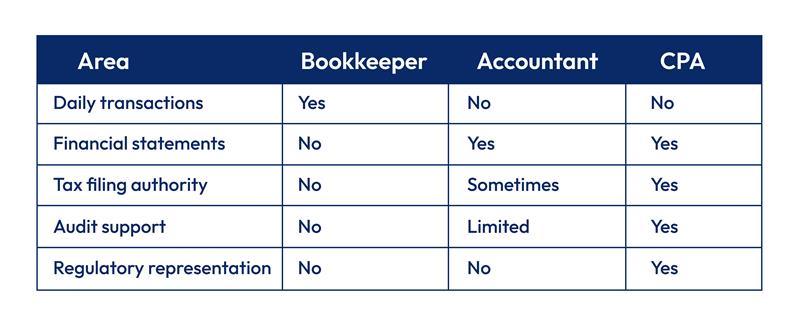

CPA vs Accountant vs Bookkeeper: Key Differences

This comparison helps answer common questions like do I need a bookkeeper or accountant, or do I need a CPA or accountant.

When to Hire a CPA for Business Needs?

Many businesses ask when to hire a CPA for business operations if an accountant is already involved. A CPA is typically required when financial work moves into regulated territory.

A CPA is usually needed when:

- Tax filings involve complexity or regulatory risk

- The business faces audits or formal reviews

- Representation with tax authorities is required

- Certified tax or compliance advice is needed

A CPA complements existing bookkeeping and accounting support rather than replacing it.

According to the IRS, only CPAs, attorneys, and enrolled agents can represent taxpayers before the IRS in all matters. This makes a CPA essential when you need formal representation.

What to Consider When Choosing Between These Roles for Your Business Stage?

- Startup Phase (0-2 years):

Focus on establishing proper record-keeping. Start with a bookkeeper and consult a CPA for initial tax structure decisions. - Growth Phase (2-5 years):

Transaction volumes increase and financial reporting becomes necessary. Maintain bookkeeping support, add an accountant for reporting, and consult a CPA for tax planning. - Established Phase (5+ years):

Complex operations require comprehensive support. Consider a full team or integrated service covering bookkeeping, accounting, and CPA services.

Key Evaluation Questions:

- What’s your transaction volume and complexity?

- Do you need GAAP-compliant financial statements?

- What are your tax filing requirements?

- Does your industry have specific compliance needs?

- Are you making decisions based on financial data?

According to the Small Business Administration, maintaining accurate financial records from day one is critical for business success.

When Should You Hire Each Role?

Different business stages require different support.

Early-Stage Businesses

- Bookkeeping vs CPA for startups often comes down to volume and tax complexity

- A bookkeeper may be sufficient initially

Growing Businesses

- Accounting oversight becomes necessary

- Financial statements support funding and planning

Established Businesses

- CPA vs Accountant for taxes becomes relevant

- Regulatory compliance and filings increase

Some businesses combine services using outsourced bookkeeping vs CPA support, depending on workload and compliance needs.

| Task | Bookkeeper | Accountant | CPA |

|---|---|---|---|

| Record transactions | Yes | No | No |

| Reconcile accounts | Yes | Yes | Yes |

| Fix accounting errors | Limited | Yes | Yes |

| Financial reporting | No | Yes | Yes |

| Tax preparation | No | Limited | Yes |

Understanding these accounting tasks lists helps businesses and accountants avoid service gaps.

Should You Outsource Or Manage In-House?

Some firms prefer in-house teams. Others rely on outsourced services.

Outsourced bookkeeping and accounting support can

- Reduce fixed hiring commitments

- Improve turnaround times

- Provide access to trained teams

This model works well for practices managing variable workloads across multiple clients.

Conclusion

Understanding the difference between a bookkeeper, an accountant, and a CPA helps businesses make better financial decisions and helps accountants deliver the right services at the right time. Each role serves a specific purpose, and using them correctly reduces risk, improves reporting quality, and supports compliance.

Clear service definitions, supported by well-structured accounting proposals, make it easier for both businesses and accountants to work efficiently and confidently.

FAQs

Do I need a bookkeeper or accountant?

When should I hire a CPA for business?

Is a CPA better than an accountant for taxes?

Can one firm provide all three services?

Which accounting professional do I need as I grow?

What’s the role of a CPA when I already have an accountant?

What can a CPA do that an accountant cannot?

How does a CFO differ from a Bookkeeper, Accountant, or CPA?

Parul is a content specialist with expertise in accounting and bookkeeping. Her writing covers a wide range of accounting topics such as payroll, financial reporting and more. Her content is well-researched and she has a strong understanding of accounting terms and industry-specific terminologies. As a subject matter expert, she simplifies complex concepts into clear, practical insights, helping businesses with accurate tips and solutions to make informed decisions.